Analysis

April 25, 2025

Global steel production recovers in March

Written by David Schollaert

Global raw steel production increased in March, according to the latest figures released by the World Steel Association (worldsteel). March’s output reached a two-year high, a significant reversal after February marked one of the lowest monthly production rates post-pandemic.

Steel mills worldwide produced 166.1 million metric tons (mt) of raw steel in March. This represents a 15% boost over the previous month and is 3% above the same month last year (161 million mt).

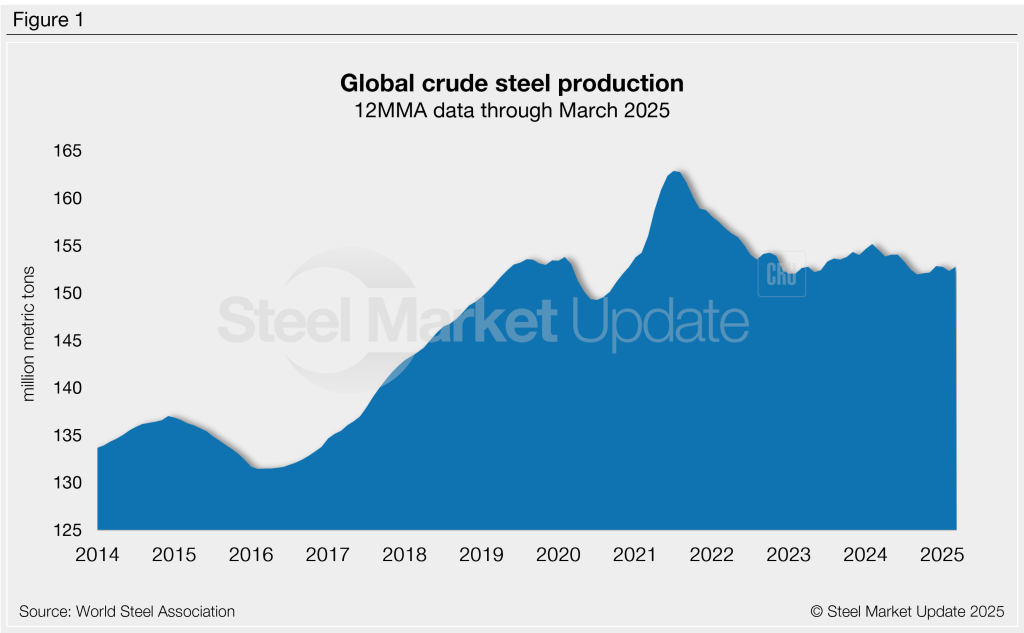

On a 12-month moving average (12MMA) basis, global production has averaged 152.7 million mt per month over the past year (Figure 1). This annual rate is 0.2% lower than the 12MMA measured a year earlier (156.4 million mt). Annual mill output has generally remained in the 152-154-million-mt range over the past two and a half years, like pre-pandemic levels.

Daily global steel output averaged 5.36 million mt per day in March. This is nearly 4% higher than February’s daily rate and a solid 3% boost over levels seen a year earlier. Across 2024, the daily production rate climbed as high as 5.36 million mt per day in June and was as low as 4.67 million mt per day in August and December.

