Market Segment

August 21, 2024

BlueScope advances HR and coating capacity expansions in US

Written by Laura Miller

BlueScope Steel is progressing on its expansion plans for the US market. Those plans include lifting the capacity of its North Star sheet mill – again – and setting up a greenfield metal coating facility in the Midwest.

The Australian steelmaker provided updates on its plans in its fiscal 2024 second-half and full-year earnings report on Monday, Aug. 19.

Lifting North Star’s HR capacity – again

The North Star BlueScope (NSBS) mini mill in Delta, Ohio, operates three electric-arc furnaces, the third of which has been ramping up production since its 2021 commissioning. That EAF and a second caster added 850,000 metric tons (mt) of annual hot-rolled (HR) sheet making capacity, increasing the mill’s annual steelmaking capacity to 3 million mt (3.3 million short tons).

The North Star mill is “really settling in nicely at that 3-million-metric-tons run rate,” said BlueScope CEO Mark Vassella on an earnings call with analysts on Monday.

After completing a feasibility study earlier this year, BlueScope’s board approved a $130-million-Australian-dollar (US$87.7-million) debottlenecking expansion plan for the mill.

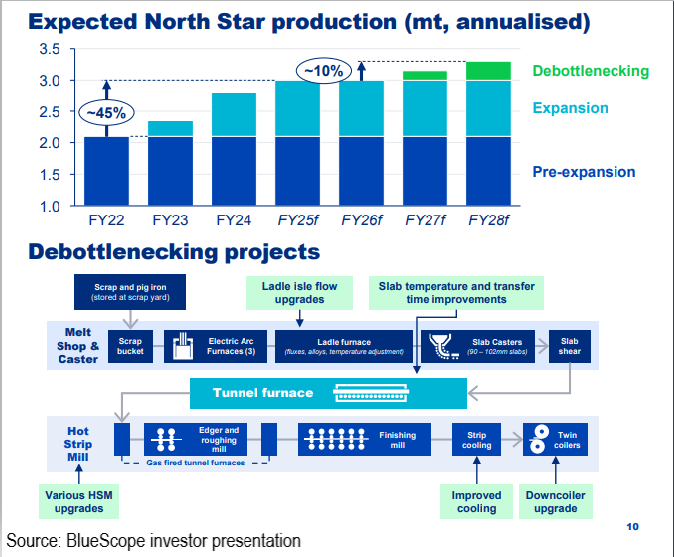

BlueScope plans to lift the mill’s capacity by another 10% to more than 3.3 million mt (3.6 million st). To achieve this, it has already begun various debottlenecking projects, including upgrades to the hot strip mill (see image below).

“Once at full run rate in financial year ’28, the North Star mini mill will be producing nearly 60% more steel than it did in FY’22, materially increasing our exposure to the consolidated and rationalized US steel industry and the robust steel spreads and returns it offers,” Vassella said in his remarks.

NSBS reported stronger fiscal 2024 results than in the prior year, “predominantly on higher volumes due to the expansion ramp-up, which produced 660,000 metric tons in the year.”

The North Star mill operated at full capacity during the 2024 fiscal year, as demand from end users remained robust, the company said.

Slight change in plans for greenfield coating facility

BlueScope is also advancing its plans to build a greenfield cold rolling and coating facility in the Midwestern US.

“We progressed our feasibility study into the further integration of our US value chain, which presents a compelling medium- to long-term opportunity for BlueScope,” Vassella commented.

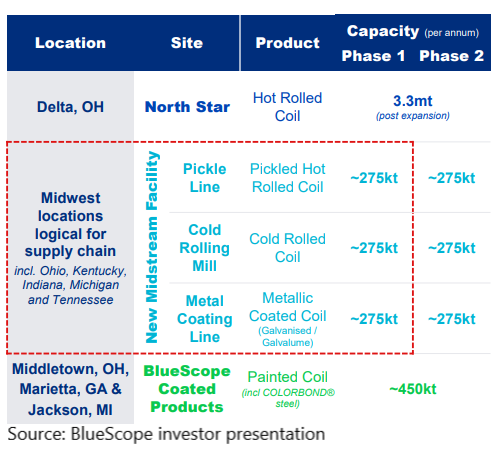

The planned midstream coating facility would connect the NSBS mill in Ohio with three BlueScope Coated Products (BCP) paint facilities. Locations are being considered in Ohio, Kentucky, Indiana, Michigan, and Tennessee.

He said the company foresees needing 550,000 mt of cold rolling, pickling, and metal coating capacity in the medium to long term to support its growth plans in the North American pre-paint market.

Plans are for that additional capacity to be phased in over the next five to seven years, Vassella explained. The first phase will install half of that capacity (~275,000 mt), with commissioning slated for 2028. Then the rest will be “added as required.”

He said the updated plan calls for one coating line instead of two, as previously planned. Initially building one line “gives us optionality if other opportunities emerge that don’t require a second metal coating line,” he noted.

BlueScope projects outlays of $800 million in upfront capital for the project will be spread across FY’26 to FY’28.

BlueScope Coated Products

BlueScope established BCP in 2022 after its $500-million acquisition of Coil Coatings, the second-largest metal painter in the US at the time.

That acquisition added 900,000 mt, more than tripling BlueScope’s US coating and painting capacity to 1.3 million mt per year.

BCP is one of the largest toll-processing coil coaters in the US. It has locations in Cambridge and Middletown, Ohio; Rancho Cucamonga, Calif.; Jackson, Miss.; Marietta, Ga.; Memphis, Tenn.; and Houston.

Now two years since the acquisition, Vassella said BCP has “absolutely not” been performing to expectations.

BCP “underperformed on continued operational challenges, compounded by lower foundation customer demand,” said a BlueScope investor presentation. Its contribution to BlueScope’s results were “negligible,” according to Vassella.

“So there’s an enormous amount of effort going into BCP to get it back to our business case,” he disclosed on the call.

And while “conditions aren’t fabulous” for the segment at present, he reiterated that it’s always been a medium- to long-term play.

“We still fundamentally believe there’s going to be a spot for Colorbond in North America. … That’s a very big market,” he noted.

Colorbond is BlueScope’s proprietary pre-painted steel. It’s been refined as a building material in some of Australia’s harshest environments for more than 50 years, according to the company.

Vassella said it doesn’t need to capture a huge amount of market share. The planned initial addition of ~275,000 mt is in an East Coast painted market of ~5 million mt, he pointed out.

“I’m looking through where we are right now, and looking out into the medium and longer term, and still fundamentally believe in the outlook for that economy,” he said.