Canada

August 9, 2023

Stelco Q2 Earnings Up Sequentially on Higher Prices

Written by Ethan Bernard

Stelco

| Second quarter ended June 30 | 2023 | 2022 | % Change |

|---|---|---|---|

| Revenue | $841 | $1,037 | -19% |

| Net income (loss) | $117 | $554 | -79% |

| Per diluted share | $2.12 | $7.67 | -72% |

| Six months ended June 30 | |||

| Revenue | $1,528 | $1,943 | -21% |

| Net income (loss) | $106 | $816 | -87% |

| Per diluted share | $1.92 | $11.14 | -83% |

Stelco reported decreased profits in the Q2’23 compared to Q2’22 on lower steel prices and shipments.

But earnings were up versus Q1’23, when the Canadian flat-rolled steelmaker reported a loss, thanks to higher average selling prices.

Note that spot prices often flow through to contracts on a lag. In other words, low spot prices in Q4’22 hurt contract prices in Q1’23. Sharply higher spot prices in Q1’23, in contrast, resulted in higher contract prices in Q2’23. (You can chart out spot price trends with out pricing tool.)

All told, the Hamilton, Ontario-based company posted net income of Canadian $117 million (USD$87 million) in Q2’23, off 79% from CAD$554 million a year earlier on revenue that fell 19% to CAD$841 million (USD$627 million). However, Stelco swung to a profit after losing CAD$11 million in Q2’22 on revenue of CAD$687 million.

The discrepancy in net income year over year also stemmed from a CAD$260-million gain on the sale of “land buildings” in Q2’22 and a CAD$254-million decrease in operating income in Q2’23.

“During the second quarter, we experienced relief from certain of the inflationary pressures that have impacted our costs over the last several quarters and benefited from a more normalized market with stabilized price levels and lead times,” Stelco executive chairman and CEO Alan Kestenbaum said in a press release on Wednesday after markets closed.

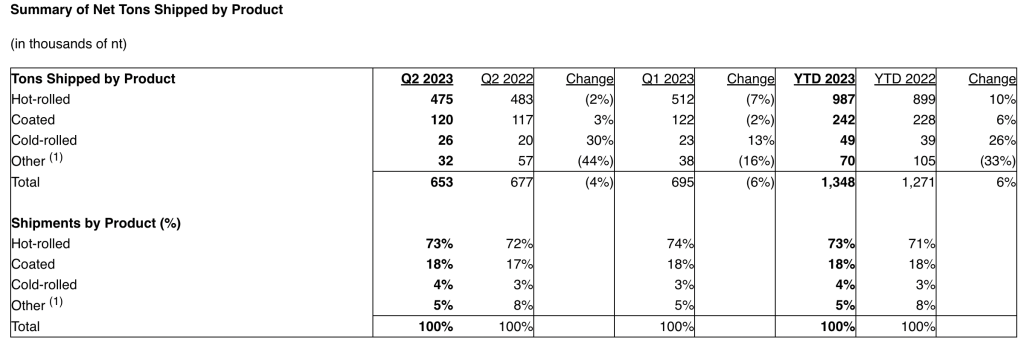

Average selling prices for Stelco’s steel products increased from CAD$960 per ton in Q1’23 to CAD$1,217 per ton in Q2’23. Shipping volumes fell from 695,000 per ton in Q1’23 to 653,000 per ton in Q2’23.

Stelco CFO Paul Scherzer said the company was well positioned “to be able to capitalize on favorable market conditions.” Q3 shipment volumes were expected to be ~675,000 net tons, he added.