CRU

October 8, 2024

CRU: Iron ore rally showing signs of cooling down

Written by Yusu Mao

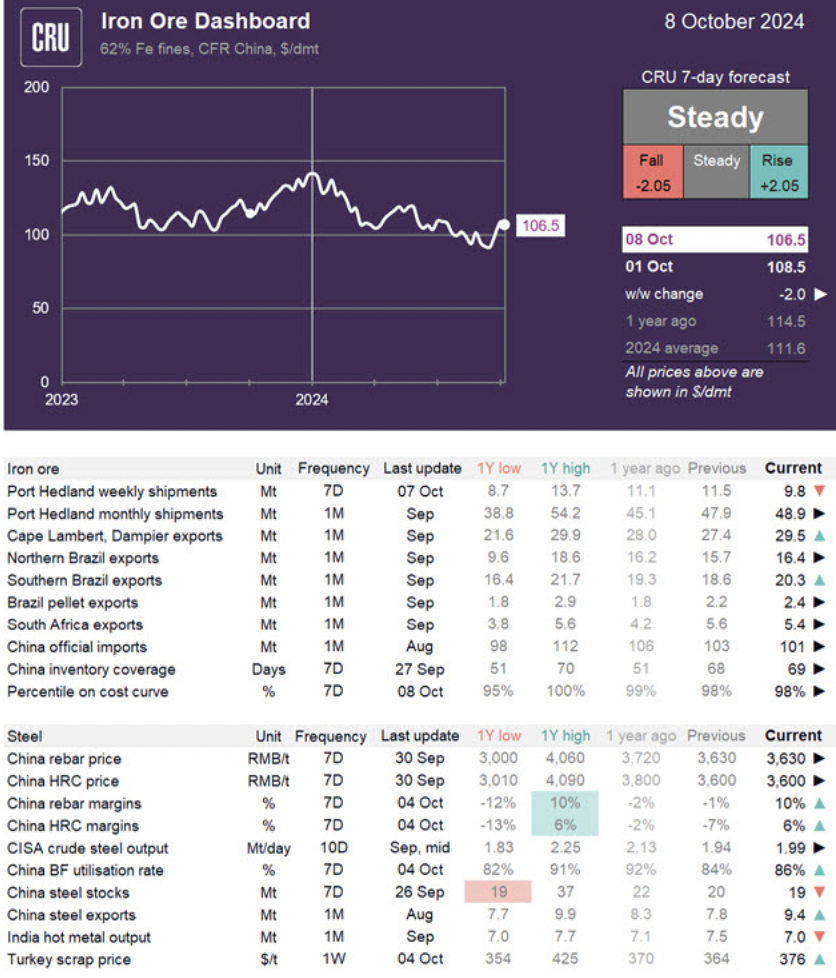

Iron ore prices spiked as the Chinese market reopened after the country’s seven-day holiday, but the rally started to lose steam on Tuesday afternoon. The iron ore price closed at $106.5 per dry metric ton (dmt) today, which is $2.0/dmt lower than the closing price before the holiday.

