Mexico

November 26, 2024

Plate report: Prices holding at new lows

Written by David Schollaert

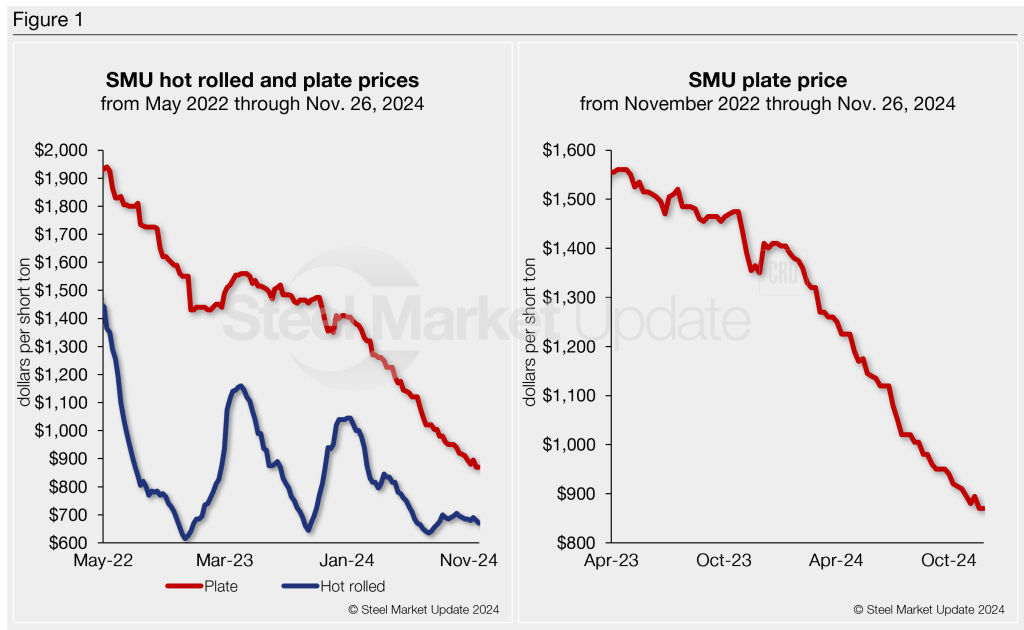

US plate prices are at their lowest level in nearly four years and mills continue to do what they can to limit the bleeding. Domestic prices are now just a fraction of their all-time high of $1,940 per short ton (st) reached in May 2022, and trending lower.

Nucor maintained its published plate price of $975/st late last week with the opening of its January 2025 book after slashing it by $100/st back on Oct. 30.

Recall, that SSAB Americas increased its plate price for the first in nearly a year late last month. While the steelmaker didn’t specify their base prices, the $60/st price bump, brought tags near the $950/st mark.

Here’s the latest

SMU’s plate price currently stands at $870/st on average based on our Tuesday, Nov. 26, check of the market (see Figure 1, left-side chart). While some very small spot orders have been reported higher, plate transactions remain largely in the mid-to-low $800s.

What might be more significant is that smaller volumes are drawing competition among mills and sellers. And $900/st is far from a competitive number. According to sources, tags have easily been transacting roughly $100/st below Nucor’s published plate price, even for product from the Charlotte, N.C.-based steelmaker itself.

By comparison, our HR price is $670/st. HR tags, while up from July’s lows, are roughly just $35/st above 2024’s low and are down $375/st a recent high of $1,045/st at the start of the year.

And even though plate prices have seen fewer volatile swings vs. HR, plate tags have been largely trending down since peaking more than two years ago, especially of late (see Figure 1, right-side chart). Now, they’re at their lowest level since nearly December 2020.

Market reaction

The general sentiment among domestic buyers is that mills are still doing what they can, trying to stop the bleeding and set a floor – something that’s been largely elusive thus far in 2024. Some suggest prices are unlikely to fluctuate much in the near term because inventories are lean and spot buying is hit or miss at year’s end.

