Nucor cuts plate prices by $100/ton, cites market conditions

Nucor Corp. announced that its plate mill group would cut prices for as-rolled, discrete, and cut-to-length plate with the opening of its December order book.

Nucor Corp. announced that its plate mill group would cut prices for as-rolled, discrete, and cut-to-length plate with the opening of its December order book.

Primetals Technologies renewed two long-term maintenance service contracts with steel producers in the Americas.

US plate prices are at their lowest level in almost four years, and less than half of what they were when they reached an all-time high of $1,940 per short ton (st) in May 2022.

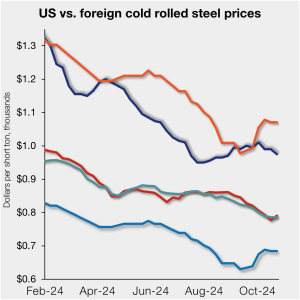

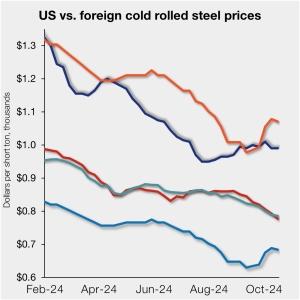

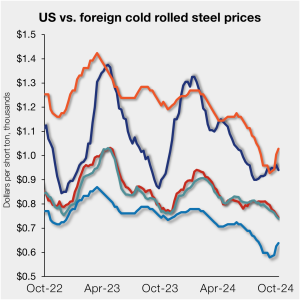

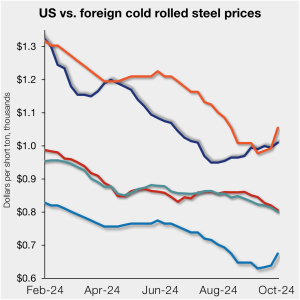

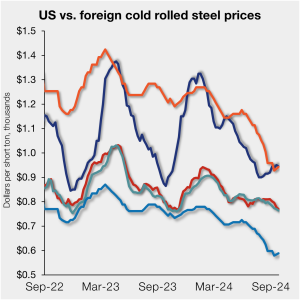

The price spread between US-produced cold-rolled (CR) coil and offshore products was negligibly tighter in the week ended Oct. 25, on a landed basis.

SMU’s latest steel buyers market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Past survey results are also available under that selection. If you need help accessing the survey results, or if […]

The construction sector added 25,000 jobs in September, driven by labor shortages and improved wages, according to data released by the US Bureau of Labor Statistics.

Growth in the US economy continues to crawl with little change in most districts. The Federal Reserve’s October Beige Book report showed three-quarters of reporting districts with flat or declining economic activity.

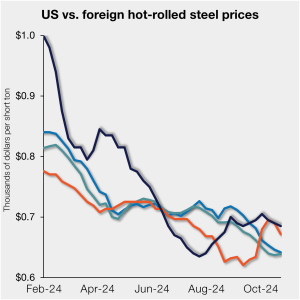

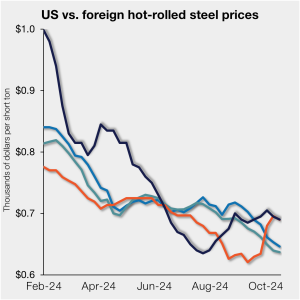

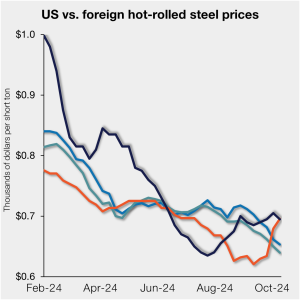

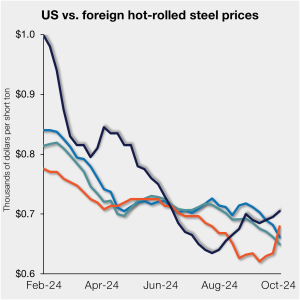

US hot-rolled (HR) coil prices moved lower again this past week. A similar trend was seen in offshore markets, keeping domestic tags marginally above imports on a landed basis.

Insteel Wire Products Co., a subsidiary of Insteel Industries, has acquired Liberty Steel’s Engineered Wire Products (EWP) for $70 million with cash on hand.

