US CR, import prices trend higher

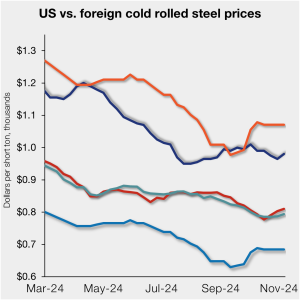

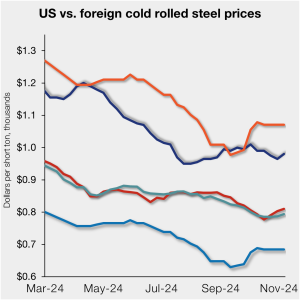

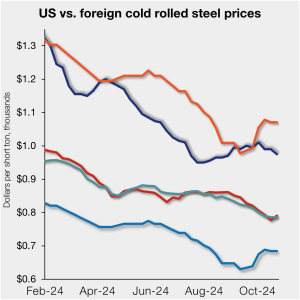

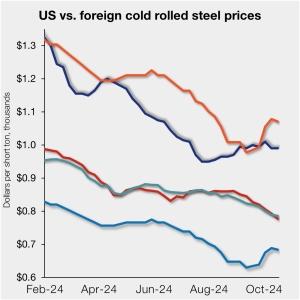

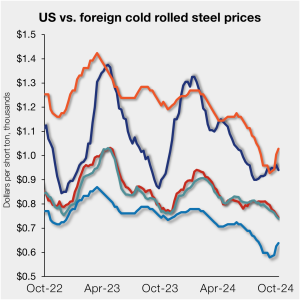

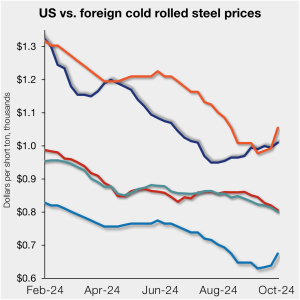

The price spread between US-produced cold-rolled (CR) coil and offshore products remained largely flat in the week ended Nov. 8, on a landed basis.

The price spread between US-produced cold-rolled (CR) coil and offshore products remained largely flat in the week ended Nov. 8, on a landed basis.

China’s steel export volumes reached 11.2 million metric tons (mt) in October, the highest monthly level since September 2015. Steel export prices were mostly stable in China and India this week, while in Turkey steel export prices increased week over week (w/w).

Since June, The US hot-rolled coil (HRC) futures market has been in a rare period of prolonged price stability, closely mirroring the subdued volatility seen in the physical market. Over the past five months, futures have been rangebound, with prices oscillating between a floor near $680 and a ceiling around $800. This tight range, highlighted in the chart, underscores a cautious market environment. The chart below shows the rolling 3rd month CME HRC Future.

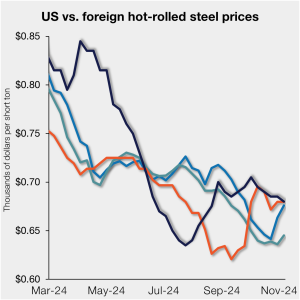

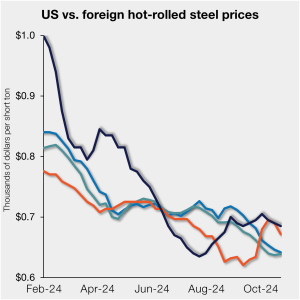

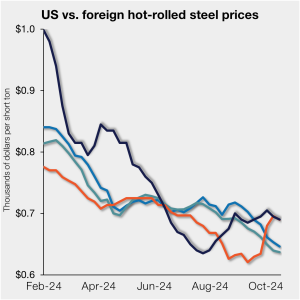

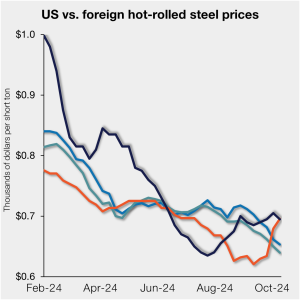

US hot-rolled (HR) coil prices moved lower this past week while tags in offshore markets were largely higher. Domestic tags are again nearly level with imports on a landed basis.

