Market Segment

July 20, 2023

Lead Time Movements Vary, Hot Rolled Retreats

Written by Laura Miller

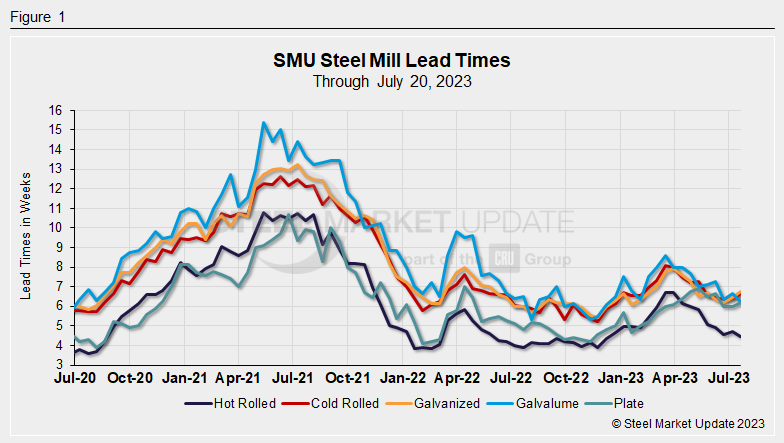

Movements in lead times were mixed this week, with those for hot rolled and Galvalume falling back marginally, and those for cold rolled, galvanized, and plate extending slightly.

We’re still waiting for a clear pattern to emerge with lead times, as they seem to have been bouncing around since June and generally trending down since May.

Hot rolled lead times are now into late August while other flat-rolled products are into September. We are now into the third quarter of the year and, taking seasonality into consideration, we should begin to see lead times push out in what is typically a strong quarter for steel.

Steel buyers this week reported lead times ranging from 2.5 to 6 weeks for hot-rolled sheet. After extending in our market check two weeks ago, this week’s HR average retreated by 0.23 weeks to 4.48 weeks. The average HR lead time has been below 5 weeks for all of June and July.

For cold-rolled sheet, lead times were said to be between 4 and 10 weeks. Cold rolled lead times lengthened by 0.26 weeks from the previous market check to an average of 6.67 weeks. CR lead times have been extending since late June.

Lead times of 3 to 10 weeks were reported for galvanized sheet this week, with an average of 6.74 weeks. This was an extension of 0.29 weeks from two weeks ago and the longest lead time for galv since the end of April.

For Galvalume, lead times of 5 to 8 weeks were reported this week, with an average time of 6.25 weeks. This was a pullback of 0.42 weeks from the 6.67 weeks reported in the previous market check and the shortest lead time for Galvalume since December.

Buyers this week reported plate lead times between 4 and 9 weeks. After remaining steady at 6.0 weeks in the previous two market checks, the average extended by 0.17 weeks to 6.17 weeks in this week’s check. Lead times for plate have been averaging between 6 and 7 weeks since mid-March.

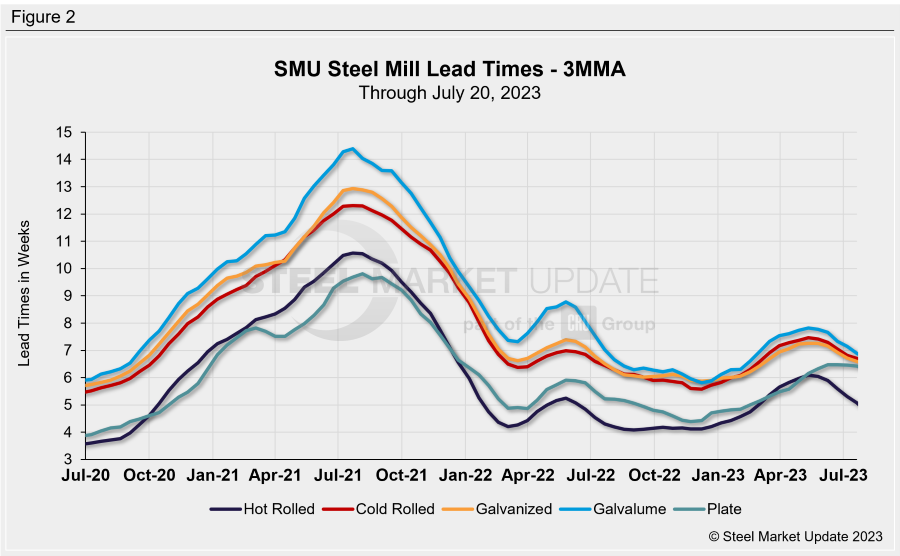

Let’s take a look at lead times as three-month moving averages (3MMA) to smooth out the variability in SMU’s biweekly readings.

The 3MMA of hot-rolled lead times fell back to 5.1 weeks in this week’s check – that’s the lowest the 3MMA has been since early March.

The 3MMAs of cold rolled and galvanized lead times both fell back for a fifth consecutive market check, with cold rolled coming in at 6.7 weeks and galvanized at 6.6 weeks.

Galvalume’s 3MMA lead time retreated for the fourth consecutive market check to 6.9 weeks.

Plate’s 3MMA had been steady at 6.5 weeks in the three previous market checks. This week it was also largely unchanged at 6.4 weeks.