Market Segment

November 7, 2024

ArcelorMittal Q3 earnings down, still recovering from Mexico strike

Written by David Schollaert

ArcelorMittal SA

| Third quarter ended Sept. 30 | 2024 | 2023 | % Change |

|---|---|---|---|

| Net sales | $15,196 | $16,616 | -8.5% |

| Net income (loss) | $287 | $929 | -69.1% |

| Per diluted share | $0.37 | $1.11 | -66.7% |

| Nine months ended Sept. 30 | |||

| Net sales | $47,727 | $53,723 | -11.2% |

| Net income (loss) | $1,729 | $3,885 | -55.5% |

| Per diluted share | $2.42 | $4.59 | -47.3% |

ArcelorMittal’s earnings saw notable declines from a year earlier as the company said market conditions remain challenging.

“China’s excess production relative to demand is resulting in very low domestic steel spreads and aggressive exports; steel prices particularly in Europe are well below the marginal cost curve,” the company said in a statement on Thursday, highlighting that current market continues are unsustainable.

The Luxembourg-based steelmaker reported net income (attributable to equity holders of the parent) of $287 million in Q3’24, down 69% from $929 million a year earlier. Sales slid 9% to $15.2 billion in the same comparison.

The company said Ebitda in Q3’24 fell 15% to $1.58 billion vs. $1.86 billion the previous quarter. However, ArcelorMittal believes their performance was resilient and benefited from regional diversification.

Mexico resumes operations

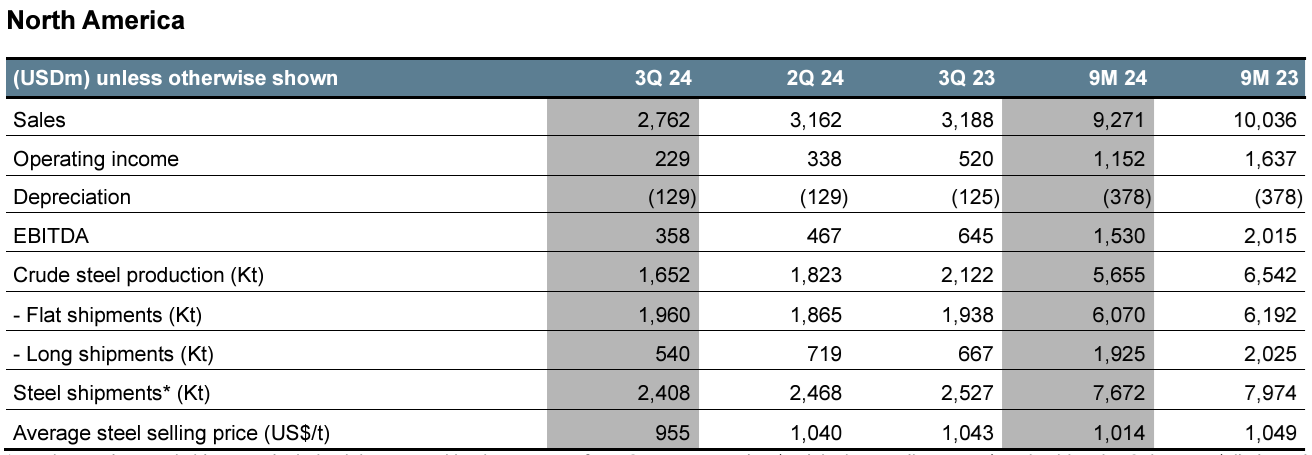

Sales at ArcelorMittal’s North American operations fell 12.7% in Q3’24 to $2.8 billion vs. the previous quarter. The company cited a 2.4% decline in steel shipments, primarily long products. Third-quarter performance was impacted by the post-strike production ramp-up at its Mexican operations.

Recall that a labor settlement was reached on July 19 with union workers at ArcelorMittal Mexico’s steel plant in Lazaro Cardenas and La Mira mine located in the state of Michoacán. The electric-arc furnace and hot strip mill resumed operations in August, with a gradual restart of production and shipments.

AM/NS Calvert

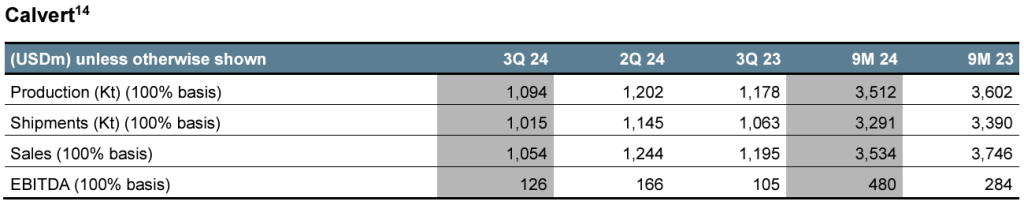

At AM/NS Calvert, its 50/50 joint venture with Nippon Steel in Calvert, Ala., the company said sales declined 15.3% to $1.1 billion due to lower shipments driven by weaker demand.

Last month ArcelorMittal said it would take full ownership of the joint venture if Nippon Steel finalizes its pending acquisition of U.S. Steel. The equity purchase agreement ensures Nippon would transfer its 50% stake in the AM/NS Calvert to ArcelorMittal upon the consummation of its $14.9-billion purchase of USS.

The mill has the capacity to produce 5.3 million tons of flat-rolled carbon steel products annually, according to its website.

Calvert Ebitda of $126 million fell 24.2% quarter over quarter, “primarily due to lower steel shipments and a negative price-cost effect,” ArcelorMittal said.

Potential Trump tariffs on Mexico

Earlier this month, Donald Trump – now president-elect – said he would impose tariffs on goods from Mexico of 25% as a measure to crack down on the flow of fentanyl into the United States.

Recall that Calvert relies on external slabs from Mexico and Brazil for its rolling operations. Those operations include a hot strip mill, continuous pickling line, pickle line-tandem cold mill, and galvanized and aluminized coating lines.

“We can bring materials from Europe if we have to… .” said ArcelorMittal CFO Genuino Christino on a Q3 earnings call with analysts on Thursday. He had been asked about how the steelmaker would mitigate risks associated with potential Trump tariffs.

“But at this point in time, I think it’s just too early to speculate on that,” Christino added.

Christino noted that ArcelorMittal has options, currently sourcing slabs from Brazil and other domestic sources in addition to Mexico. Not to mention a 1.65-million-short-ton-per-year EAF currently being constructed at Calvert to give the mill full melting capabilities. Start-up is still slated for this year.