Sheet

November 25, 2024

SMU Steel Demand Index rallies

Written by David Schollaert

Steel Market Update’s Steel Demand Index recovered by nearly 10 points last week, though it still remains in contraction territory.

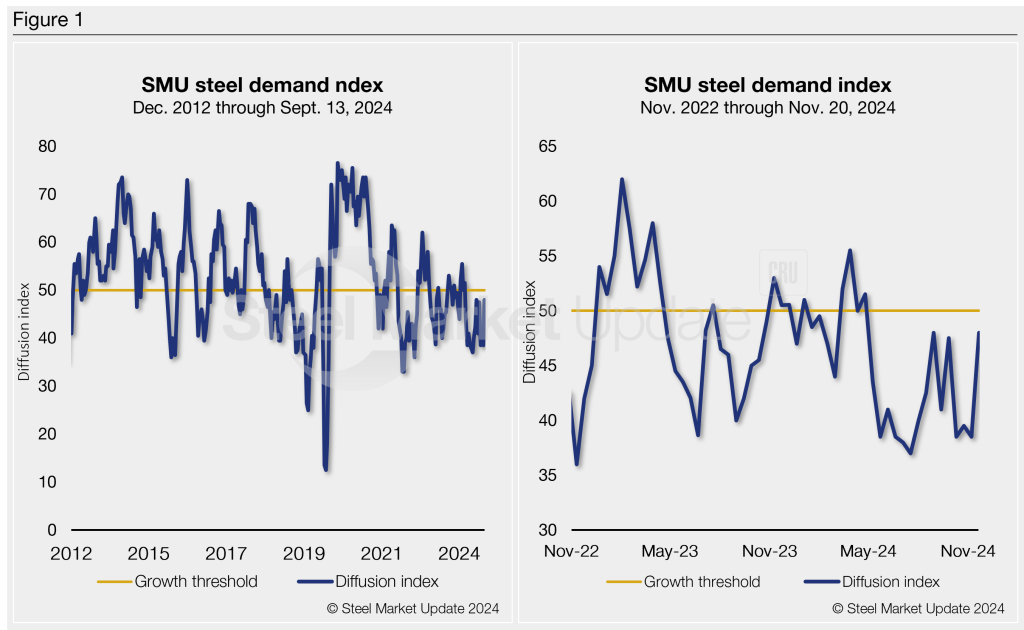

The Steel Demand Index, compiled from our weekly survey data, now stands at 48, up from 38.5 at the beginning of November. The bounce puts the index back to one of its best readings since late August.

The index – still down 7.5 points from a recent high of 55.5 in March – continues signaling lower demand. Prices and lead times also struggle to find higher footing even as mills try to keep tags elevated by publishing higher prices.

Methodology

Derived from the market surveys SMU conducts every two weeks, the index compares lead times and demand to create a diffusion index. This index has historically preceded lead times, which is notable given that lead times are often seen as a leading indicator of steel price moves. An index score above 50 indicates rising demand and a score below 50 suggests declining demand.

Figure 1 shows the nearly 12-year history of the index on the left and provides a closer look at the Steel Demand Index readings of the past two years on the right.

State of play

Falling prices and slumping demand turned the index into contraction in mid-April. Despite some short-lived momentum from mill price hikes, the index hasn’t moved out of contraction territory since. The flat-rolled steel market is still struggling to find its footing even as mills push for higher prices. Large-volume buyers continue to find discounted steel, though most remain cautious, working down bloated inventories and weak end-market demand.

Sheet buyers continue to find mills willing to talk price, at times, just as aggressive as they have been since late Q3. SMU’s Current Buyers’ Sentiment ticked back up from historic lows but remains in line with some of the lowest marks this year. Two separate October and November readings in the low 30s were the lowest the index has been since May 2020.

