Market Data

February 21, 2025

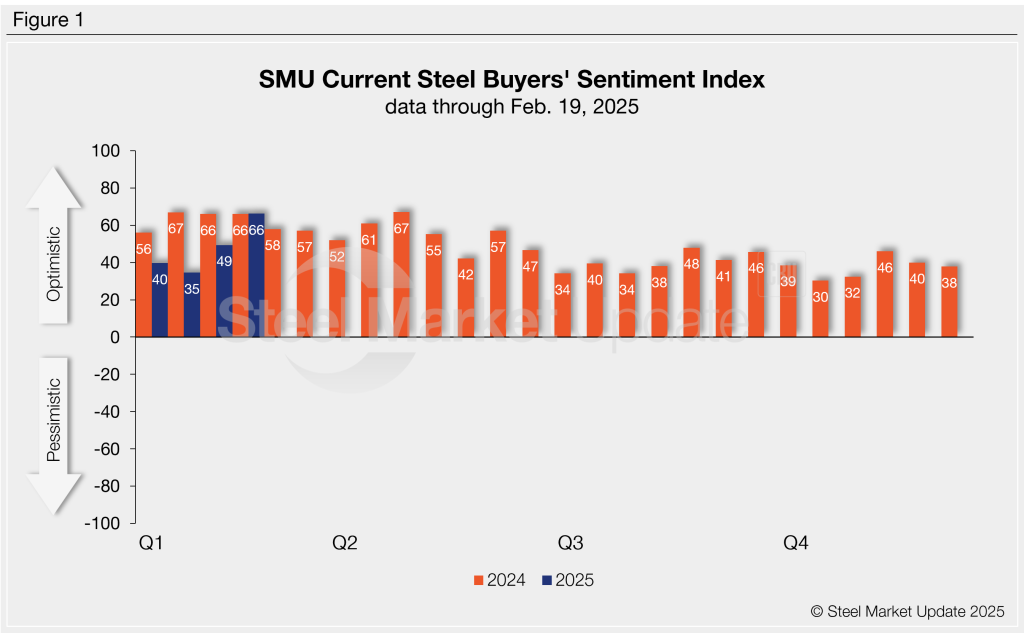

SMU Survey: Current Buyers' Sentiment Index jumps, Future Sentiment slips

Written by Ethan Bernard

SMU’s Current Buyers’ Sentiment Index rocketed up this week, while the Future Buyers’ Sentiment Index edged down. The two indices are almost at parity.

Current Buyers’ Sentiment signals buyers are optimistic about their companies’ chances of success. Future Buyers’ Sentiment also demonstrates buyers have a positive forecast for the first half of 2025.

Every other week, we poll hundreds of steel buyers on how they rate their companies’ chances of success in today’s market, as well as their future business expectations for the next three to six months. This data is used to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics tracked since SMU’s 2008 inception.

Current Sentiment

SMU’s Current Buyers’ Sentiment Index jumped 17 points from two weeks earlier to +66. This is the highest reading since it measured +67 in April 2024. (Figure 1). In the last month there has been +31 shift.

Future Sentiment

Future Sentiment slipped two points this week to +65. (Figure 2). This index has bounced around the mid- to high-60s since the start of the year.

What SMU survey respondents had to say:

“Margins are going to get a boost from these price increases.”

“Demand needs to persist at higher pricing levels, which is still TBD.”

“Very unpredictable due to threat of steel tariffs.”

“We remain conservative.”

“We’re good today… will have to manage inventory tightly going forward.”

“Maybe in three to six months demand will slow as buyers purchased their future demands a few months ago.”

“We expect the tariff threat to be resolved allowing for business growth.”

“Market pricing will peak in Q2 and there will be contract minimums (tons) that will need to be purchased.”

“Depends on whether or not the tariffs create a margin squeeze for the manufacturing space.”

“We’ll be OK if we can pass along these price increases.”

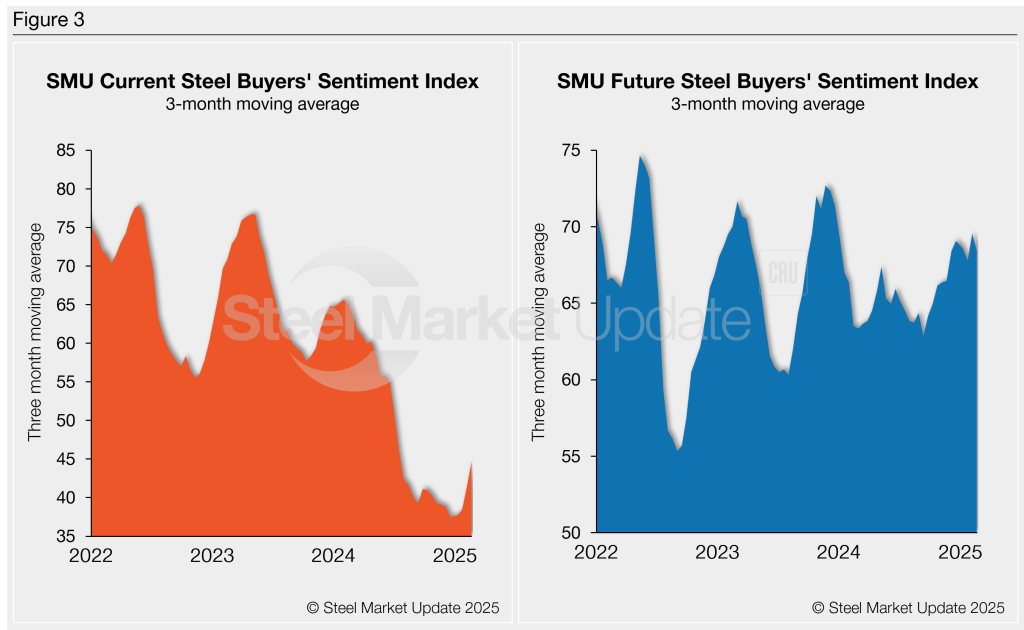

Sentiment trends

When analyzed as a three-month moving average, Current Sentiment inched up while Future Sentiment edged down vs. two weeks earlier (Figure 3). The Current Sentiment 3MMA increased to +44.64 from +41.26 on Feb. 5, and the Future Sentiment 3MMA declined to +68.43 from +69.54.

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.