Market Segment

November 20, 2023

Architecture firms saw business decline in October

Written by Becca Moczygemba

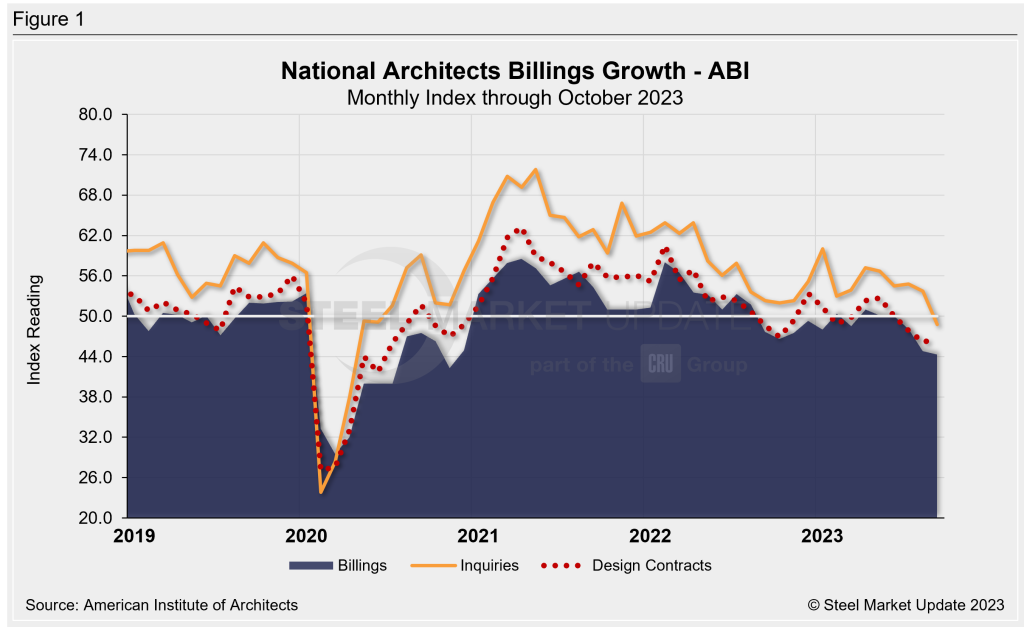

The Architecture Billings Index (ABI) reading from the American Institute of Architects (AIA) and Deltek showed a decline for the fifth consecutive month in October.

The index dropped to 44.3 in October, 0.5 points below 44.8 in September – and marking the lowest score since December 2020.

The ABI is a leading economic indicator for nonresidential construction activity with a lead time of 9-12 months. Any score above 50 indicates an increase in billings. A score below 50 indicates a decrease. The score has been below 50 for six months of 10 months in 2023.

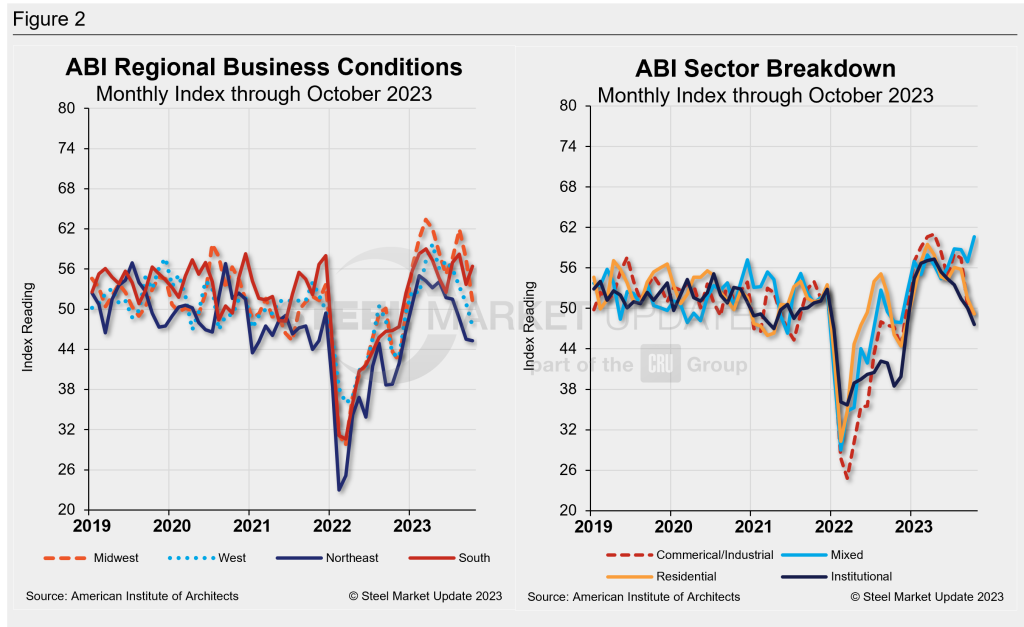

“This report indicates not only a decrease in billings at firms, but also a reduction in the number of clients exploring and committing to new projects, which could potentially impact future billings,” AIA chief economist Kermit Baker said in a statement. “The soft conditions were evident across the entire country as well as across all major nonresidential building sectors.”

Newly signed design contracts were at 46.5 in October, little changed from 46.2 in September.

The AIA also reported that firms have shed 2,600 jobs since the beginning of the year. But industry employment remains higher than it was at the beginning of the year.

Billings were down across the country in October. Firms in the Northeast and West reported the lowest number of billings for the second consecutive month.

Overall billings at architecture firms with an institutional specialty were flat at 49.1 in October, down from 50.0 in September. Firms with a specialization in multifamily residential dropped to 40.1 from 43.5, while firms with a commercial/industrial specialty fell to 43.7 from 45. Mixed specialization firms dipped to 44 from 46.2.

The AIA also reported that firms have shed 2,600 jobs since the beginning of the year. But industry employment remains higher than it was at the beginning of the year.

Future Outlook

AIA and Deltek asked firm leaders about current and future trends for revenue and expenses.

“Overall, responding firm leaders indicated that they expect net revenue to be essentially flat at their firm this year, growing by an average of just 0.5%, with only slightly more firms projecting an increase in their revenue from 2022 (44%) than projecting a decrease (37%),” AIA said.

Large firms are more likely to see an increase in revenue this year than small firms, the group said.

One medium-sized firm in the West commented, “Urban mixed-use market sector continues to stall, while our convention center and education market sectors are very active.”

A small firm in the South noted that it was working on some backlog projects but that it is expecting a slower 2024.

“Significant volume of awarded projects on hold, primarily in the commercial market. There is also a significant volume of proposals submitted with award decisions on hold,” said a firm in the Midwest with an institutional specialization.

An interactive history of the AIA Architecture Billings Index is available on the SMU website.