CRU

November 8, 2024

CRU: China’s monthly steel exports reach highest level since 2015

Written by Anton Perevezentev & Linda Lin & Puneet Paliwal

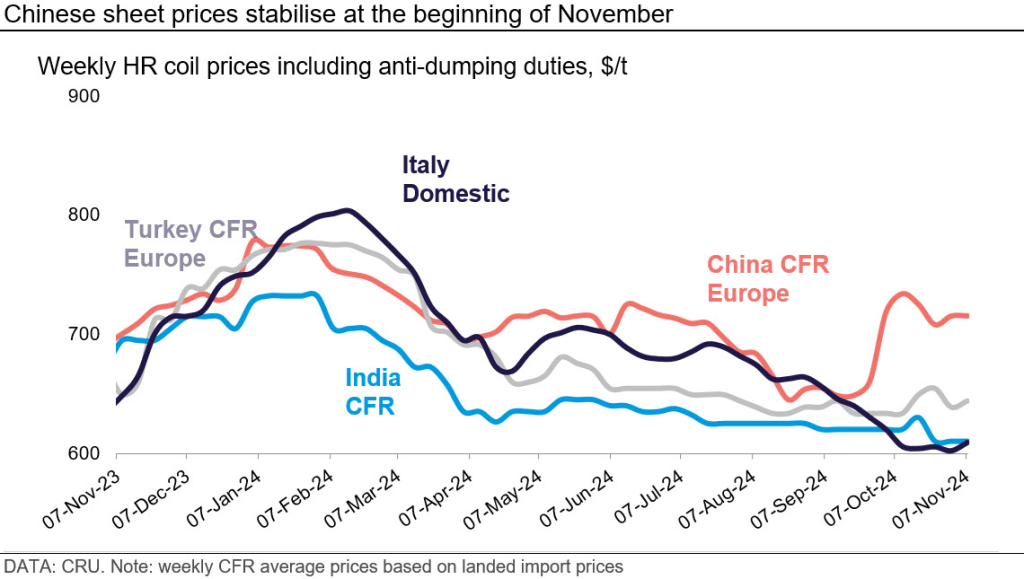

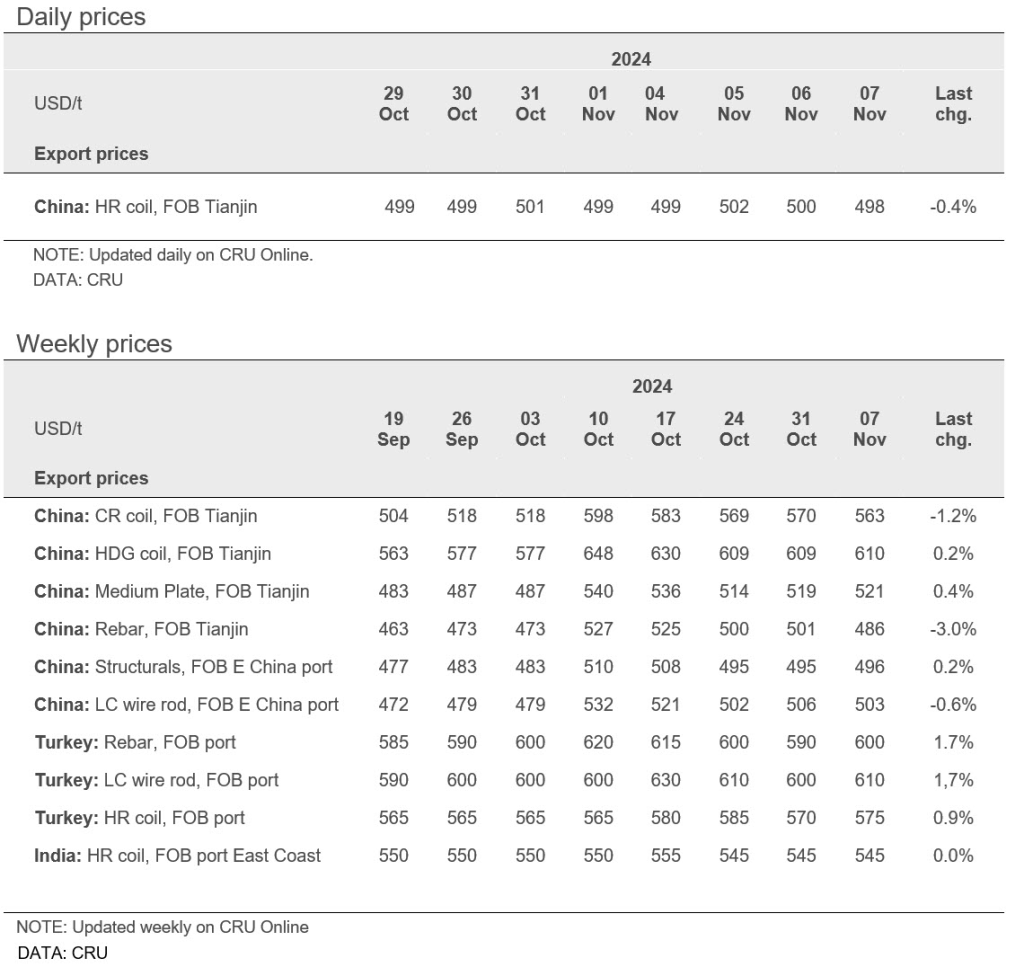

China’s steel export volumes reached 11.2 million metric tons (mt) in October, the highest monthly level since September 2015. Steel export prices were mostly stable in China and India this week ended Nov. 8, while in Turkey steel export prices increased week over week (w/w).

Chinese steel export prices stable in a wait-and-see mode

Chinese steel export prices were largely stable for the second week, as market participants were mostly on the sidelines before the US announced its presidential election results and Beijing releases fiscal policies following the National People’s Congress meeting.

Export prices for major steel products fluctuated in a tight range of -1.2% to 0.4% this week. Rebar prices fell 3%, as major mills rushed into the export market and competed for shipments due in January/February. Rebar domestic sales are expected to slow down soon in the coming winter season and mills must secure enough bookings for the Chinese New Year holiday long break.

General export trading was slow, as market players were mostly in a wait-and-see mode.

