Prices

August 29, 2024

HR futures: Trying to form a bottom

Written by David Feldstein

On Aug. 14, the chairman of the world’s largest steel producer, China’s Baowu Steel Group, had some alarming news. He told staff at the firm’s mid-year meeting that conditions in China are like a “harsh winter” that will be “longer, colder and more difficult to endure than expected.” Ferrous markets reacted aggressively over the next three trading sessions sending the rolling 2nd month iron ore future down to an intraday low of $91.80/per metric ton (mt), its lowest since November 2022. Six trading sessions later, iron ore was back above $100/mt.

Rolling 2nd month SGX iron ore future $/mt

The panic in iron ore took Turkish scrap futures down with it, but then Turkish scrap rebounded alongside ore. What is even more interesting is Turkish scrap continues to bounce off its $355 support level as indicated by the yellow dashed line.

Rolling 2nd month LME Turkish scrap future

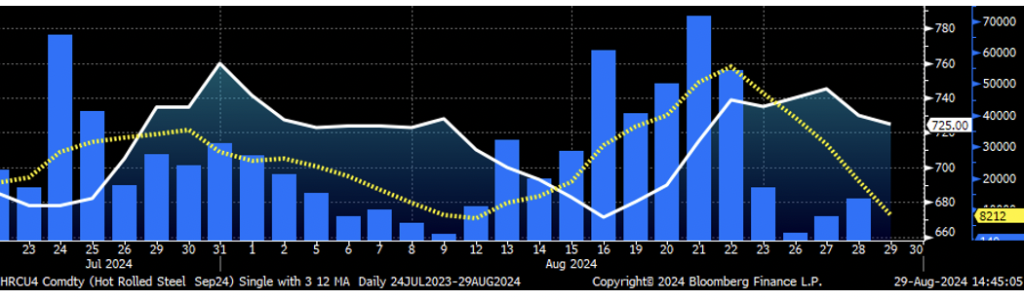

Over the past few years, financial market participants have increased their footprint in HRC futures. As a result, Midwest HRC futures can be heavily influenced at times by developments on the global ferrous or macroeconomic front. For instance, HR futures trading volume ground to a halt through the first seven trading sessions of August as the summer doldrums arrived in full force. The news out of China and panicked-selling in iron ore spilled into the Midwest futures market. Trading volume exploded as futures tanked.

September CME HRC future $/st w aggregate curve volume & 5-day avg.

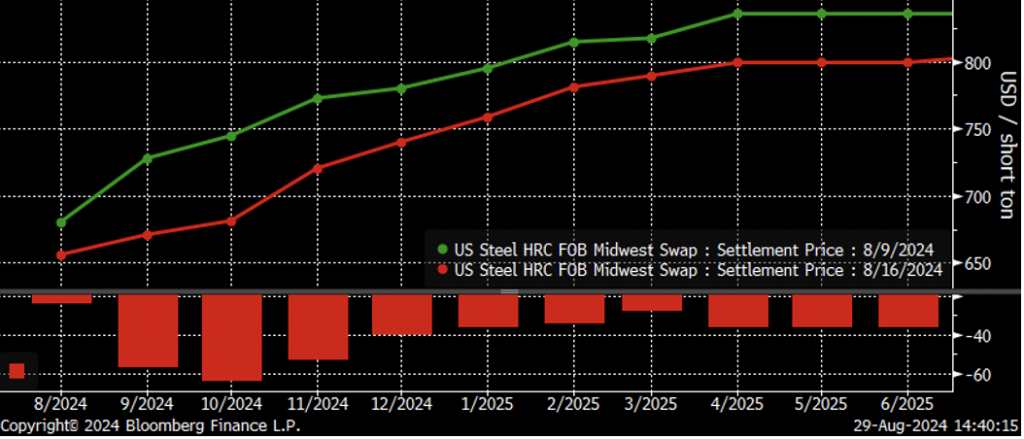

This chart shows the sell-off during the week of Aug. 12 with the October future leading the group lower down $64 week over week.

