Analysis

September 29, 2024

Final thoughts

Written by Ethan Bernard

Washington loomed large in SMU’s survey responses this week. Two big things, actually: the upcoming presidential election and the trade case against imported coated products from 10 nations.

We have to go no further than the first two comments of the first survey question to find them mentioned. The query was: “When do you think sheet prices will peak, and why?” And the first two responses:

“Election results will determine the price until demand improves.“

“It all depends on the next update to trade petitions.”

A little over a month out from the election, it’s understandable why market participants don’t think any clarity will return until the election is decided. Both presidential candidates have staked out positions that make them seem broadly supportive of domestic industry. Vice President Kamala Harris and former President Donald Trump, the respective Democratic and Republican nominees, have both come out against Tokyo-based Nippon Steel’s bid for U.S. Steel, for example.

Still, my gut is that Harris would be more in line with the current global order, while Trump is more of a wild card. Whether it’s tightening trade policy further, perhaps Section 232 on steroids, or a change in US positions on the current geopolitical conflicts roiling the world, a second Trump administration could shake things up. Whether that sounds good or bad to you probably depends on your political persuasion.

The coated case is more straightforward. If duties are slapped on imports from 10 nations, it would cause ripples throughout the market on pricing and affect demand for domestic material. Whether they are gentle swells or 30-foot ship-sinkers remains to be seen.

Still, recall that Canada and Mexico are two nations targeted in the trade case. They represent two-thirds of the USMCA agreement. So what does this development mean for relations within the trading bloc, especially with the US and Mexico already at loggerheads over the supposed “surge” of Mexican steel into the US?

A provision in the agreement puts it up for review by the three nations every six years. That year would be 2026. Yes, so back to what could be a very determinative presidential election for a host of reasons. All roads lead to Washington. Let’s hope that infrastructure spending money gets flowing so we can repair them and get some clarity back soon.

In the meantime. Here are some slides and responses from our current survey to help paint a picture of how market participants are viewing the steel landscape.

Want to share your thoughts? Contact david@steelmarketupdate.com to be included in our market questionnaires.

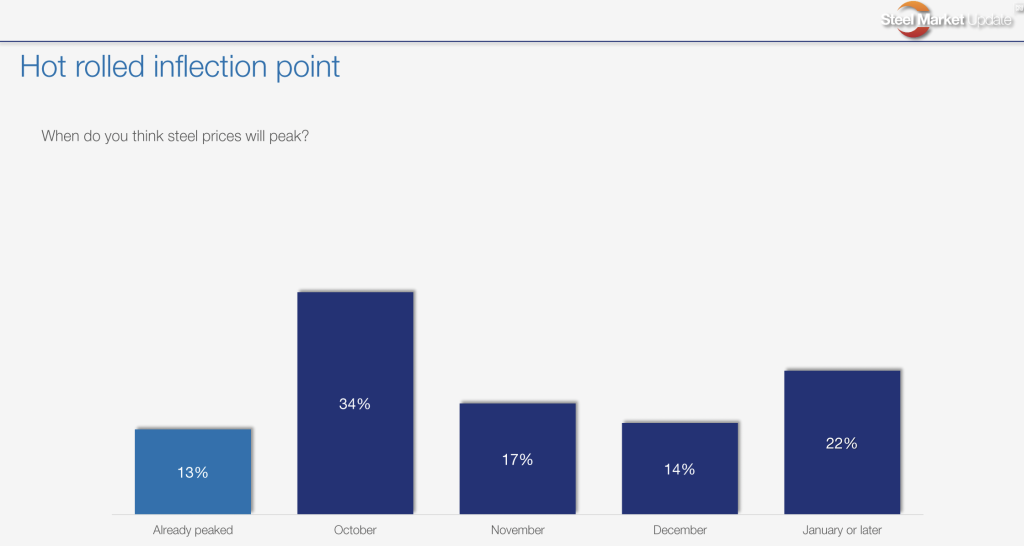

When do you think sheet prices will peak, and why?

“Way less import coming in and demand is decent.”

“The recent increases have stuck for the most part, so hopefully they will implement some more.”

“There will be more availability when the outages are complete.”

“The trade cases will impact most of the flat rolled market if a number of implicated countries stay in. The ultimate effect will take time to reach the market in full, and it could be January or later.”

“Futures indicate February 2025. We think Q2’25 will be strongest.”