“Not much has changed in the plate market,” said a service center executive. “We have our inventory in the range we wanted to be in going into the end of the year.”

“Probably going to be in the first quarter before we see any pricing change,” another buyer said. “Demand for plate isn’t there. It’s a tough market still.”

“Demand just isn’t there yet, and we’re still all waiting to see what Trump is going to do on tariffs. He’s still negotiating publicly and it’s yet to be determined,” a third source said.

More familiar spreads

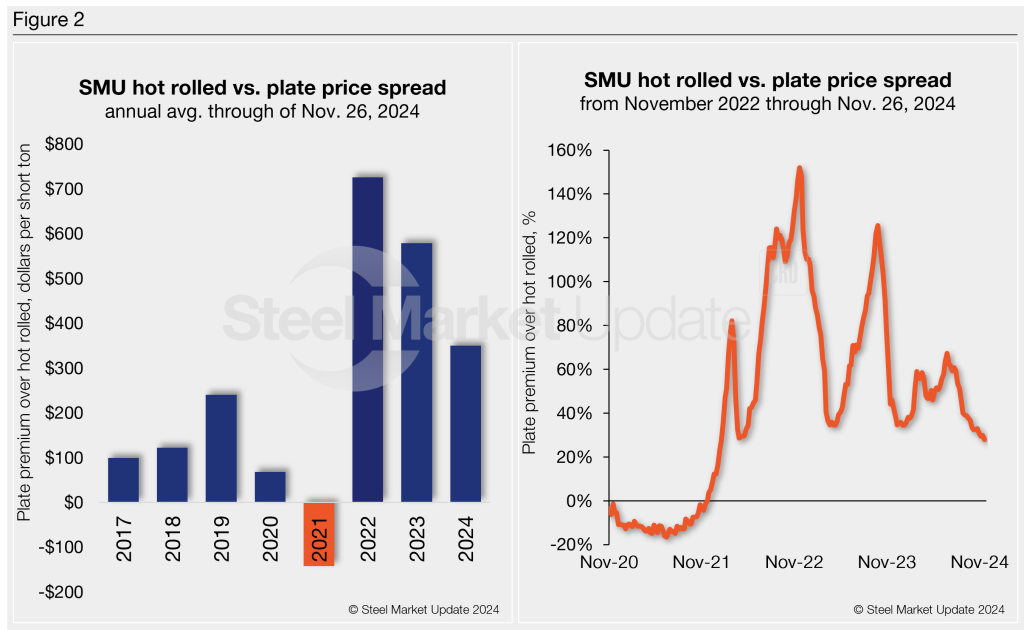

The average spread, or premium, plate had over HR between 2017-20 was $132/st. Volatility took hold post-pandemic, and the spread was all over the place before ballooning to $970/st in the summer of 2022. It currently sits at a nearly three-year low of $200 per ton – closer to a more historical level (see Figure 2, left-side chart).

On a percentage basis, plate’s premium over HRC skyrocketed to 126% in late September 2023 (Figure 2, right-side chart), reaching a 10-month high. It was also not far from the all-time high of 152% in November 2022. However, with HR prices near recent lows and plate tags declining, the premium is down to just 28%, one of the lowest in nearly two years.

What to watch for

The US plate market has been largely quiet for the better part of 2H’24. Demand has been driven by inconsistent projects, specifically due to slower-than-expected infrastructure spending.

The market is still working to find a bottom, and it might be in sight, given that there is not much time left until the start of 2025. But with short lead times – discrete plate lead times are averaging 3.85 weeks and are at their lowest level since April 2020 – demand would have to rebound quickly to influence a price shift.

But also stay tuned on service center inventories data. Plate inventories had been a bit bloated in July but have since been worked down and are presently rather lean, according to October’s report. So, while demand might not be a driving force, any added buying in Q1 could push the needle higher simply as a function of low inventory levels.