Analysis

September 6, 2024

CRU: Large output cuts in China overshadow mixed global picture

Written by Martin Trouilloud

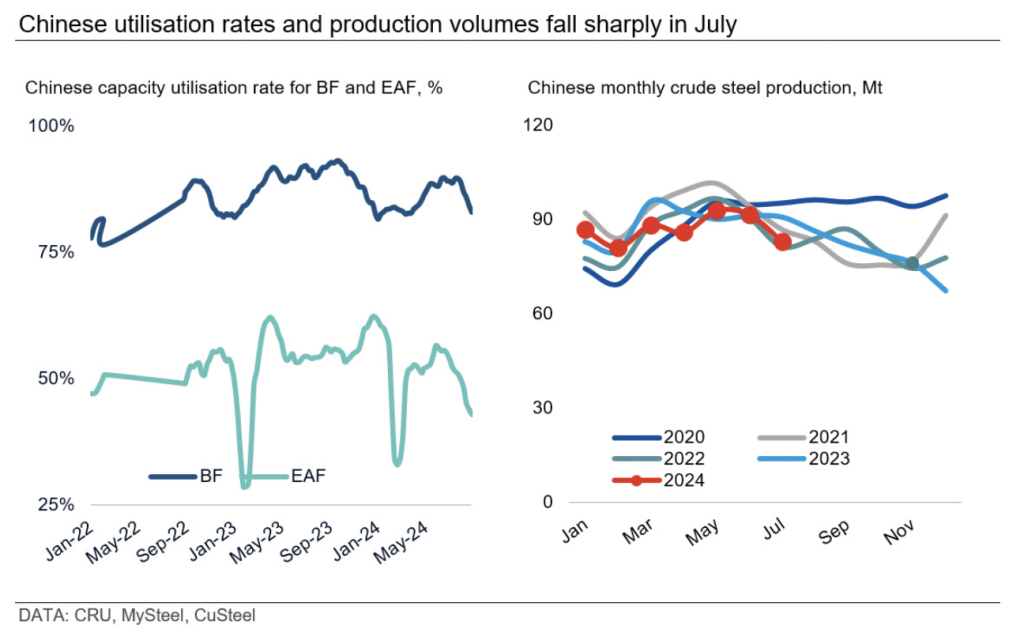

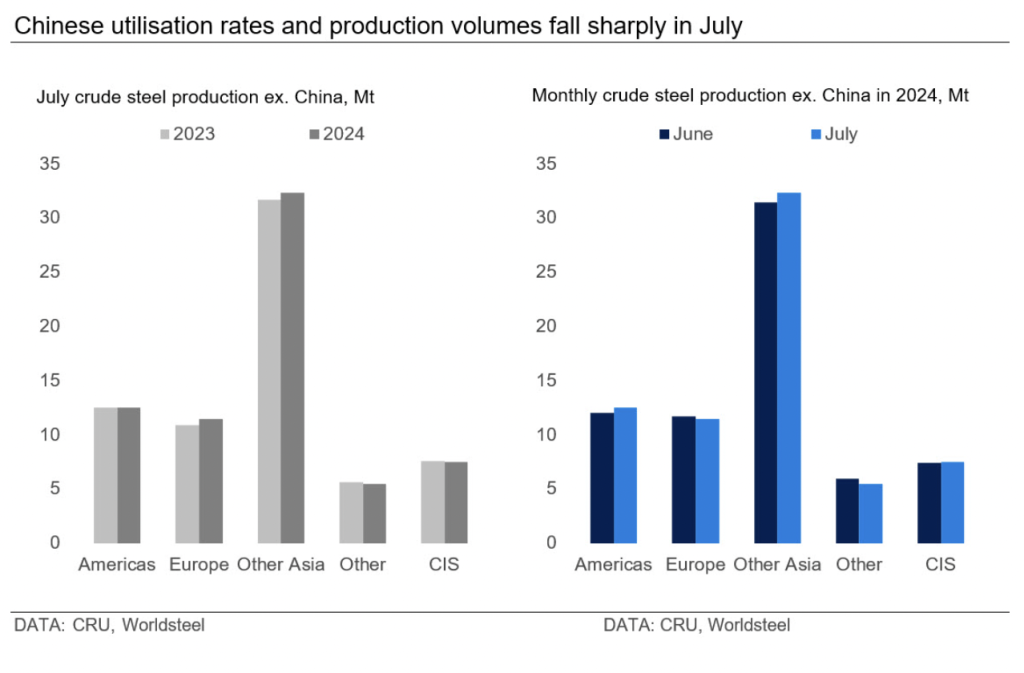

Global crude steel production fell by 4% month over month (m/m) in July, led by a major drop in Chinese output, which fell 9% m/m. The decline in global production was larger year over year (y/y), decreasing by 5%. With the seasonal summer slowdown coming on top of underlying weak demand, Chinese mills are competing aggressively on price, keeping margins negative and now causing significant output cuts. In the rest of the world, small increases in crude steel production were seen, driven by a strong 3% m/m rise in output from Asia outside China.

Very low margins finally cause serious output cuts in China

Chinese crude steel output decreased by 9% y/y to 83 million metric tons (mt) but this has not significantly affected prices. The short-lived growth in domestic production following the May Day holidays was the last sign of steel industry life, but cuts only began to accelerate this month, prolonging the oversupply issue. Prices have yet to see any upwards pressure from lower supply as domestic demand falters, due to the weak property market, less government support than hoped and a bearish macroeconomic outlook. A change to the rebar quality standard increased supply pressure as sellers try to destock. Rebar prices in China are at their lowest level since 2017.

RoW follows divergent production trends

In Asia outside of China, the mild but steady production growth of the past few years was reinforced by a 3% m/m increase, bringing the July total to 32 million mt. There was broad-based growth throughout the APAC region, with all the major regional steel producers seeing some level of monthly increase. The standouts were Taiwan and South Korea, with a number of South Korean mills restarting to drive 7% m/m growth. In y/y terms, Vietnam and Turkey continue to increase steel production. Output in Asia outside of China grew 2% y/y.

European output is down to 11 million mt as maintenance shutdowns continue in the face of low and weak demand – weaker than the usual summer slowdown. However, this still represents a 5% y/y increase, and margins are not yet at Chinese levels. A large decline in import availability was no match for the continued downwards price pressure. Overall, Europe saw a 5% m/m decrease in crude steel production.

Both longs and sheet prices were more stable in the US than elsewhere, though price declines still occurred. With mills running up against costs, a potential bottom is in sight. North American crude steel production rose by 3% m/m, but fell 2% y/y because of a severe drop in Mexican output over 2024. This was due in part to the Biden administration’s recent strengthening of US tariffs against Mexican steel. The US, Mexico, and Canada have each announced increased tariffs on Chinese output, further limiting good export options for Chinese producers.

To learn more about CRU’s services, visit www.crugroup.com.