Market Data

October 16, 2023

SMU Steel Demand Index Inches Up Again But Still in Contraction

Written by David Schollaert

Steel Market Update’s Steel Demand Index remains in contraction territory despite repeated improvements since mid-September, according to our latest survey data.

The latest developments come on the heels of Cleveland-Cliffs’ late September price increase, mill outages, and idlings because of the ongoing UAW strike.

And while lead times for hot-rolled coil have also moved out, they are still within a normal range.

Despite the dynamics currently at play, demand for flat-rolled steel is stable at best, with some still concerned it’s still trending down.

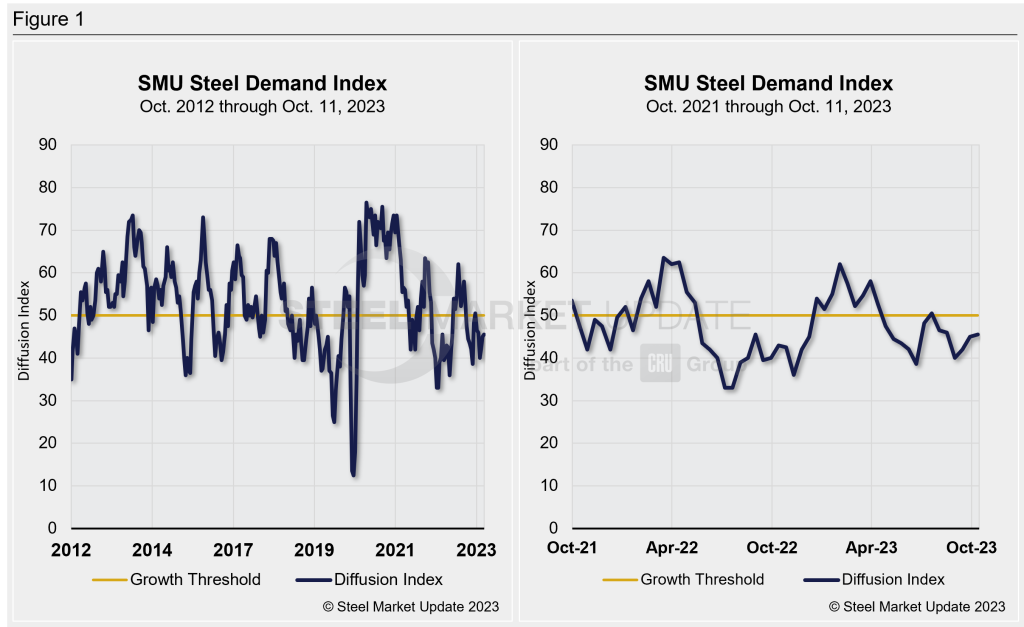

SMU’s Steel Demand Index now stands at 45.5, up a half of a point from a reading of 45 at the end of September. The measure has improved by more than five points, however, since reaching a recent low of 40 back in late August.

Except for a short-lived bump when the market responded to mill price hikes in mid-June, SMU’s Steel Demand Index had been largely trending downwards and remaining in contraction territory since early April.

Methodology

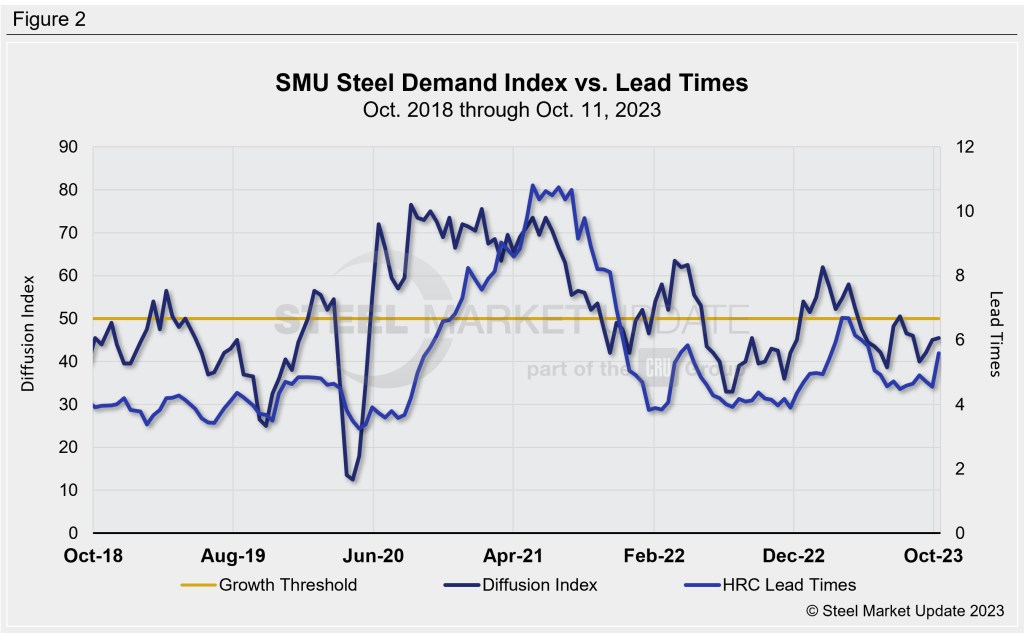

The index, which compares lead times and demand, is a diffusion index derived from the market surveys we conduct every two weeks. This index has historically preceded lead times, which is notable given that lead times are often seen as a leading indicator of steel price moves.

