Analysis

September 13, 2024

Plate report: Prices getting closer to pre-Covid norms

Written by David Schollaert

The US plate market finds itself in unfamiliar territory, well maybe unfamiliar territory for this side of the post-Covid “normal,” that is.

Domestic plate prices had been on a historic ride. For a while, it seemed prices would never come down from stratospheric highs.

Up to speed

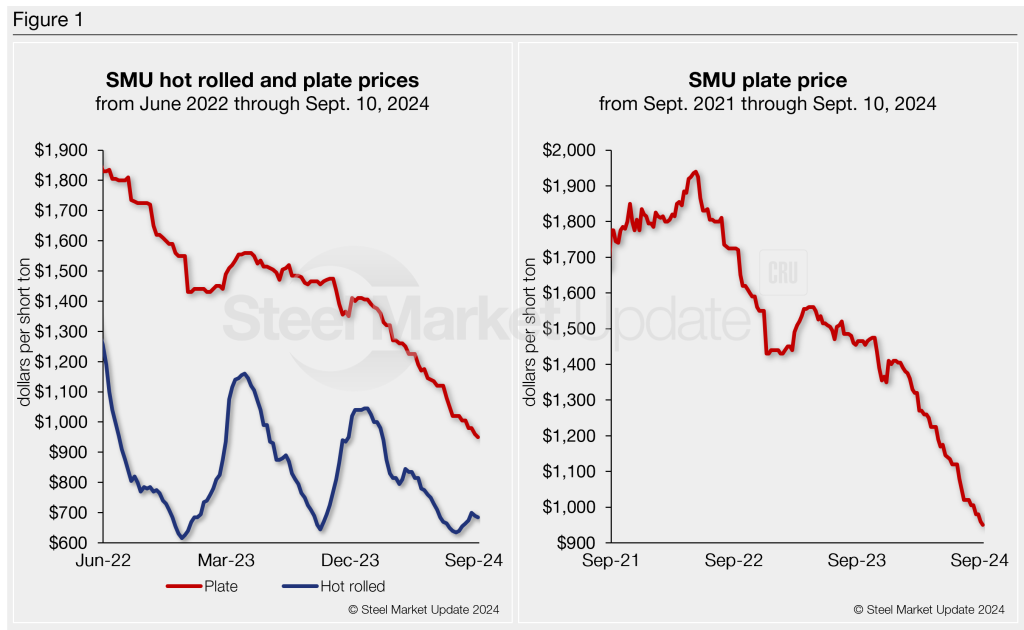

Domestic plate prices began surging in January 2021. Tags reached an all-time high of $1,940 per short ton (st) in May 2022, though they have mostly trended lower since then.

During that three-and-a-half-year period, tags averaged roughly $1,500/st. Before the rally, US plate prices averaged roughly $790/st, according to Steel Market Update’s data.

SMU’s plate price currently stands at $950/st on average based on our Tuesday, Sept. 10, check of the market (see Figure 1, left-side chart). However, lower prices were confirmed shortly after we closed our weekly assessment.

Transactions were confirmed in the upper $800s, though the bulk of business is in the mid $900s. Next week’s price assessments are likely to capture lower tags.

What might be more significant is that smaller volumes are drawing competition amongst mills and sellers. And $1,000/st is not a competitive number. Nucor’s published plate price of $1,075/st is ancient history – even for the Charlotte, N.C.-based steelmaker itself, according to sources.

You can almost “name your price” with a 1,000-st spot need, sources told SMU.

“Plate is right around $900 all day for standard width and thickness,” said an OEM executive. “A little too quiet. Kind of eerie actually.”

By comparison, our HR price is $685/st. HR tags, while up from July’s lows, are down $360/st since reaching a recent high of $1,045/st at the start of the year.

Even though plate prices have seen less volatile swings vs. HR, plate tags have been largely trending down since peaking more than two years ago, especially of late (see Figure 1, right-side chart). Now, they’re at their lowest level since January 2021.

Back to historic spreads?