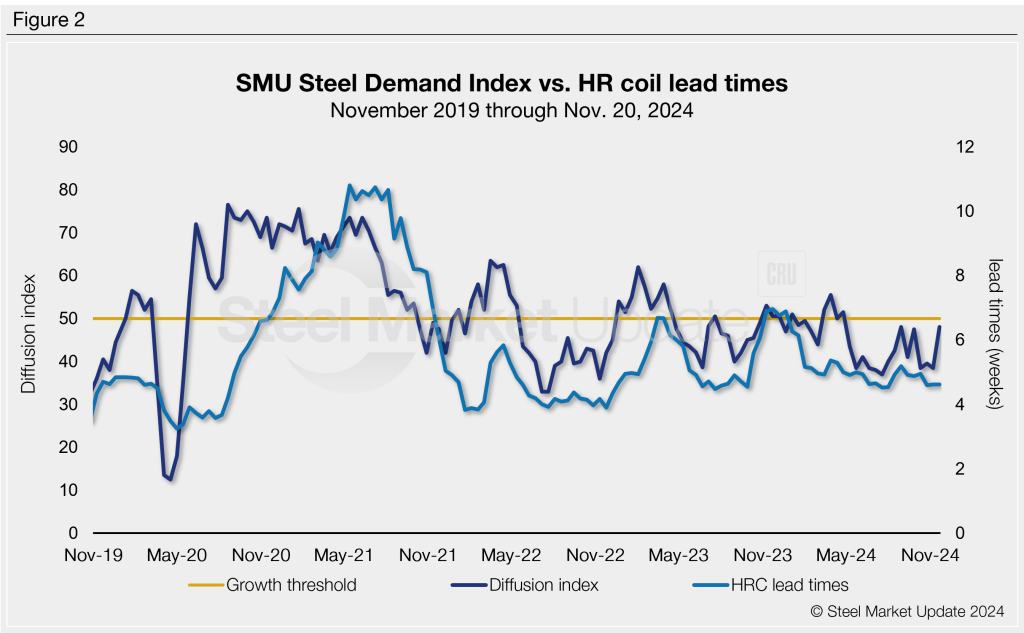

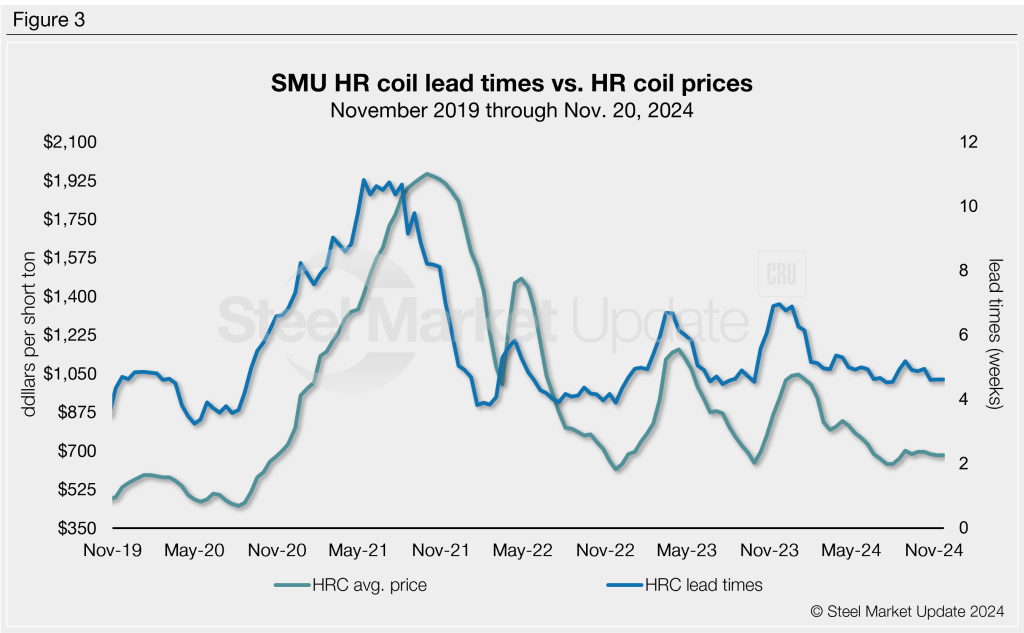

Lead times have been largely stable since late October, still below the 5-week mark at 4.62 weeks on average. Hot-rolled (HR) coil prices have seen a similar trend, with prices below $700 per short ton (st) since late August. HR prices are presently at an average of $680/st, according to SMU’s latest check of the market on Tuesday, Nov. 19.

For nearly a decade, SMU’s demand diffusion index has preceded moves in steel mill lead times (Figure 2), and SMU’s lead times have also been a leading indicator of flat-rolled steel prices, particularly for HRC (Figure 3).

What to watch for

Despite a reading still in contraction territory, nearly 85% of our survey respondents report stable or improving demand. That’s something to keep an eye on as we move through Q4 and into 2025. Still, 17% report declining demand, but that’s a noticeable shift from earlier in the month when 31% were reporting falling demand.

The shift in demand could potentially be a result of basement bottom pricing at which some US mills have recent sold hot band. While Nucor and Cliffs continue to hold their published price at $750/st, buyers continue to report heavy discounts.

The index has reached growth territory only a handful of times since late April 2023. All those gains were short-lived bumps when the market responded to mill price hikes. The latest 9.5-point bump could be a result of large buys ahead of the year-end slowdown.

Time will tell if the current firm position mills continue to hold pricing will help wish the market forward or if SMU’s Steel Demand Index will continue to bump around in contraction territory as we move toward Q1’25.

Note: Demand, lead times, and prices are based on the average data from manufacturers and steel service centers participating in SMU’s market trends analysis surveys. Our demand and lead times do not predict prices but are leading indicators of overall market dynamics and potential pricing dynamics. Look to your mill rep for actual lead times and prices.