Market Data

December 21, 2023

Architecture Billings Index shows soft November

Written by Becca Moczygemba

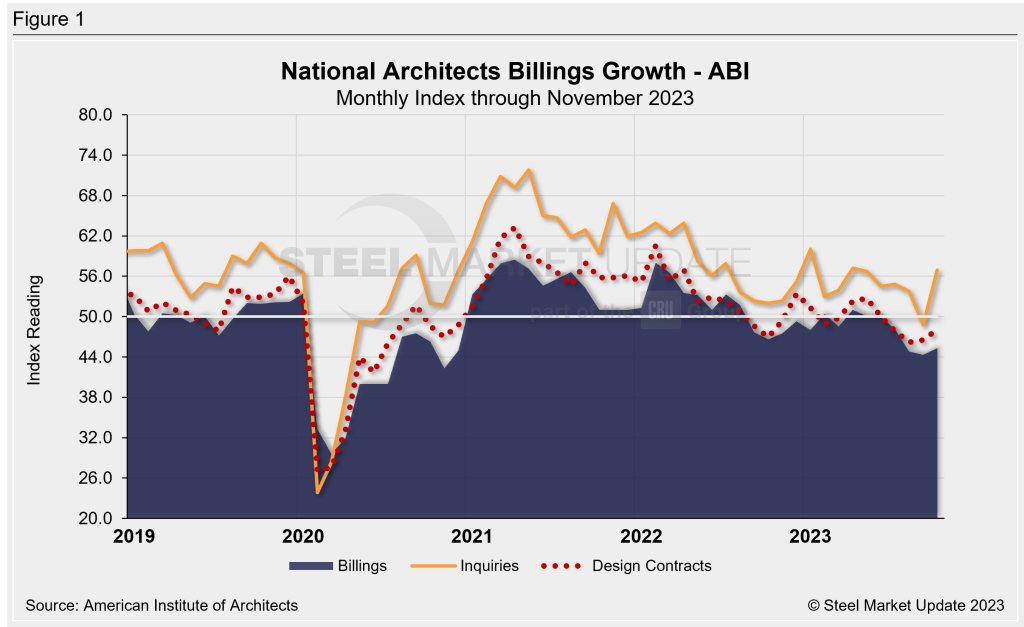

The Architecture Billings Index (ABI) reading from the American Institute of Architects (AIA) and Deltek showed a slight uptick in November, but was still in negative territory.

The index inched up to 45.3 in November, an increase from October’s 44.3. However, the index is lower than the 46.6 points during the same month in 2022.

The ABI is a leading economic indicator for nonresidential construction activity with a lead time of 9-12 months. Any score above 50 indicates an increase in billings. A score below 50 indicates a decrease.

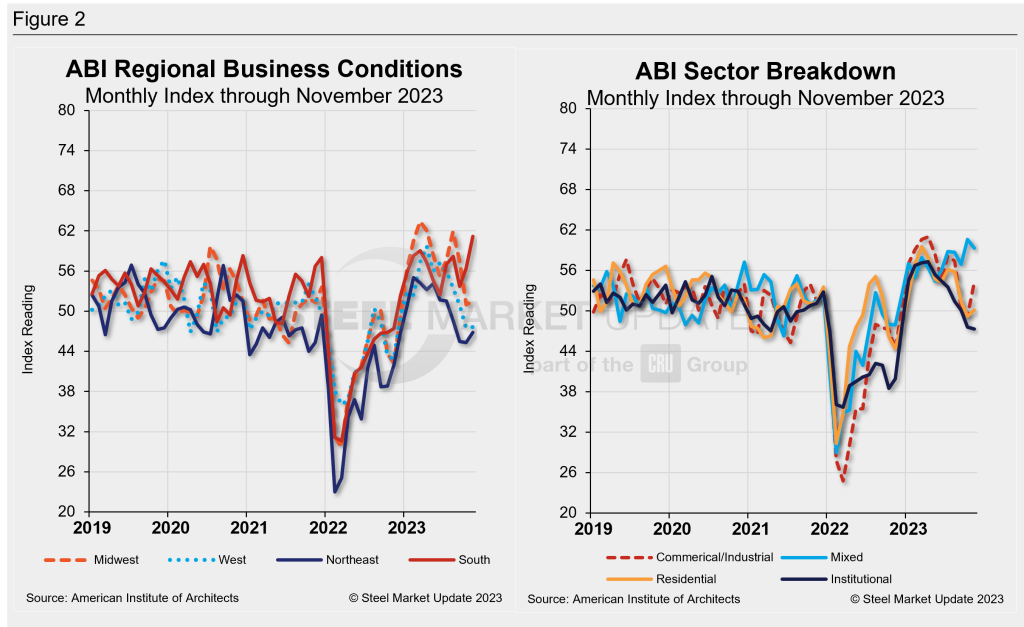

“This marks the seventh month in 2023 with a decline in billings. Over the past three months this pace of decline has accelerated, with firms in all specializations and in all regions of the country reporting weakening business conditions,” AIA chief economist Kermit Baker said in the latest report.

Newly signed design contracts were at 48.1 in November, moving up from October’s 45.5, but not over the 50-point threshold, the report said.

Though all firms reported a decrease in billings, “firms specializing in multi-family residential continue to remain the weakest,” according to the report.

Results were mixed across the country. The North and Midwest regions inched up, while the South and Western regions saw a drop, AIA said.

Although firms with an institutional specialization started the year strong, they continue to see waning business conditions, the report said.

Future outlook

AIA and Deltek asked survey participants to comment on the current market.

“Projects are dropping off or not moving forward. Many firms are starting layoffs,” said a small firm in the Northeast.

Another small firm in the West noted mixed conditions, citing paused, restarting, or cancelled projects.

A larger firm in the South said, “Industrial demand remains strong, but developers will need to see a reduction in interest rates before we get back to ‘normal.'”

For 2024, about one in five expect a down year. Around 18% expect a challenging year, 1% expect a potentially disastrous year. However, nearly triple that share, 59%, expect a good-to-great year. The remaining 22% anticipate a stable year, according to the report.

Across the country, conditions are fairly flat. Larger firms and firms with an institutional specialization tend to be slightly more optimistic about 2024 than other firms, AIA said.