All major Chinese mills surveyed by CRU this week reported either increasing or stable domestic sales, whereas about half saw slower w/w sales in the previous week.

China’s steel export volumes reached 11.2 million metric tons (mt) in October, the highest monthly level since September 2015. The surge was mainly due to upfront exporting activities of Chinese traders amid increasing trade investigations including an anti-dumping case initiated by Vietnam. As one of the biggest buyers for Chinese steel products, Vietnam is expected to make the final decision of tariffs on Chinese HR coil this month.

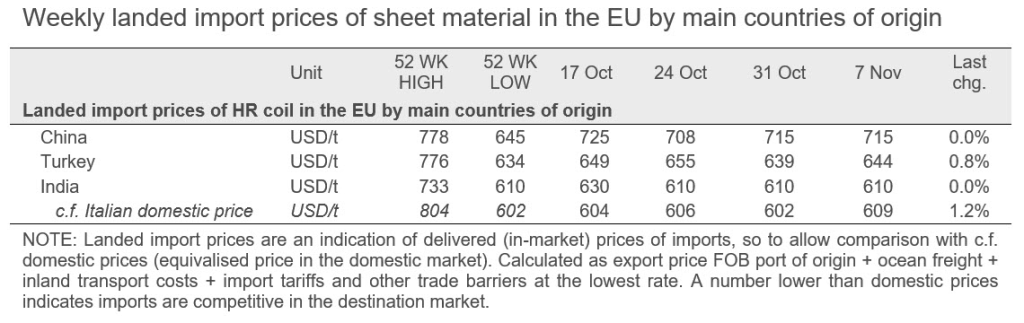

Indian exports fail to pick up due to low buyer bids

Indian HR coil export price remained unchanged w/w at $545/mt FOB due to lack of new deals. Buyers in the Middle East and Southeast Asia turned their attention back to Chinese offers, which fell below $500/mt FOB. Moreover, major Indian steelmakers did not entertain low bids in anticipation of a near-term revival in domestic demand and prices. Meanwhile, European buyers maintained a cautious stance towards import bookings given the ongoing trade investigations, weak end-use demand and ample local availability. Market sources suggest that Indian suppliers hoped to raise export offer prices after the Diwali holidays, but ongoing weak offers from China have prevented any price hike.

