Plate

February 28, 2025

Plate Report: Prices rally on mill increases, higher scrap, and Trump tariff threats

Written by David Schollaert

US plate prices have moved up at a sharp clip over the past three weeks. The gains come on the heels of a unified mill pricing blitz, bolstered by the threat of looming tariffs and the expectation of sharply higher scrap prices.

Prices hit their lowest level in more than four years in late January, a fraction of their all-time high of $1,940 per short ton (st) in May 2022. But that almost feels like ancient history now.

Since Jan. 27, there have been nine plate mill price announcements. In under a month, Nucor, SSAB Americas, and Evraz North America all issued three price hikes. They ranged between $240-280/st.

Here’s the latest

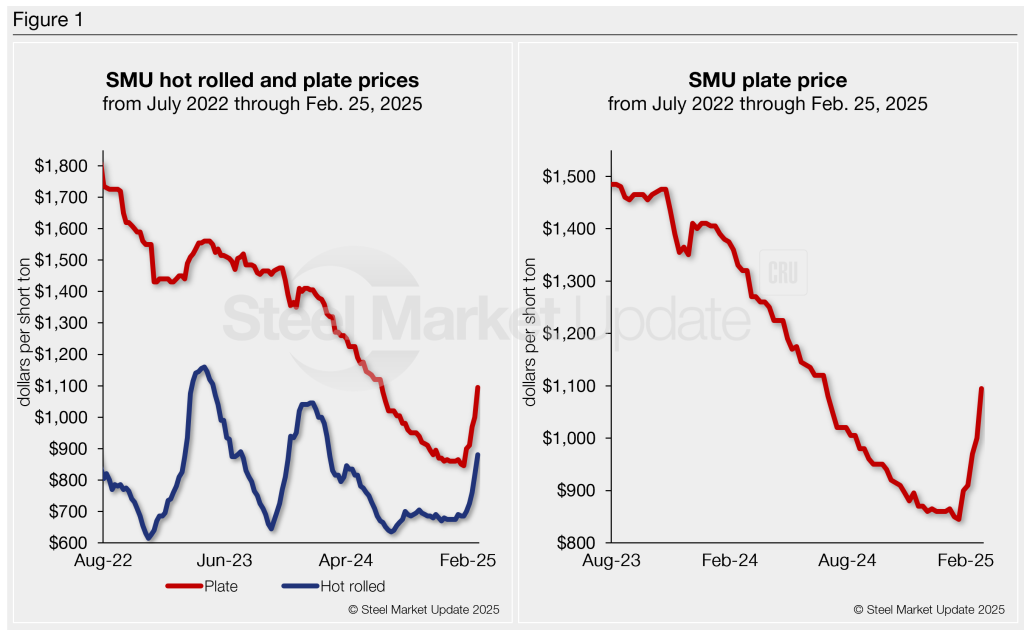

SMU’s plate price stands at $1,095/st on average as of our Tuesday, Feb. 25, check of the market (see Figure 1, left-side chart), up $95/st from the previous week. That marks the highest level for plate prices since June 2024. It also marks the sharpest week-on-week (w/w) gain for plate since August 2021, according to our pricing archives.

And while there was some wiggle room on pricing earlier in the month, sources have pointed to mill pricing letters – or even higher – as an indicator of the market.

In another shift, buyers are no longer finding mills eager to negotiate. We saw a major shift in a matter of two weeks, according to recent survey data. In early February, roughly 83% of survey respondents still found mills willing to talk price, but that shifted to just 33% halfway through the month. We’ll have updated figures on March 5.

To compare, our average HR price is $880/st, up $65/st w/w and $205/st above a recent low of $675/st that closed out 2024.

Even though plate prices have seen fewer volatile swings vs. HR, plate tags had largely been trending down since peaking more than two years ago (see Figure 1, right-side chart). An early rebound has some worried about an unsustainable rally.

Market reaction

The general sentiment among domestic buyers is that the current run-up in price led to a frenzy of buys, some would say borderline panic buying. Lean inventories and higher input costs have supported rising prices, but the threat of tariffs has been the catalyst.

However, most fear insufficient downstream demand to support the current run-up, and the price rally could see a sharp correction.

“There’s not enough downstream demand to support all this forward buying,” said an OEM executive. “All the buying is stressing inventories, but come May or June, what will this rally look like?”

“We’re seeing a supply-side market at its finest,” said a service center source. “Lots of panic buying, and a little pent-up demand from folks who had jobs and waited for the bottom before jumping in. But I don’t think it can bridge the summer gap.”

Quota no more

While prices get all the headlines, sources also question if removing import quotas in favor of a 25% tariff would ultimately drive import totals up, making offshore plate an incredible bargain.

