Market Data

October 16, 2023

Service Center Shipments and Inventories Report for September

Written by Estelle Tran

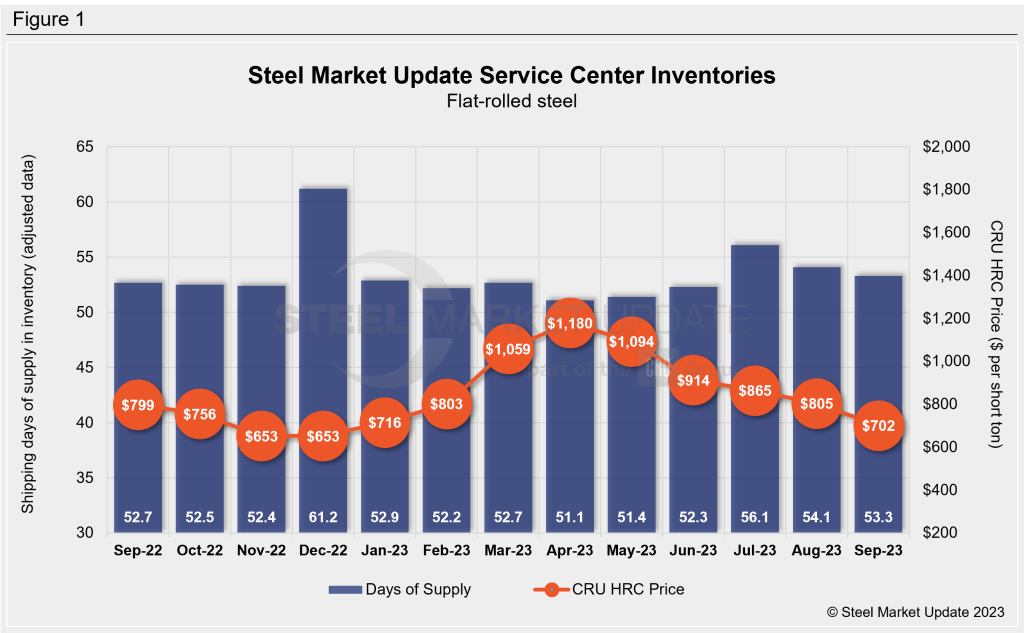

Flat Rolled = 53.3 Shipping Days of Supply

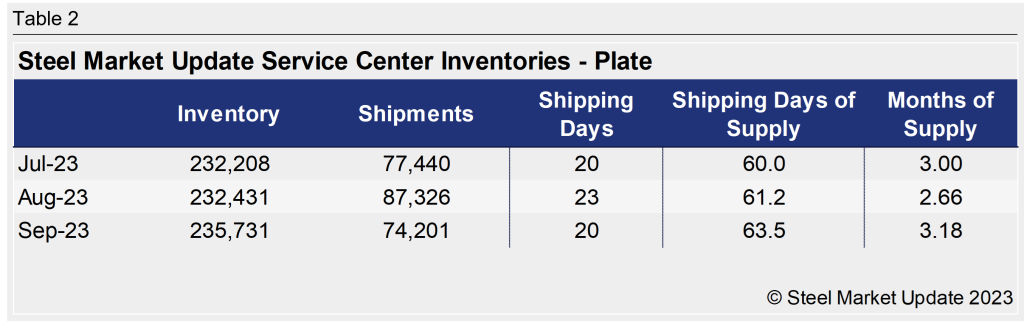

Plate = 63.5 Shipping Days of Supply

Flat Rolled

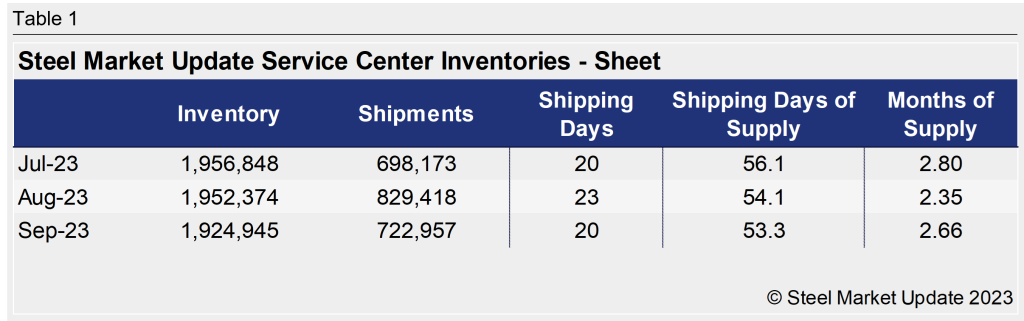

US service center flat-rolled steel inventories declined for a second month as shipping rates picked up in September. At the end of September, service centers carried 53.3 shipping days of flat-rolled steel supply, according to adjusted SMU data. This is down from 54.1 shipping days of supply in August. Flat-rolled supply represented 2.66 months of supply in September, up from 2.35 months in August.

September had 20 shipping days, compared to August’s 23 shipping days. The daily shipping rate in September increased m/m, as it typically does, and this caused inventories to ease. The outlook on demand remains unclear, though, particularly because of the ongoing United Auto Workers union strike. Anticipation of the strike possibly pulled forward orders, and we have seen evidence that the amount of material on order is high relative to demand.

At the end of September, service centers shipping days of flat rolled supply on hand were up from the total shipping days of supply in August. The spike in material on order and decrease in inventories caused the amount of material on order to push inventories up in September vs. August. The result exceeded the previous high for the year set in February, and the amount of material on order could be at levels not seen since the Covid-related shortage (September 2021).

The elevated amount of material on order reflects some opportunistic buying to extend lead times, which could impact mills’ ability to place new orders. Sheet prices have reached a bottom for now, and contacts are seeing mill lead times extend with some help from outages. Buyers may be well booked for the rest of Q4, which is also a slower demand period.

Plate

US service center plate inventories continued to rise in September with weaker shipping levels. Plate inventories, measured by days of supply, have risen each of the last six months. At the end of September, service center plate inventories represented 63.5 shipping days of supply on an adjusted basis, up from 61.2 shipping days of supply in August.

Plate inventories in September represented 3.18 months of supply, up from 2.66 months of supply in August. The uptick in months of supply is more pronounced because September had three fewer shipping days than August. Still, the daily shipping rate for September was marginally lower m/m in what has historically been a stronger shipping month.

With bearish views on demand and plate pricing, service centers have been eager to offload inventory. The September daily shipping rate is down 7.2% y/y, according to SMU data. Total plate shipments in September were down 11.6% y/y, but September 2022 had one more shipping day.

Plate inventories appear to be slightly high relative to demand, and service centers remain focused on reducing inventories. The amount of plate on order at the end of September caused shipping days of supply to move up marginally from August. Plate on order saw inventories in September remain nearly flat compared to August.

The SMU survey published on Sept. 28 showed plate mill lead times at 4.86 weeks, which was lower than the 5.25-week lead time reported a month prior.