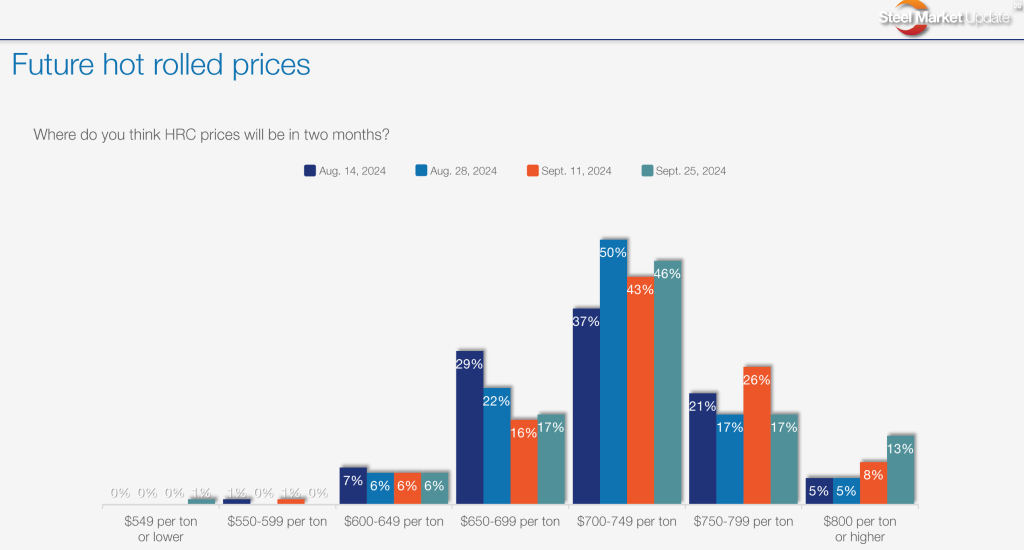

Where will hot rolled prices be in two months?

“USA elections.”

“Election + supply.”

“We need to get into the $700s before the election and move higher after.”

“Unless some of these trade cases pan out, there’s too much capacity and too little demand for prices to climb much further.”

“With domestic demand so weak and China starting to worry folks, we just don’t see any reason for a true ‘rally’ here.”

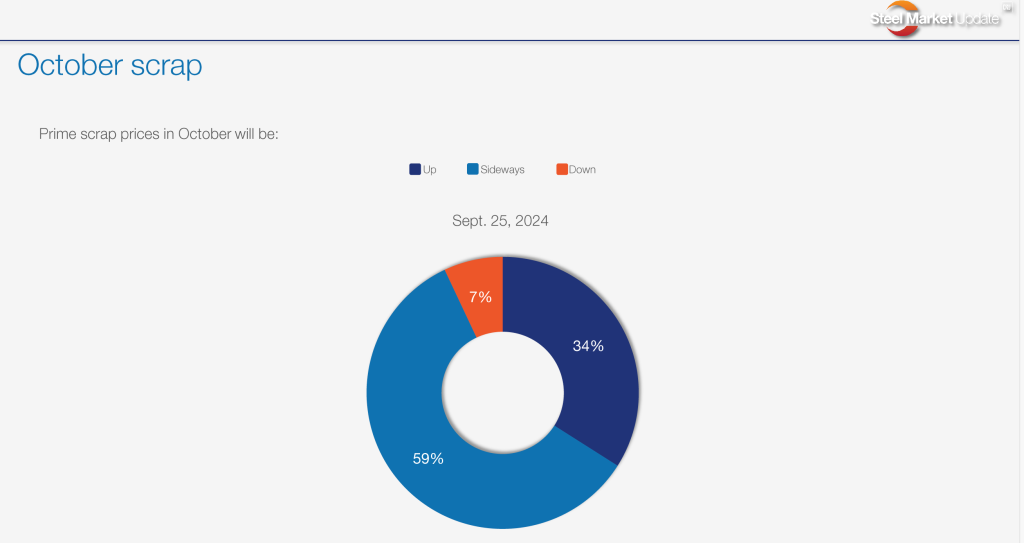

Prime scrap prices in October will be:

“More EAFs in the market.”

“Potentially up a bit on primes.”

“Soft down with less demand due to mill outages.”

“Believe it has to move down to match the move in substitute products – iron ore.”

“Lack of demand.”

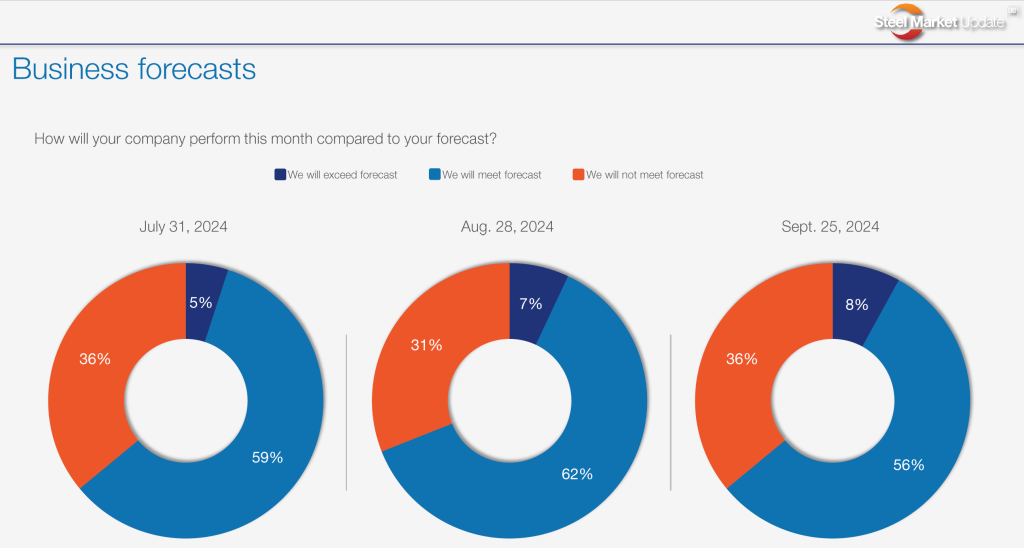

How will your company perform this month compared to your forecast?

“Steady.”

“Spot business has been incredibly slow.”

“Or maybe slightly above forecast.”

As always, all of us here at Steel Market Update truly appreciate your business.