“I have more import offers right now than I’ve had in ten years,” said another source. “The administration is trying to stop imported steel, but the opposite is happening.”

Offers from Brazil and South Korea are presently $900-920/st DDP Houston with late March ship dates. Domestic replacement costs are $1,235/st fob mill.

“Our prices are far and away the most expensive,” said an OEM. “Imports are going to be very competitive regardless of 25%.”

2018 (or 2022?) redux

Many have been looking at 2018 as a barometer for the current price rally and market dynamics. Looking back at the market’s response when the “original” Section 232 tariffs were first introduced is a prudent approach.

But others seem to think what’s in store will likely mirror the market’s reaction to Russia’s initial all-out assault on Ukraine three years ago: Concerns surrounding raw materials supply drove prices nearly $500/st higher over a seven-week period before demand ultimately ruled, and pricing fell just as thrilling as the run-up.

“It will be interesting to see how long this market can run,” said a service center source. “In 2018, we had a run-up through mid-year, and then prices dropped quickly.”

“The makeup of the market looks more like the rally from three years when Russia invaded Ukraine than Trump’s first go-around,” said another source. “These moves won’t stabilize the market. I think we’re in for a ride.”

Spreads remain low

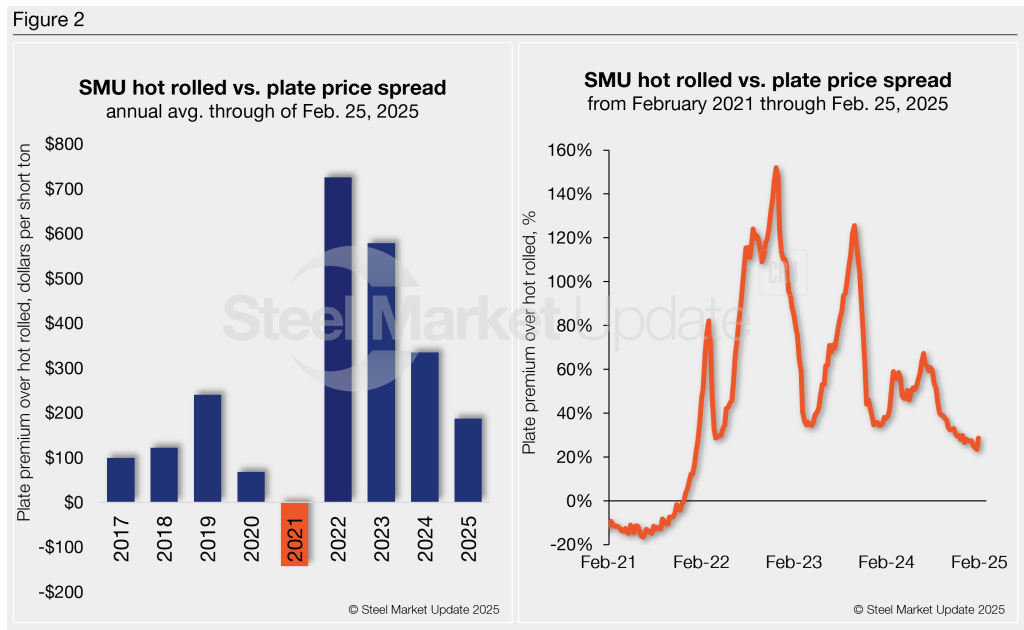

The average premium plate had over HR from 2017-2020 was $132/st. That all changed after the pandemic. The spread saw significant swings before ballooning to $970/st in the summer of 2022. It fell to a three-year low of $160/st in January. It has since started to widen but is still closer to a more historical level (see Figure 2, left-side chart).

On a percentage basis, plate’s premium over HRC skyrocketed to 126% in late September 2023 (Figure 2, right-side chart), reaching a 10-month high. It also wasn’t far from the all-time high of 152% in November 2022. With both plate and HR prices now on a rally, the current spread is just 24%, one of the lowest in nearly two years.

What to watch for

US plate prices have been bolstered by the revival of Section 232, higher input costs, and the impending removal of quotas. What’s not known is whether the Trump administration will move the goalposts should tariffs have unintended consequences.

There are also big questions around demand. The market had been largely quiet since the second half of 2024. Demand had been driven by inconsistent projects, and if forward buying is now aiding the price rally, how long can it be sustained?

Sources think the answer is controlled order books. Once demand or the perception of demand begins to erode, mills will likely limit tons in hopes of keeping tags elevated and at a premium to hot rolled.

Ultimately while opinion on whether demand is or isn’t yet a driving force, lean inventories, higher input costs, and slightly longer lead times should support higher prices well into Q2.

Trump, trade, and tariffs remain the wildcards.