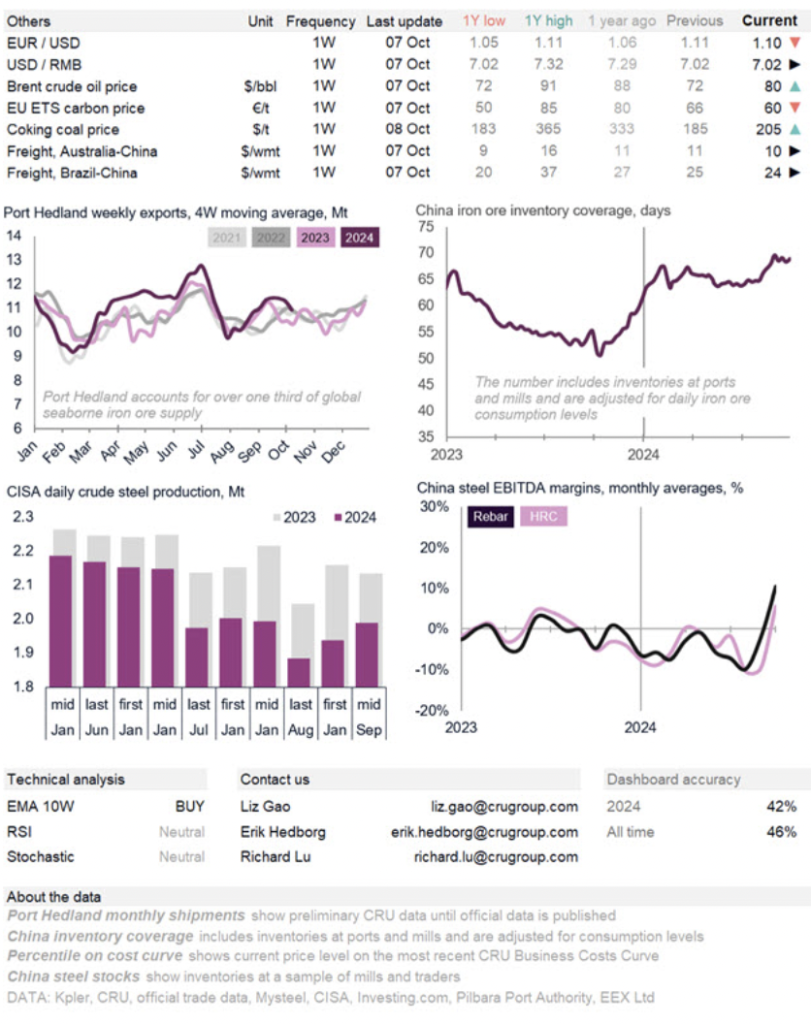

Iron ore supply has remained ample after strong shipments in September. Australian supply declined somewhat in the first week of October, but this is expected for the first week of Q4 as producers are carrying out maintenance after sustaining robust shipments since mid-August. Indian exports have been subdued during China’s holiday period and will be restricted by post-monsoon restocking activity in the domestic market in October. Ukrainian producer Ferrexpo released its Q3 results, showing a 16% quarter-over-quarter (q/q) decline in total production under challenging environment of high costs including electricity, freight, and additional war risk insurance premiums. In Brazil, iron ore exports were very strong in September at 36.9 million metric tons (mt), up by 2.6 million mt month over month (m/m) and 1.3 million mt year over year (y/y). Low-grade exports remained high as many small producers in Minas Gerais make one final push before the wet season starts. We also see an increasing proportion of Brazilian ore being shipped to China. Our data shows that arrivals of Brazilian ore to the Chinese market will reach a new all-time high in the coming months.

Rising Chinese steel and iron ore prices before the holiday sent positive signals to steel producers. Besides the announced monetary measures, there are rumors regarding strong fiscal stimulus, which is believed to be more effective in supporting steel demand and exacerbated the upward price reaction. Hot metal production responded quickly and edged higher even during the quiet holiday period. A contact commented that government-imposed production cuts are very unlikely as pollution control needs to give way to employment. Steel demand is yet to show any concrete change on the first day of market reopening, and the weak steel market in other parts of the world, combined with the absence of new stimulus measures on Tuesday, have made traders more cautious about the iron ore price direction in the coming weeks.

The current price level cannot sustain as optimism will fade away and demand/supply fundamentals are not supportive. We expect iron ore prices to hold steady in the coming week. The market is still looking for a direction and the stimulus hopes will still linger, while the strong supply and weak demand mean we are poised for a correction later in the month.

NOTE: There are two price assessments for iron ore and coal displayed on this page, both sets of prices are published weekly each Tuesday. The assessments in the column on the right represent the average of market prices over the past week and are available in online tables, workbooks and Data Lab. The assessments in the dashboard below include only price information for Tuesday up to market close in Asia and are only available in this dashboard.

Editor’s note: This article was first published by CRU. To learn more about CRU’s services, click here.