SMU price indices edged lower this week for all products but one, marking the fifth consecutive week of overall declining prices.

Nucor’s weekly consumer spot price (CSP) for hot-rolled coil was unchanged week on week at $740 per short ton as of Monday, Nov. 4.

The premium galvanized-coil prices carry over hot-rolled (HR) coil continues to decline following the uptick seen earlier this year.

The theme of “unprecedented stability” in pricing predominated among galvanized steel buyers this month.

Cleveland-Cliffs is keeping its market price for HRC flat at $750/short ton with the opening of its December order book.

SMU price indices declined again this week for all products other than hot-rolled sheet. Our indices have trended lower across October, falling as much as $75 per short ton (st) in that time.

Nucor has raised its weekly consumer spot price (CSP) for hot-rolled (HR) coil by $20 per short ton (st), now at $740/st as of Monday, Oct. 28.

US plate prices are at their lowest level in almost four years, and less than half of what they were when they reached an all-time high of $1,940 per short ton (st) in May 2022.

The price spread between US-produced cold-rolled (CR) coil and offshore products was negligibly tighter in the week ended Oct. 25, on a landed basis.

SSAB Americas plans to increase plate prices by at least $60 per short to, according to a letter to customers dated Thursday, Oct. 24. The higher prices are effective immediately for all new non-contract orders scheduled to ship on or after Dec. 2.

U.S. Steel aims to increase spot prices for all new orders of flat-rolled steel by at least $30 per short ton (st), according to an internal letter dated Thursday.

US hot-rolled (HR) coil prices moved lower again this past week. A similar trend was seen in offshore markets, keeping domestic tags marginally above imports on a landed basis.

Steel prices ticked lower again this week for most of the products SMU tracks. Our indices have declined as much as $40 per short ton (st) across the last four weeks.

The price spread between US-produced cold-rolled (CR) coil and offshore products was negligibly wider in the week ended Oct. 18, on a landed basis.

The price spread between hot-rolled coil (HRC) and prime scrap narrowed marginally in October, according to SMU’s most recent pricing data.

After a relatively stable and boring September, CME hot-rolled coil (HRC) futures have been on the move lower thus far in October. Since Sept. 30, the November and December futures have declined $63 and $65, respectively, with the curve’s contango steepening.

US hot-rolled (HR) coil prices slipped again this past week, mirroring movement in offshore markets. This kept domestic tags marginally higher than imports on a landed basis.

Steel sheet prices mostly edged lower for a second week, while plate prices slipped for the third consecutive week.

After holding its weekly spot price for hot-rolled (HR) coil steady for three weeks at $730 per short ton (st), Nucor lowered the price this week by $10/st.

The price gap between US-produced cold-rolled (CR) coil and offshore products narrowed slightly again in the week ended Oct. 11, mainly due to a stateside price cut.

CRU Principal Analyst Josh Spoores shares insight into the hot-rolled coil futures market.

US hot-rolled (HR) coil prices slipped this past week but remain marginally higher than offshore material on a landed basis.

Nucor said it would keep plate prices unchanged in a letter to customers on Wednesday. The Charlotte, N.C.-based steelmaker in addition said it was opening its November order book for plate. The company did not specify what its plate price was. It has officially kept prices flat since cutting them by $125 per short ton (st) on July 1.

Steel sheet and plate prices moved lower this week as efforts among some mills to hold the line on tags ran up against continued concerns about demand.

Iron ore prices spiked as the Chinese market reopened after the country’s seven day holiday, but the rally started to lose steam on Tuesday afternoon.

The price gap between US-produced cold-rolled (CR) coil and offshore products narrowed slightly in the week ended Oct. 4, mainly due to a price jump in Asian markets.