Turkish steel prices edge up in early November

Turkish longs and sheet export prices have fluctuated over the past two weeks as there was a lack of clarity on the near-term price trend direction. This week, rebar export prices rose to $600/mt, $10/mt higher w/w, while HR coil export prices edged upwards by $5/mt w/w to $575/mt. Sheet prices were primarily supported by Chinese import prices, which have risen slightly in the past week. Longs prices increased as steelmakers tried to maintain margins and expected that scrap prices would be supported by the current raw material procuring activity. However, sales in the steel export market have remained restrained due to insufficient demand in key export destinations.

Turkish HR coil delivered to Southern Europe was offered at a premium of $35/mt this week, duties included, compared to the locally supplied sheet, being unattractive for European consumers.

Key trade prices

China price details

HR coil: An average of 14 price points for HR coil were collected daily during the week. On Thursday, 10 offers for SS400 3mm gauge HR coil and one deal price was included in the final calculation. CRU set the spread between offer and bid at $10/mt this week to reflect the actual market level.

Rebar: A total of 15 price points were collected for the weekly assessment, including 13 offers, one indication and one deal price. Ten offers and one deal price were included in the final calculation. The remaining were excluded as they were for rebar of standard not line with CRU’s definition for this price. The Indication was collected for reference but not included in the final calculation according to CRU’s methodology for this price. The offer/bid spread was unchanged at $20/mt to reflect the actual market level.

CR coil: A total of 20 price points for SPCC 1.0mm gauge CR coil were collected over the past week, 13 offers at $565-585 /t FOB and three deal prices were included in the final calculation. The remaining were for CR coil in other grade, therefore were excluded from the final assessment according to CRU’s methodology. CRU set the spread between offers and bids at $10/mt to reflect the actual market level.

HDG coil: A total of 16 price points for SGCC 1.0mm gauge HDG coil were collected over the week, among which seven offers at $590-641/mt FOB and two deals were included in the final calculation. The remaining were for HDG coil with coating different from Z120 or other grade, therefore were not in line with CRU’s definition for the price. CRU set the spread between offers and bids at $10/mt to reflect the actual market level.

Medium Plate: A total of 15 price points were collected for the weekly assessment, including 10 offers and five deal prices. Four offers were excluded as they were for special grade plate or above mainstream market levels. Two deal prices were excluded for being not verified or for special grade plate. The offer/bid spread was set at $10 to reflect the actual market level.

Structurals: A total of six price points were collected for the weekly assessments, all were offers. Two offers were excluded for being above market levels. The offer/bid was set at $20 for both Japanese grade H-beam and UK grade H-beam to reflect actual market levels.

Low carbon wire rod: A total of 20 price points were collected for the weekly assessment, including 13 offers, four deal prices and three indications. Eleven offers and three deal prices were included in the final calculations, with the remaining excluded for high carbon or being not representative of the prevailing market levels by using expert judgement. Indications were collected for reference and excluded from final calculations according to CRU’s methodology for this price. The offer/bid spread remained unchanged at $10/mt.

High carbon wire rod: A total of 16 price points were collected for the monthly assessment, including 13 offers and three deals. Twelve offers and all the deal prices were included in the final calculation, with one offer excluded for being not representative of the prevailing market levels by using expert judgment. The offer/bid spread was enlarged from previous $5 to $15 to reflect actual deal levels.

Billet: A total of nine price points were collected for the monthly assessment, which were all offers, and all included in the final calculation. The offer/bid spread was kept flat at $5/mt.

Editor’s note: This article was first published by CRU. To learn more about CRU’s services, click here.