Nucor is holding its hot-rolled coil consumer spot price at $720/short ton this week.

Zekelman Industries has announced a joint venture with Maverick Pipe, expanding its offerings of US-made strut channel, PVC conduit, and PVC fence products.

The price spread between US-produced cold-rolled (CR) coil and offshore products was negligibly wider in the week ended Oct. 18, on a landed basis.

CMC Fourth quarter ended Aug. 31 2024 2023 Change Net sales $1,996.1 $2,209.2 -9.6% Net income (loss) $103.9 $184.2 -43.6% Per diluted share $0.90 $1.56 -42.3% Full year ended Aug. 31 Net sales $7,925.9 $8,799.5 -9.9% Net income (loss) $485.5 $859.7 -43.5% Per diluted share $4.14 $7.25 -42.9% (in millions of dollars except per share) […]

US hot-rolled (HR) coil prices slipped again this past week, mirroring movement in offshore markets. This kept domestic tags marginally higher than imports on a landed basis.

The latest SMU Community Chat webinar reply is now available on our website to all members. After logging in at steelmarketupdate.com, visit the community tab and look under the “previous webinars” section of the dropdown menu. All past Community Chat webinars are also available under that selection. If you need help accessing the webinar replay, or if your company […]

We just wrapped up another Steel 101 workshop, easily the most hands-on industry workshop on steelmaking and market fundamentals, in this humble opinion. Last week on Tuesday and Wednesday, SMU’s Steel 101 was held in Starkville, Miss.

North American auto assemblies fell by nearly 7% from August, but were still ahead of July’s 20-month low. Assemblies were also down just under 1% year on year (y/y), according to LMC Automotive data.

Flat rolled = 60.8 shipping days of supply Plate = 52.7 shipping days of supply Flat rolled Flat-rolled steel supply at US service centers declined in September, though still seasonally high. September’s report reflects lower demand, stable lead times, and restocking early in the third quarter at a perceived bottom in prices. At the end […]

US light-vehicle (LV) sales fell to an unadjusted 1.17 million units in September, down 12.8% from a year ago, the US Bureau of Economic Analysis (BEA) reported. Despite the year-on-year (y/y) drop, domestic LV sales rose 3.3% month on month (m/m).

Everybody has an opinion about politics these days. More importantly for our readers, though, every business has a bottom line. A popular question in our most recent steel buyers survey asked how uncertainty around the upcoming US presidential election could affect that line.

The price gap between US-produced cold-rolled (CR) coil and offshore products narrowed slightly again in the week ended Oct. 11, mainly due to a stateside price cut.

SMU’s latest steel buyers market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Past survey results are also available under that selection. If you need help accessing the survey results, or if […]

US hot-rolled (HR) coil prices slipped this past week but remain marginally higher than offshore material on a landed basis.

The price gap between US-produced cold-rolled (CR) coil and offshore products narrowed slightly in the week ended Oct. 4, mainly due to a price jump in Asian markets.

Construction spending in the US declined for a third month in August but showed an increase year over year (y/y). The US Census Bureau estimated construction spending to be $2.131 trillion in August on a seasonally adjusted annual rate (SAAR). While this was 0.1% below July’s revised spending rate, it was 4.1% higher than spending […]

US hot-rolled (HR) coil prices moved slightly higher again this past week but remain marginally higher than offshore material on a landed basis. Since reaching parity with import prices in late August, domestic prices have been slowly pulling ahead of imports. This has been driven by a slight deviation in price movements – slow but […]

Bull Moose Tube Co. (BMT) will expand its steel pipe and structure operations with a $25 million plant in Gerald, Mo., according to The Economic Times.

Wabash National and Steel Dynamics Inc. (SDI) have signed a 10-year supply agreement that secures “critical steel components” for Wabash’s growing operations, the company said in a press release.

SMU’s latest steel buyers market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Past survey results are also available under that selection. If you need help accessing the survey results, or if […]

The price gap between US cold-rolled (CR) coil and offshore product has shrunk slightly this week ended Sept. 27 as stateside tags edged down. The premium slipped moderately but remains well ahead of the 10-month low from late July.