Nucor's HR spot price unchanged for 5th week

Nucor’s weekly spot price for hot-rolled (HR) coil will remain at $750 per short ton (st) for a fifth week.

Nucor’s weekly spot price for hot-rolled (HR) coil will remain at $750 per short ton (st) for a fifth week.

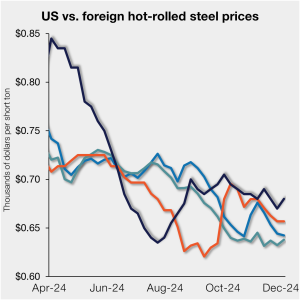

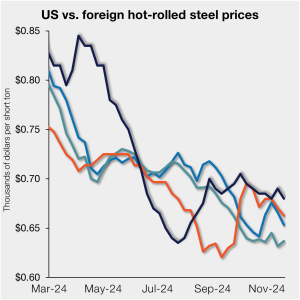

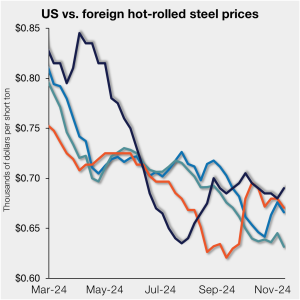

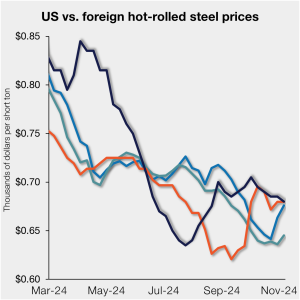

Hot-rolled (HR) coil prices ticked back up in the US this week, while tags in offshore markets moved in varying directions. Thus, the price premium between stateside hot band and imports on a landed basis widened slightly. After leveling with import prices in late August, stateside tags have been mostly stable and ahead of imports […]

Steel sheet prices remain at or near multi-month lows, while plate prices continue edging lower from their mid-2022 peak.

Cleveland-Cliffs has officially had spot HRC prices at $750/st since mid-September.

For the fourth week in a row, Nucor will keep its published spot price for hot-rolled (HR) coil unchanged.

On Monday, Nucor published new extras effective Jan, 4, 2025.

The slowdown in North American zinc demand in recent months has played out across all sectors, and CRU now expects it to contract by 3.7% y/y.

Prices were stable to down in November for all seven steelmaking raw materials tracked by SMU, according to our latest analysis.

After experiencing a rally ahead of the 2024 election, the nearby part of CME HRC futures complex has softened as we approach year-end. Meanwhile, the forward positions (second half of 2025) have remained supported and largely unchanged.

US hot-rolled (HR) coil prices slipped this week, while tags in offshore markets were also largely down. Thus, the price premium between stateside hot band and imports on a landed basis was relatively unchanged.

SMU’s flat-rolled steel prices were mixed this week with slight declines across most products and a modest increase in prices for cold-rolled coil.

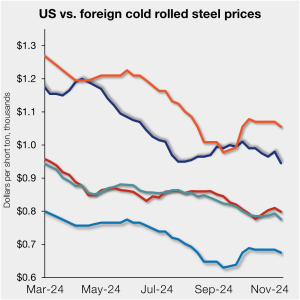

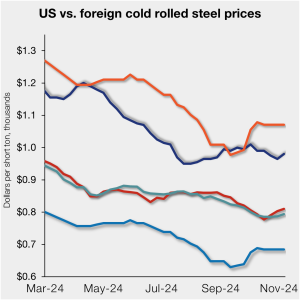

The price spread between US-produced cold-rolled (CR) coil and offshore products slipped in the week ended Nov. 15, on a landed basis.

The price spread between hot-rolled coil (HRC) and prime scrap remained the same in November as both tags were at the levels seen a month earlier, according to SMU’s most recent pricing data.

This CRU analysis from discusses steel sheet prices, demand, and inventory levels around the globe this past week.

No more excuses! The election is over. Donald Trump will be inaugurated on Monday January 20 with the Republican party in control of Congress. Now, it is time to get back to work!

Wolfe Research's Managing Director Timna Tanners discusses the 'Trumplications' for steel in the coming year in this week's SMU Community Chat.

Ferrous scrap prices were largely rangebound to down at the November settle, market sources told SMU.

The pig iron markets have retreated over the last two months amidst a concerted effort by US-based buyers to drive down prices to more closely follow the lower domestic scrap prices.

US hot-rolled (HR) coil prices edged up this week, while tags in offshore markets moved lower. As a result, domestic tags pulled ahead of imports on a landed basis. Since becoming level with import prices in late August, stateside tags had been mostly stable, though they slowly drifted closer to parity over the past month. […]

Prices for sheet and plate products were mixed this week. While market participants have noted a post-election uptick in activity, most said that it was (so far) nothing to write home about.

Nucor raised its weekly consumer spot price (CSP) for HRC this week to $750/short ton.

The price spread between US-produced cold-rolled (CR) coil and offshore products remained largely flat in the week ended Nov. 8, on a landed basis.

China’s steel export volumes reached 11.2 million metric tons (mt) in October, the highest monthly level since September 2015. Steel export prices were mostly stable in China and India this week, while in Turkey steel export prices increased week over week (w/w).

Since June, The US hot-rolled coil (HRC) futures market has been in a rare period of prolonged price stability, closely mirroring the subdued volatility seen in the physical market. Over the past five months, futures have been rangebound, with prices oscillating between a floor near $680 and a ceiling around $800. This tight range, highlighted in the chart, underscores a cautious market environment. The chart below shows the rolling 3rd month CME HRC Future.

US hot-rolled (HR) coil prices moved lower this past week while tags in offshore markets were largely higher. Domestic tags are again nearly level with imports on a landed basis.

SMU price indices edged lower this week for all products but one, marking the fifth consecutive week of overall declining prices.

Nucor’s weekly consumer spot price (CSP) for hot-rolled coil was unchanged week on week at $740 per short ton as of Monday, Nov. 4.

The premium galvanized-coil prices carry over hot-rolled (HR) coil continues to decline following the uptick seen earlier this year.

The theme of “unprecedented stability” in pricing predominated among galvanized steel buyers this month.

Cleveland-Cliffs is keeping its market price for HRC flat at $750/short ton with the opening of its December order book.