Galvanized price premium over hot-rolled coil slips

The premium galvanized coil prices carry over hot-rolled (HR) coil continues to shrink, according to SMU price indices.

The premium galvanized coil prices carry over hot-rolled (HR) coil continues to shrink, according to SMU price indices.

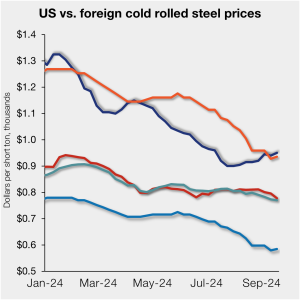

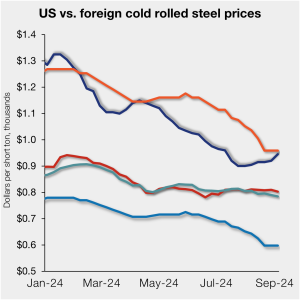

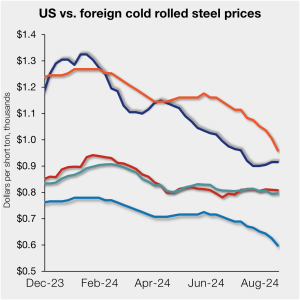

The price gap between US cold-rolled (CR) coil and offshore product widened this week as stateside tags inched up. The premium has been steadily increasing after falling to a 10-month low in late July.

SMU is pleased to share the latest news from the global pig iron markets from our sister publication, Recycled Metals Update.

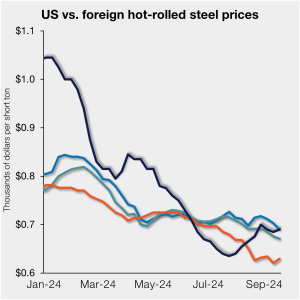

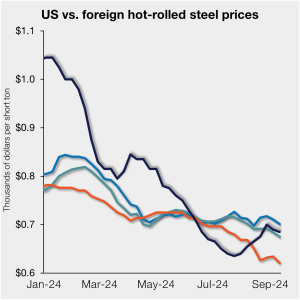

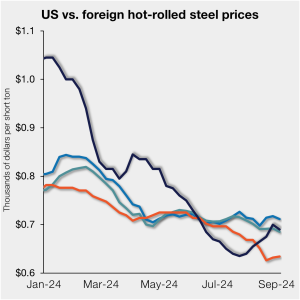

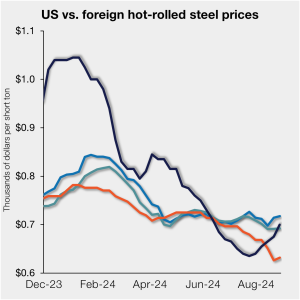

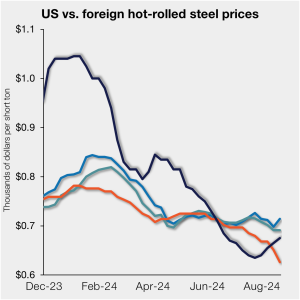

US hot-rolled (HR) coil prices edged up this past week and remain modestly more expensive than offshore material on a landed basis. Since reaching parity with import prices in late August, domestic prices have been slowly pulling ahead of imports. The move has been driven largely by declines overseas.

SMU’s steel price indices were steady to higher this week. Each of our sheet indices crept upwards from last week, while our plate index was unchanged.

Cleveland-Cliffs aims to increase prices for hot-rolled (HR) coil to $750 per short ton (st) effective immediately. The move represents a price hike of $20/st from the Cleveland-based steelmaker's previously published price of $730/st.

Nucor’s weekly consumer spot price (CSP) for hot-rolled (HR) coil is unchanged from last week.

The price spread between hot-rolled coil (HRC) and prime scrap widened again in September, according to SMU’s most recent pricing data.

