CRU

October 4, 2024

CRU: US longs prices remain mostly flat in October

Written by Alexandra Anderson

Scrap declines caused US rebar prices to edge down m/m in October, while all other products remained flat. The appetite for longs imports stayed low as domestic suppliers can meet current demand. Still, uncertainty surrounding scrap prices and seasonal declines in downstream construction activity have market participants shifting their focus on securing their year-end requirements.

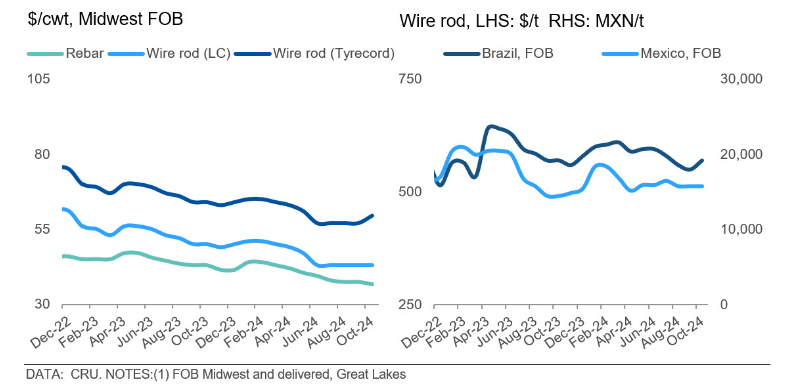

While merchant bar and structurals prices were unchanged from last month, the US rebar assessment fell $0.75/cwt ($15/st), largely because of weaker shredded scrap prices in some regions. With mill maintenance outages slowing, suppliers noted slightly better activity, but buyers are becoming more inclined to shop around for pricing. However, as Q4 begins, buyers are also being mindful of year-end inventory management and not taking on too much supply.

Low-carbon wire rod prices were flat m/m as producers are unwilling to reduce prices further due to higher production costs and narrowed margins. As a result, wire rod prices have largely decoupled from scrap movements amid continued declines. Competitively priced domestic material has kept imports at bay, with September license volumes down 33% from August, according to the US Department of Commerce.

A recent topic of conversation among market participants is how leading indicators of market demand have diverged. The Architecture Billings Index (ABI), which measures architecture firm billings as a lead indicator of non-residential construction activity over the next 9-12 months, fell in August. At the same time, the Dodge Momentum Index (DMI), which measures the value of non-residential construction projects in the planning stage over 12 months, rose m/m. While the timing of when these indices are assessed could play a part, the likely reason is that one measures the revenue an architecture firm will receive for non-residential construction projects (ABI), whereas the other measures the value of the projects themselves. For instance, a $450 million data center that broke ground would boost the Dodge Index for that month, but a slowdown in designs for projects like the retail or office sectors would cause the ABI to decline.

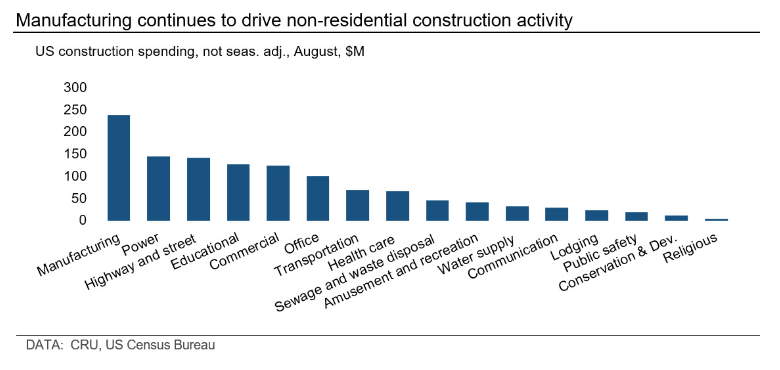

Nonetheless, the US Census Bureau reported that construction spending (not seas. adj.) rose in August to nearly $197 million, up 7.6 % y/y. Residential spending was nearly flat from July levels, while non-residential rose 1.2% m/m. The main non-residential sectors driving this activity were public safety, manufacturing, and water supply.

In Brazil, domestic long prices increased 3.7% m/m as demand improved, even after the central bank increased interest rates during its September meeting. According to IABr, the production of long products remained stable in August compared to July but rose by 19% y/y, with the year-to-date production increasing by 4.3% y/y. Market participants said this increase in production is in response to expectations of better demand in the coming months. In terms of trade, imports rose in August by 36% m/m to 112,000 mt, with the main sources of imports being China and Egypt, while exports decreased by 18% m/m to 68,000 mt.

Learn more about CRU’s services at www.crugroup.com.