SMU survey: Steel buyers' optimism waning

SMU’s Steel Buyers’ Sentiment Indices moved in differing directions this week. Both indices have generally trended downward across 2024, but continue to indicate optimism among steel buyers.

SMU’s Steel Buyers’ Sentiment Indices moved in differing directions this week. Both indices have generally trended downward across 2024, but continue to indicate optimism among steel buyers.

SMU's latest steel buyers market survey results are now available on our website. Here are some key points that we think are worth your time.

Three out of four of our market survey respondents report that steel mills are open to negotiating new order prices this week, a slight decline compared to our previous market check.

Steel buyers continue to report short mill lead times for both sheet and plate products, according to SMU's latest canvass of the market. Lead times for hot-rolled and plate products marginally increased from our late July survey, likely due to limited restocking in anticipation of upcoming mill outages for scheduled maintenance.

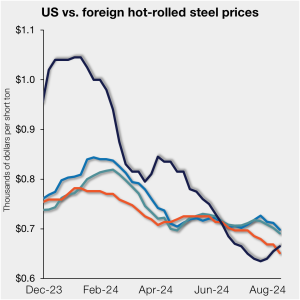

US hot-rolled (HR) coil prices are nearly even with prices for offshore material on a landed basis as domestic tags continue to inch up.

Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, contact info@steelmarketupdate.com. Flat rolled = 64.2 shipping days of supply Plate = 60.9 shipping days of supply Flat rolled Flat-rolled steel supply at US service centers grew in July with restocking as […]

SMU’s Monthly Review articles summarize important steel market metrics for the prior month. Our July report contains figures updated through July 31.

Following an uptick in mid-July, SMU’s Steel Buyers’ Sentiment Indices both eased this week. Current Buyers Sentiment has been see-sawing for the past few months, now back down to one of the lowest readings recorded since August 2020.

The latest SMU market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Historical survey results are also available under that selection. If you need help accessing the survey results, or if your […]

Buyers continue to report very short mill lead times on sheet and plate products, according to our latest market canvass of steel service center and manufacturer executives

Steel buyers of sheet products say mills are still flexible on spot pricing this week, though less so than two weeks prior, according to our most recent survey data.

The majority of steelmaking raw material prices declined in June, following the same trend seen in May, according to SMU’s latest analysis.

SMU’s sheet price ranges slid again this week. But the declines were more pronounced on tandem products whereas prices for hot-rolled coil held roughly steady.

SMU’s Key Market Indicators include data on the economy, raw materials, manufacturing, construction, and steel sheet and long products. They offer a snapshot of current sentiment and the near-term expected trajectory of the economy. All told, nine key indicators point lower, 16 are neutral, and 13 point higher. One thing worth noting: The nine indicators pointing lower are all lagging indicators. Many of those pointing upward are leading indicators.

SMU’s Steel Buyers’ Sentiment Indices both saw improvement this week. Current sentiment ticked higher but remains near the four-year low seen earlier this month. Future Sentiment continues to indicate that buyers are optimistic for future business conditions.

The latest SMU market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Historical survey results are also available under that selection. If you need help accessing the survey results, or if your […]

Sheet steel buyers continue to report that mills are willing to talk price on new orders, according to our most recent survey data collected this week.

Steel mill lead times remain short according to our latest market canvass of steel service center and manufacturer buyers. Of the sheet and plate products SMU tracks, production times for all materials are nearing historical lows not seen in months or years.

US raw steel mill production ticked up to 7.57 million short tons (st) in May, a 4% increase from the prior month, according to recently released American Iron and Steel Institute (AISI) data

Flat Rolled = 60.9 Shipping Days of Supply Plate = 59 Shipping Days of Supply Flat Rolled US service center flat-rolled steel supply remained high at the end of June at 60.9 shipping days of supply, according to adjusted SMU data. This translates to 3.05 months of supply in June. At the end of May, […]

The volume of finished steel entering the US market, dubbed ‘apparent steel supply,’ ticked up 3% from April to May according to SMU analysis of Department of Commerce and the American Iron and Steel Institute (AISI) data.

The latest SMU market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.”

Data on US industrial production, capacity utilization, new orders and inventories all held steady through the latest figures, indicating a stable and healthy manufacturing sector. The strength of the manufacturing economy has a direct bearing on the health of the steel industry.

SMU’s Steel Buyers’ Sentiment Indices dropped this week, with Current Sentiment plummeting to a level not seen since the Covid-19 pandemic, according to our most recent survey data.

Steel mill lead times remain near some of the lowest levels witnessed in months, according to our latest market canvass to steel service centers and manufacturers.

Sheet steel buyers found mills more willing to negotiate spot pricing this week, according to our most recent survey data.

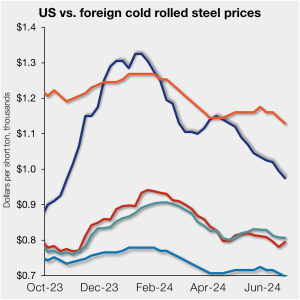

Offshore cold-rolled (CR) coil remains cheaper than domestic product pricing even as US CR coil prices slip to an eight-month low. Domestic CR coil tags stood at $975 per short ton (st) on average in our check of the market on Tuesday, June 25, down $20/st from the week before. Domestic CR prices are, on […]

Following a relatively stable first quarter, steel imports climbed in May to levels not seen in over two-years, according to preliminary Census data released earlier this week. Projected June license data suggests imports could ease from May, though still strong in comparison to levels witnessed over the past year.

Steel Market Update’s Steel Demand Index ticked down 2.5 points last week, slipping further into contraction territory, according to our latest survey data. SMU’s Steel Demand Index now stands at 38.5, down from 41 at the beginning of June. The decrease puts the index at its lowest measure since November 2022. The reading – down […]

The latest SMU market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Historical survey results are also available under that selection. If you need help accessing the survey results, or if […]