Sheet

January 16, 2025

December service center shipments and inventories report

Written by Estelle Tran

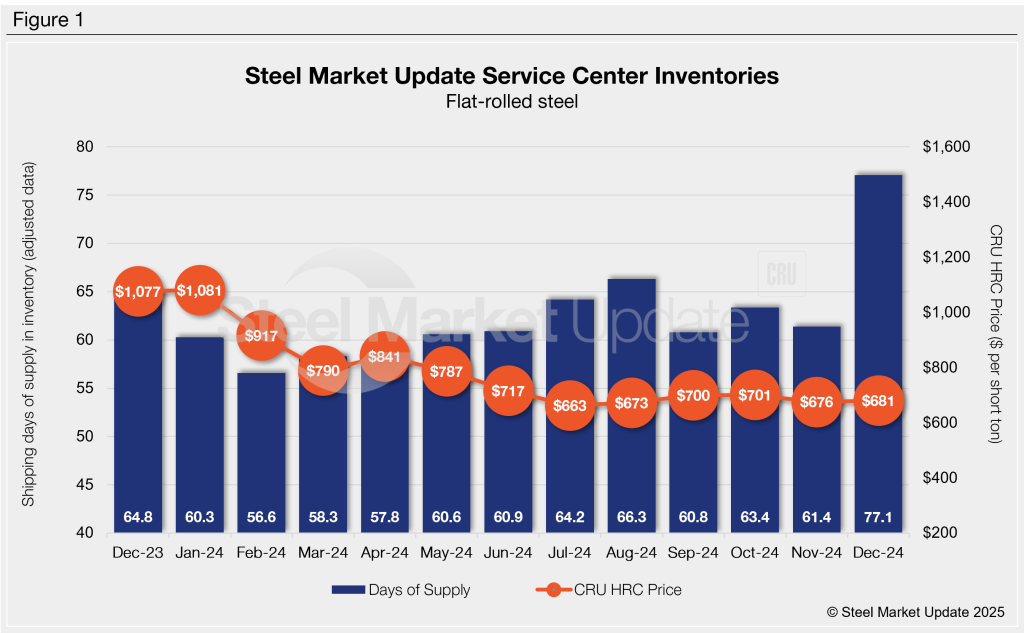

Flat rolled = 77.1 shipping days of supply

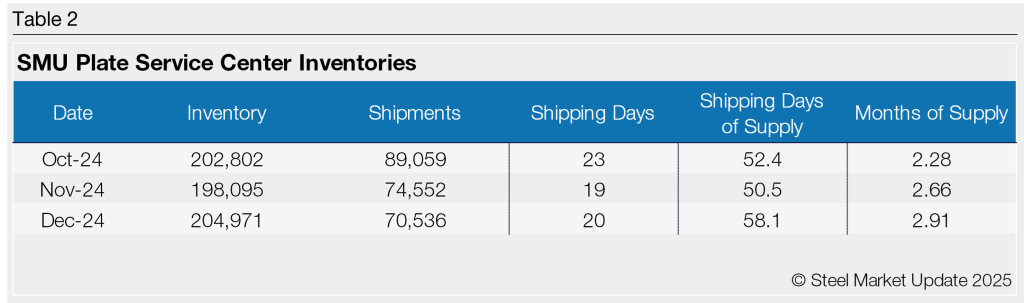

Plate = 58.1 shipping days of supply

Flat rolled

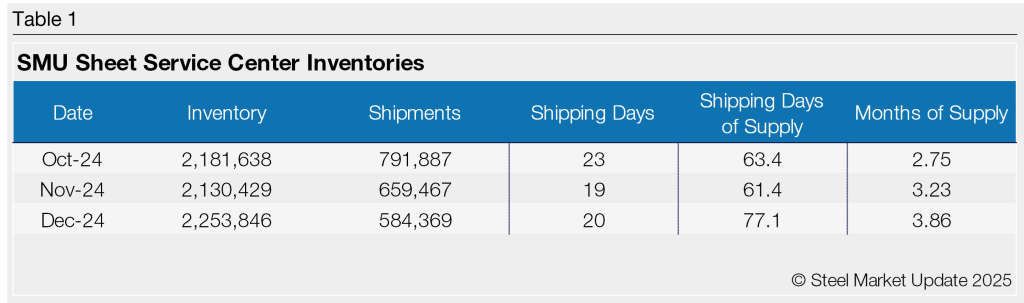

Flat-rolled steel supply at US service centers ballooned in December with higher inventories as well as seasonally lower shipments. At the end of December, service centers carried 77.1 shipping days of flat-rolled steel supply on an adjusted basis, according to SMU data. This is up from 61.4 shipping days of supply in November and still significantly higher than the 64.8 shipping days of supply on hand in December 2023. In fact, shipping days of supply in December was the highest level seen since April 2020.

Flat-rolled steel inventories represented 3.86 months of supply, up from 3.23 months in November.

December 2024 had 20 shipping days, and shipments typically slow this month as well. The December 2024 daily shipping rate was down 6.9% year over year (y/y). The latest SMU survey from Jan. 6-8 found that 50% of service center releases to customers were down compared to one year ago, and 41% said they were releasing the same amount of steel.

Lackluster demand outlooks and the higher-than-usual level of inventory at the end of December explains the lack of buying interest. Material on order at the end of December was higher than in November, but it is far below the 2023 level.

Short mill lead times also reflect buyer restraint. The Jan. 8 survey pegged mill hot-rolled coil lead times at 4.65 weeks. One year ago, SMU reported mill HRC lead times at 6.26 weeks.

With a return to normal outbound shipment levels in January, inventories should come off but still remain above where they were in November. If January shipments fall below average for a typical January, it could take time to work down inventories.

Plate

US service center plate supply followed a similar trend, where supply increased because of slower seasonal shipping rates in December. At the end of the month, service center plate inventories reached 58.1 shipping days of supply, up from 50.5 shipping days in November but lower than 66.4 shipping days in December 2023. Plate supply represented 2.91 months of supply in December 2024, up from 2.66 months in November. Plate supply in December, however, was down from 3.49 months in December 2023.

Market contacts remarked about extremely low inventory levels. Prices and lead times have been stable, though, and have not provided a catalyst to build inventories. Shipments in December were up 2.1% y/y, but service centers have been waiting for more indications of a demand pickup to place more substantial orders.

The amount of material on order declined slightly from November, though November represented a major increase from October. At the end of December, the amount of plate on order was down from November. With the weaker daily shipping rate, though, the amount of material on order in December was up slightly from November but well below year-ago levels.

Inventories remain too low given the expected seasonal increase in demand, and with the restrained amount of material on order, plate inventories are poised to remain sparse in early 2025.