CRU Principal Analyst Josh Spoores shares with SMU his analysis of the hot-rolled coil futures market.

The US plate market finds itself in unfamiliar territory, well maybe unfamiliar territory for this side of the post-Covid “normal,” that is.

It had been a relatively quiet and steady CME HRC futures market since the end of August. That was upended by Thursday’s news that instead of a two-week maintenance outage, Cleveland-Cliffs would hot idle the C-6 blast furnace at its Cleveland Works for an uncertain period of time. The CME October HRC contract, HRCV4, gained $22 per short ton (st) on the day to provisionally close at $744/st on Thursday. The first and second quarter futures strips of 2025 gained $25/st and $24/st to provisionally settle at $823/st and $829/st, respectively.

US hot-rolled (HR) coil prices edged down slightly this past week but remain at a slight premium to offshore material on a landed basis.

SMU’s steel price indices showed mixed signals for a second consecutive week. Our hot rolled, cold rolled, and plate price indices inched lower from last week, as the galvanized index held steady and Galvalume's ticked higher.

Nucor has raised its weekly consumer spot price (CSP) by $10 per short for hot-rolled (HR) coil to $720/st.

The price gap between US cold-rolled (CR) coil and offshore product has widened again. The premium has grown repeatedly since falling to a 10-month low in late July.

This month’s column on the markets could be a response to the question of last month, “Are the forward curve prices on Aug. 7 high enough to price in trade case risks?" The market’s answer has been a pretty resounding YES so far, I think.

US hot-rolled (HR) coil prices were largely flat over the past week, remaining higher than tags for offshore material on a landed basis for a second consecutive week.

Nucor intends to keep plate prices unchanged with the opening of its October order book, according to a letter to customers dated Wednesday, Sept. 4. The Charlotte, N.C.-based steelmaker said it would maintain prices set in its July 1, 2024, price letter.

SMU indices moved higher on cold rolled products this week, while galvanized prices were flat. Our indices for plate, hot rolled, and Galvalume all edged lower.

Nucor’s weekly consumer spot price (CSP) for hot-rolled (HR) coil is unchanged from last week.

On Aug. 14, the chairman of the world’s largest steel producer, China’s Baowu Steel Group, had some alarming news. He told staff at the firm’s mid-year meeting that conditions in China are like a “harsh winter” that will be “longer, colder and more difficult to endure than expected.”

US hot-rolled (HR) coil prices continue to move higher, surpassing tags for offshore material on a landed basis. Domestic prices, improving on the heels of firmer US mill offers, pulled ahead of import tags as the stateside gains this week were sharper than the increases in overseas markets. SMU’s check of the market on Tuesday, […]

Flat-rolled steel prices were flat or up moderately this week amid mixed signals from the market.

Leading industry analysts on Monday discussed steel prices and how they will be impacted by trade policy, consolidation, mill discipline, November’s elections, and more.

Nucor’s weekly consumer spot price (CSP) for hot-rolled (HR) coil increased $15 per short ton (st) from last week to $710/st.

The price gap between US cold-rolled (CR) coil and imported CR has widened since falling to a 10-month low in late July.

The basic pig iron (BPI) market remains virtually unchanged despite perceived weakness in other ferrous materials, such as scrap, billets, HRC and iron ore.

US hot-rolled (HR) coil prices continue to inch up and are now roughly even with prices for offshore material on a landed basis. The closing of the gap between cheaper US prices and more expensive import tags was driven by improving domestic prices on the heels of firmer US mill offers. SMU’s check of the […]

Cleveland-Cliffs aims to fetch $730 per short ton (st) for hot-rolled coil, up $30/st from its last published price. The steelmaker said the move was effectively immediately and “due to ongoing market developments” in a letter to customers on Wednesday, Aug. 21.

The price spread between hot-rolled (HR) coil and prime scrap widened slightly in August but remains in territory not seen since late 2022, according to SMU’s most recent pricing data.