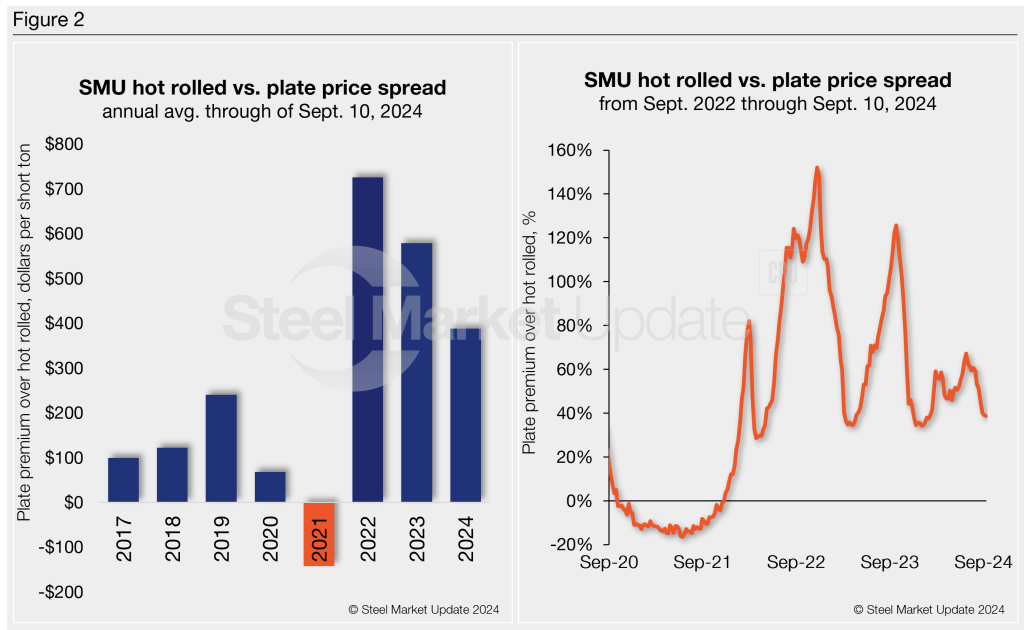

There was a time – feels like ancient history at times – when the price spread between plate and HR coil was between $100-200/st. Like AD and BC designations in the Gregorian and Julian calendars, Covid could designate a clear shift in the plate vs. HR price spread, at least up until recently (see Figure 2, left-side chart).

The average spread, or premium, plate had over HR between 2017-2020 was $132/st. Volatility reigned supreme in the immediate aftermath of Covid-19, leading the spread to invert for much of 2021. And then in 2022, plate prices decoupled from HR.

We saw the spread between plate and HRC reach as high as $970/st in the summer of 2022. It currently sits at almost a three-year low of $265 per ton.

On a percentage basis, plate’s premium over HRC ballooned to 126% in late September 2023 (Figure 2, right-side chart), reaching a 10-month high. It was also not far from the all-time high of 152% in November 2022. However, with HR prices near recent lows and plate tags declining, the premium is down to just 39%, one of the lowest in recent years.

Mill prices – word on the street

There’s growing concern in the market about the transparency of published mill prices. Many wonder if the published price is just a ceiling from where to discount, as sources note that mills are consistently offering and transacting well below their published prices.

Some in the market agree with Nucor’s recent reasoning for maintaining prices – a decrease wouldn’t drive buying.

But while keeping prices flat has some benefits, namely not devaluing inventories, it has left most sources concerned the next decrease will be a massive price cut. (Think back to when Nucor slashed prices by $90/st on April 29 and $125/st on July 1.)

So, while Nucor “officially” held the line on plate at $1,075/st this month and last, reasoning with customers that a price cut wouldn’t draw in buyers, spot transactions are, on average, more than $150/st below that.

Some dynamics at play

The US plate market has been largely quiet, with demand trending down.

The lack of stability has been highlighted by slower-than-expected infrastructure spending and, perhaps more significantly, by a wave of wind farm project cancellations.

With spot plate demand limited, expect continued discounting and undercutting of published mill prices.

Also, keep an eye on discrete plate lead times. They are trending lower and are easily below the three-week mark at some mills – levels not seen in more than four years.

What to watch for

With reports that some mills still have September availability, another price cut might be imminent. But will it be a series of incremental decreases – or will it be $100/st or more?

Sources agree the market is working to find the bottom and might be close to one. Most suggest it will be in Q4, but they don’t expect much of a bounce back after.

Keep an eye on service center inventories as well. Plate inventories were a bit bloated in July. And SMU’s recent flash report for August, which was sent to data providers earlier this month, suggests inventories were even higher last month. The final report will be distributed data providers on Monday. Premium subscribers will receive a copy later in the week.

Editor’s note: If you’d like to become a data provider for our service center inventory report, please contact David Schollaert at david.schollaert@crugroup.com. If you would like to upgrade your executive account to premium, please contact Luis Corona at luis.corona@crugroup.com.