CME hot-rolled coil futures curve $/st

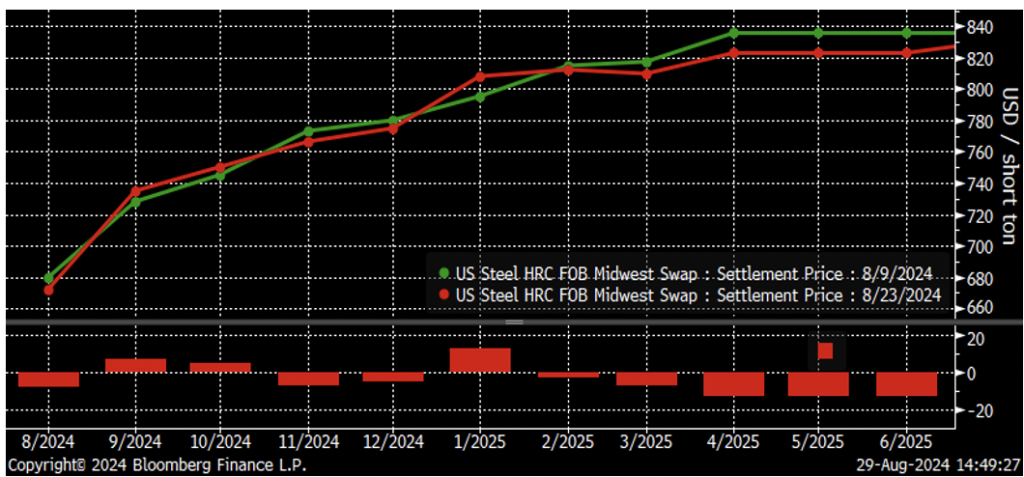

Just like in ore and Turkish scrap, Midwest HRC futures said “this aggression will not stand” and rebounded on heavy volume, essentially erasing all of the previous month’s declines. Despite the news and subsequent moves in iron ore, every month from August 2024 to June 2025 saw no more than a $13 gain or a $13 loss over the two-week period. If you were one of the lucky ones to leave on vacation on Aug. 9 and return on Aug. 23, you would look at the curve and think, I am happy to have chosen those two weeks as I didn’t miss out on anything!

CME hot-rolled coil futures curve $/st

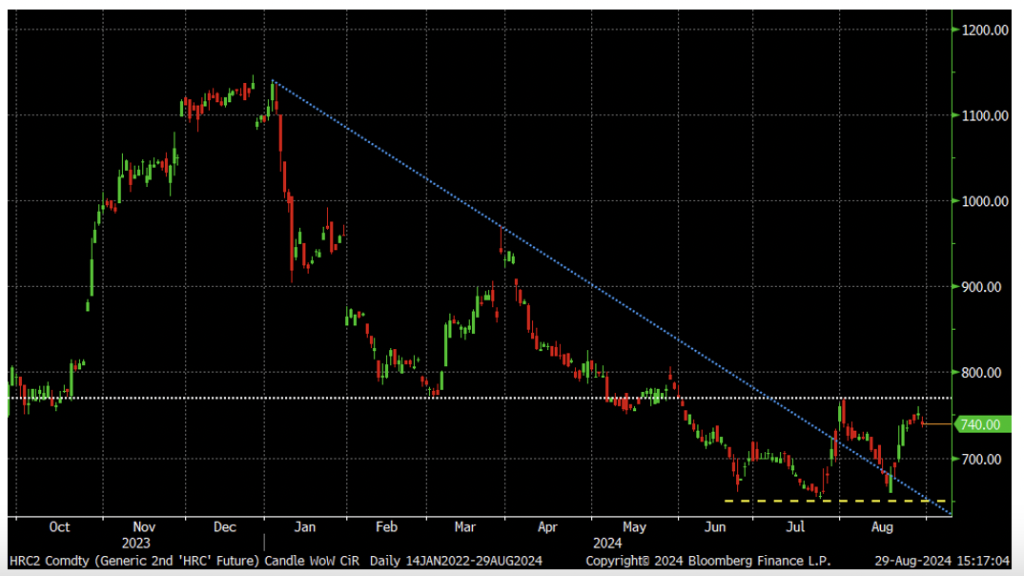

Let’s get technical. If you liked the double-bottom, you are gonna love the triple-bottom…

On the one hand, we have the comments from Baowu to add to the long list of bearish factors. However, if you are a contrarian or bullish, or a contrarian bull, or even a bullish contrarian, then you will be feeling “pretty good” about the chart of the rolling 2nd month Midwest HRC future.

The chart has formed a “triple-bottom,” having bounced off the $650-660 area in June, July, and August. A triple-bottom pattern is characterized as a trend-reversal pattern. In addition, the future traded above and has remained above its seven-month downtrend in blue. The next test sits at the $770 resistance level indicated by the dotted white line.

“Remember, one man’s ceiling is another man’s floor,” or previous support that is broken below becomes resistance when the price rebounds. If the rolling 2nd month can break above $770, then perhaps we will see another squeeze similar to the four sharp rallies experienced in HRC futures since the start of 2023.

Rolling 2nd month CME HRC future $/st

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Mr. Feldstein should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.