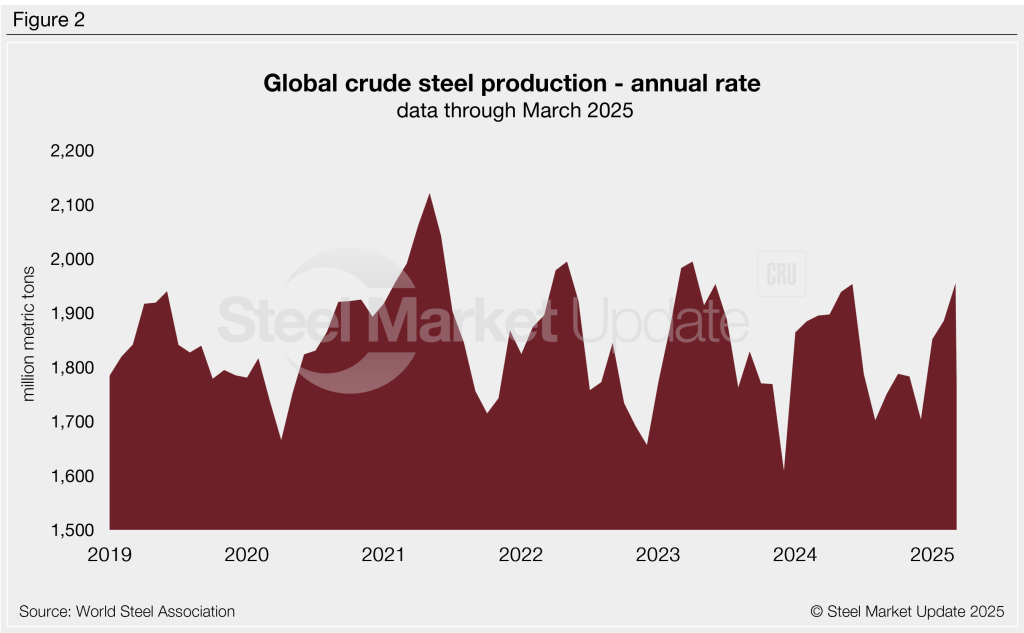

Annualizing March’s daily production rate yields an annual rate of 1.96 billion mt (Figure 2). This rate is a solid 7% higher than late-2024 levels, back in line with those seen one year ago.

Regional breakdown

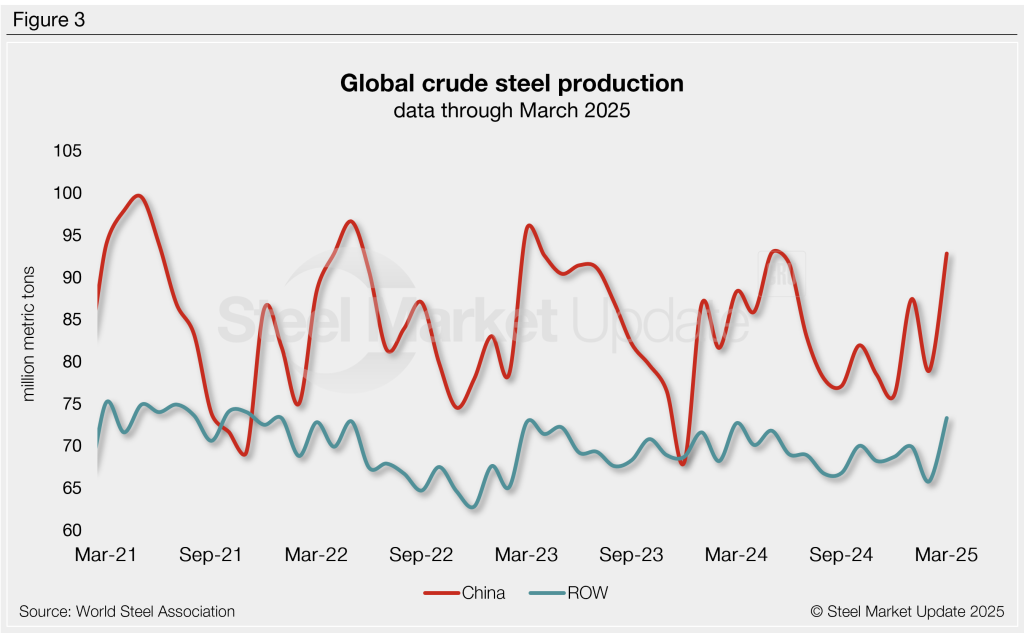

China is the world’s top steel producer, accounting for 92.8 million mt (56%) of March’s total output (Figure 3). This volume was nearly 18% higher month over month (m/m) and a 10-month high. It’s also 5% above production levels one year prior. Chinese mill output averaged 83.4 million mt per month across 2024, peaking in May at 92.9 million mt. Over the past three years, Chinese mills have accounted for 50-57% of global steel production.

Steel output from the rest of the world (ROW) totaled 73.3 million mt in March, a boost of more than 11% over the previous month and 0.8% above March 2024. ROW production averaged 69.4 million mt per month throughout 2024, peaking at 72.7 million mt in March.

Top producing countries

Looking at production levels by country, India held its place as the second-largest steelmaker in March, producing 13.8 million mt. Next up was Japan (7.2 million mt), followed by the US (6.7 million mt), Russia (estimated at 6.2 million mt), South Korea (5.0 million mt), Iran (3.3 million mt), Turkey (3.1 million mt), Germany (3.1 million mt), and Brazil (2.9 million mt).

Comparing the year-to-date (YTD) production figures for each of these countries to the same period last year shows slight shifts in market share. Indian mills have produced ~7% more steel in the first three months of 2025 than in the same time frame of 2024. Production in Iran declined by ~13% in that same period. Other notable shifts in YTD production were evident in Germany (-13%) , Japan (-5%), Russia (-4%), and South Korea (-4%).