Market Data

November 27, 2023

SMU survey: Lead times extend as pricing climbs

Written by Becca Moczygemba

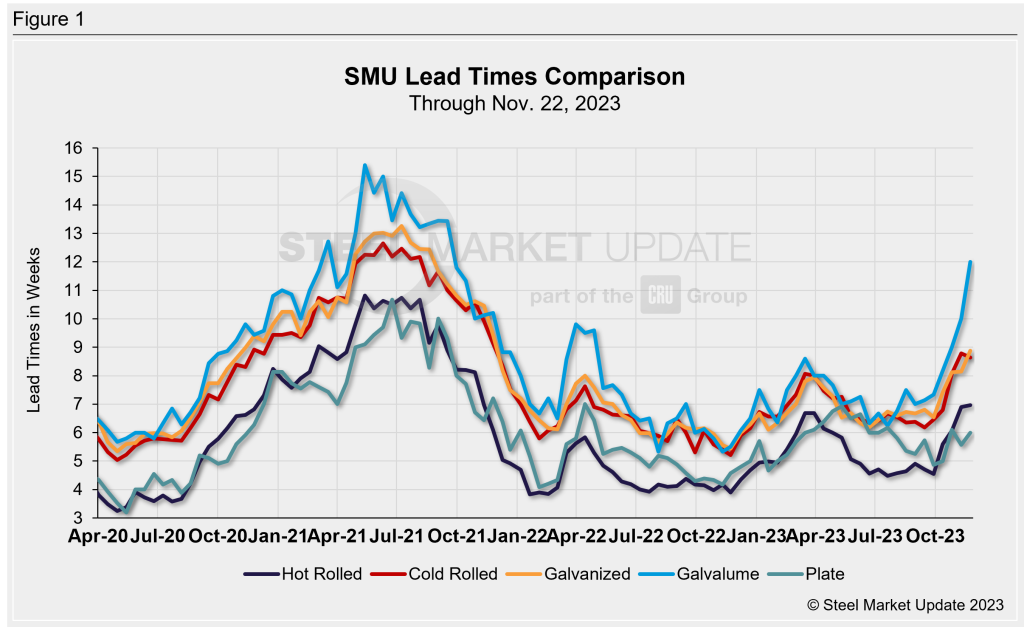

Lead times for all steel sheet products but cold rolled were extended last week as prices trend upwards.

Since our previous market check three weeks ago, we’ve seen sheet lead times move out farther than they’ve been since March 2023.

Mill lead times

Hot-rolled sheet lead times were reported by buyers in SMU’s survey last week to be between 4 and 11 weeks. The average of 7 weeks is in line with the 6.9-week average we saw two weeks earlier. This is the longest average lead time for HRC that SMU has recorded since Nov. 11, 2021.

Buyers reported lead times for cold-rolled sheet ranging from 6 to 12 weeks. Cold rolled lead times dropped by 0.14 weeks from two weeks earlier to an average of 8.64 weeks. We haven’t seen that number since December 2021.

Lead times for galvanized sheet were between 5 and 12 weeks. The average of 8.88 weeks is up from the last check’s average of 8.15 weeks. A higher average was last seen during the week of Nov. 25, 2021, according to SMU’s records.

Buyers last week reported lead times for Galvalume to be between 5 and 15 weeks. The average of 12 weeks was pushed out by two weeks from our last market check. We haven’t seen Galvalume lead times that far out since Sept. 16, 2021.

Note that our data for Galvalume is more volatile due to the smaller sample and market size. If you are a buyer of Galvalume and would like to share your lead time and pricing data with SMU, please contact david@steelmarketupdate.com.

Lead times for plate averaged 6 weeks for this update. Buyers reported a range of 4 to 8 weeks. The average of 6 weeks was in line with 5.57 weeks from our Nov. 9 market check. Just a month ago, plate lead times were, on average, 6.1 weeks.

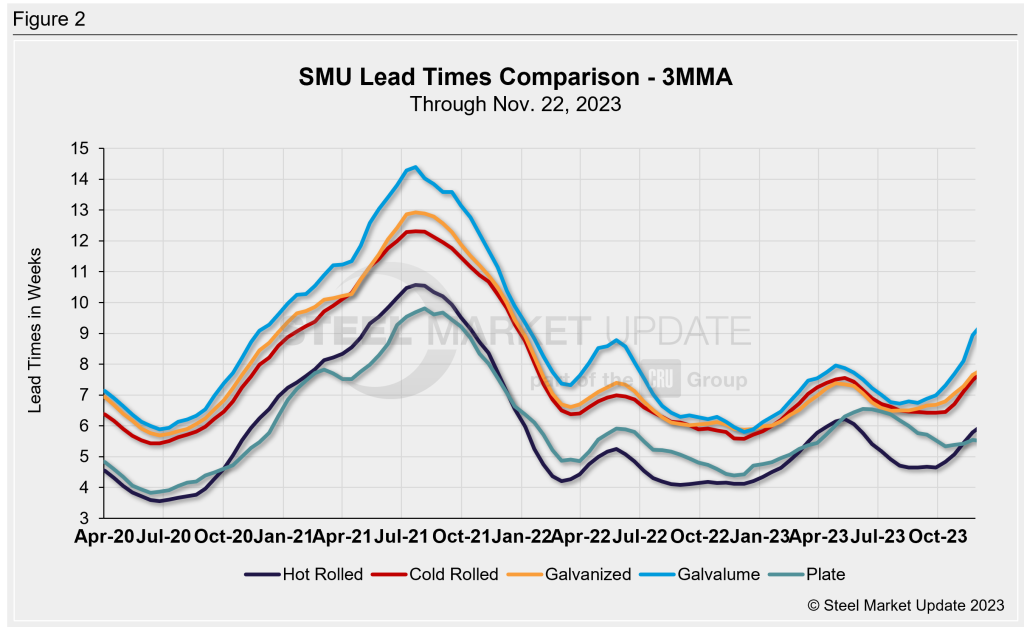

3MMA Lead Times

Analyzing lead times on a three-month moving average (3MMA) basis can smooth out the variability in the biweekly readings.

The 3MMAs for all products rose once again last week.

The 3MMAs for hot-rolled, cold-rolled, and coated sheet were calculated to be 5.8 weeks, 7.5 weeks, and 7.7 weeks, respectively. Those are comparable to the 3MMAs in early June 2023 summer.

Galvalume’s 3MMA of 8.9 weeks is the highest it’s been since the first week of January 2022.

The 3MMA of plate lead times was relatively unchanged, moving up only 0.1 weeks since the previous check to 5.5 weeks.

SMU’s survey says

About 49% of survey participants said they expect lead times to be flat in the next two months, while 25% think lead times will be up. The other 25% see lead times dropping in coming months.

Here is what a few of our respondents had to say about the direction of lead times two months from now:

“Lead times will continue to extend.”

“We believe this rally will be another severe one – i.e., drastic mini-cycle – so in two months, we’ll already be on the other side of it.”

“New year, new energy, hot start, see from there.”

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website here.If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.