Market Data

August 15, 2024

July service center shipments and inventories report

Written by Estelle Tran

Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, contact info@steelmarketupdate.com.

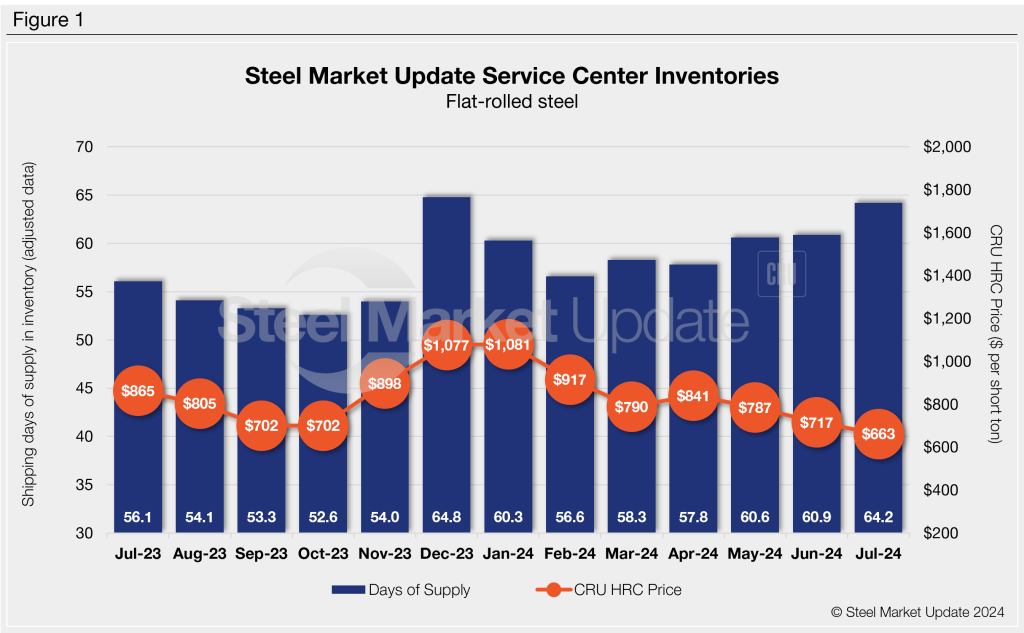

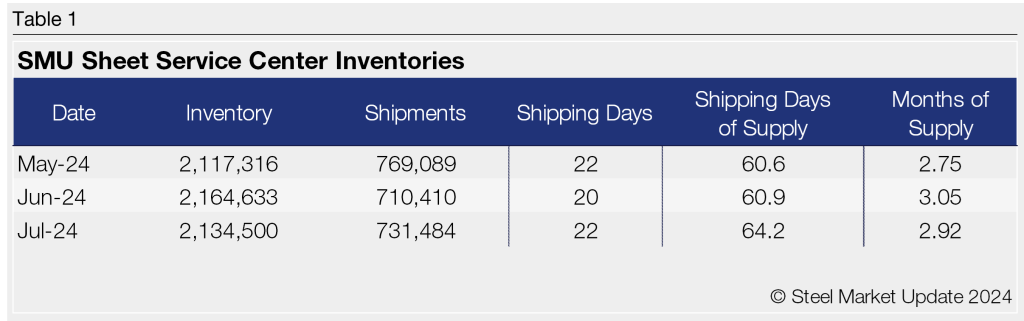

Flat rolled = 64.2 shipping days of supply

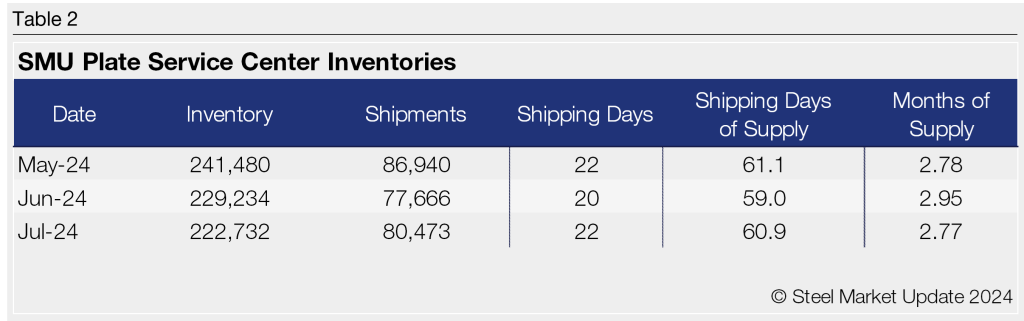

Plate = 60.9 shipping days of supply

Flat rolled

Flat-rolled steel supply at US service centers grew in July with restocking as service centers anticipated the bottom of the market and slow shipments. At the end of July, service centers carried 64.2 shipping days of supply on an adjusted basis, according to SMU data. This is up from 60.9 shipping days of supply in June and 56.1 shipping days in July 2023.

Flat-rolled steel supply in July represented 2.92 months of supply, down compared to 3.05 months in June. July had 22 shipping days compared to June’s 20. Sheet steel shipments typically hit a lull in July, though the drop-off in shipments seemed to be more pronounced this year. The SMU survey with data through July 31 reported that 77% of service centers said they were releasing less steel compared to a year ago, while 18% said they were releasing the same amount, and 5% said they were releasing more steel.

Flat-rolled steel prices seem to have stabilized in the last few weeks after mills made some large-volume deals. Mills have been publicizing higher prices but lead times have been slow to react. The July 31 SMU survey pegged hot-rolled coil lead times at 4.54 weeks, nearly flat compared to two weeks prior and down from 4.66 weeks on July 3. The SMU survey also found that 21% of service centers described mill lead times for new orders as “extremely short,” and 53% said lead times were “shorter than normal.” Service center inventories ballooned at the end of July, though.

The perception that prices were at or near the bottom at the end of July drove many service centers to buy heavily toward the end of the month. Because of the spike in flat-rolled steel on order and the lackluster demand outlook, it is unlikely that inventories will fall meaningfully in August. Even with the slew of planned mill outages, the market seems to be oversupplied relative to demand.

Plate

US service center plate supply edged up in July because of sluggish demand. At the end of July, service centers carried 60.9 shipping days of plate supply, up from 59 shipping days of supply on an adjusted basis for June. Plate inventories represented 2.77 months of supply in July, down from 2.95 months of supply in June. In July 2023, service centers carried 60 shipping days of plate supply, representing 3 months of supply.

Plate mill lead times are much shorter this year, though. The SMU survey from July 31 found plate mill lead times at 3.93 weeks, down from 4.62 weeks a month prior. The survey a year ago reported plate mill lead times at 5.81 weeks. Ramped-up capacity this year and weaker-than-expected demand have kept the US plate market oversupplied. With prices falling and weak demand, service centers have been trying to destock for months. There has been little incentive to restock though, with lead times so short. As a result, material on order remains extremely low for plate.

While inventories appear to be more than sufficient to meet immediate demand, the lower level of material on order could suggest a drop in inventories in August. This, combined with SSAB’s pulled-forward outage, could allow plate price decreases to start to taper off.