An index score above 50 indicates rising demand and a score below 50 suggests declining demand. Detailed side by side in Figure 1 are both the historical views and the latest Steel Demand Index.

Current State of Play

Overall market sentiment remains mixed, but the unprecedented strike at union-represented automakers remains the wildcard, even as mill idlings and outages take shape. While most agree that demand is still down, especially for HRC, it seems Cliffs’ recent price target has stopped the price erosion and propped tags up. Cold-rolled, coated, and plate products have also followed.

SMU’s latest check of the market on Oct. 10 placed HRC at an average of $695 per ton ($34.75 per cwt) FOB mill, east of the Rockies, up $25 per ton vs. the prior week. Hot band is now up $35 per ton since reaching the recent low of $660 per ton in mid-September.

U.S. Steel’s idling at Granite City in response to UAW’s strike, coupled with ongoing and upcoming mill outages has helped push lead times out. But the trend doesn’t seem to have shifted buying patterns as the amount of material on order and service center inventories have declined repeatedly through the end of September.

With lead times currently stretching past the second half of Q4, present and upcoming maintenance outages or production cuts are likely providing a bit of support to prices and lead times for the time being. But if the ongoing UAW strike carries on and fundamental demand eases as the year-end holidays approach, there may not be much pricing support.

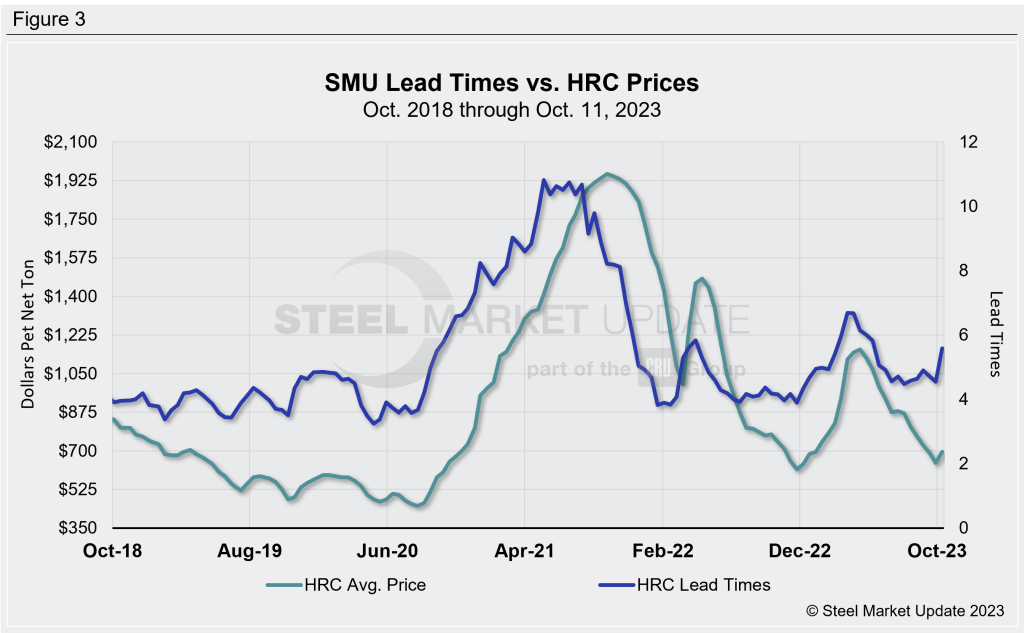

SMU’s demand diffusion index has, for nearly a decade, preceded moves in steel mill lead times. (Figure 2 shows the past five years.) Historically, SMU’s lead times have also been a leading indicator for flat-rolled steel prices, particularly HRC prices. (Figure 3 features the past five years.)

What to Watch For

It’s still important to keep a close eye on lead times. While they have been moving up a bit of late, they had been in a holding pattern for the better part of the past four months. While planned outages will cycle through, the UAW’s unprecedented strike against Ford, General Motors, and Stellantis could potentially have a more extensive impact on both pricing and lead times. There appears to be little support for flat rolled prices, should demand remain down.

Our hot-rolled lead times averaged approximately 5.59 weeks this week, up roughly a week from 4.55 weeks in late September. They remain a ways away from a recent high of 6.69 weeks in mid-March, but lead times have been hovering around the 5-week mark since roughly mid-June.

Note: Demand, lead times and prices are based on the average data from manufacturers and steel service centers who participate in SMU’s market trends analysis surveys. Our demand and lead times do not predict prices but are leading indicators of overall market dynamics and potential pricing dynamics. Look to your mill rep for actual lead times and prices.