Analysis

June 29, 2023

HRC Futures Take Wild Ride in June

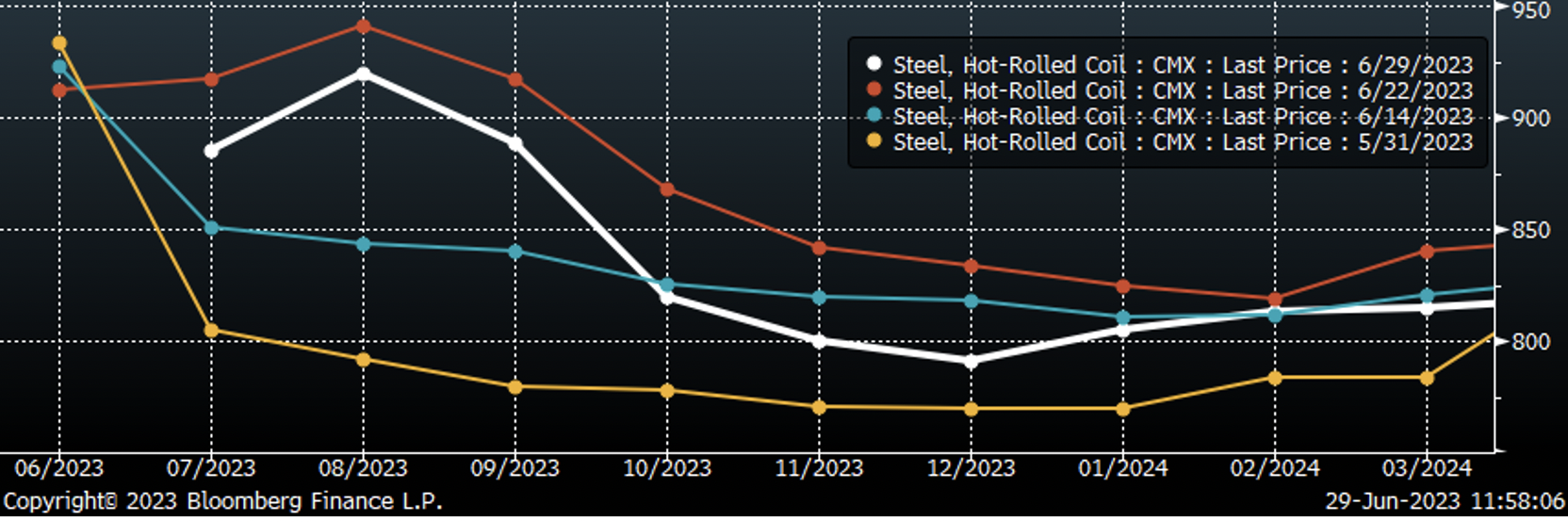

It’s been a wild ride in the HRC futures market since we last wrote this column. The chart below shows the CME Futures curve at our last publication at the beginning of June (yellow) and the last three weeks since Nucor’s initial price announcement (blue).

A month ago, the physical market was in the doldrums. As prices fell, mills appeared more eager to chase tons while buyers sat firmly on the sidelines, only purchasing what was necessary to operate. Since prices peaked in early April, this dynamic has led to a sharp destocking and a historically low inventory environment.

And so, after several weeks of down-trending prices in both the physical and futures markets, the various mill price increases of the past couple of weeks had the initial impact of halting the slide on paper, even reversing the recent price movement. Futures prices across the curve pushed up $40-$140 per ton depending on the period and expiration, with August being the month of choice. This structure to the curve (orange) indicates that while the price hike announcements are constructive for the short term, the market currently views the action as simply pulling demand forward rather than establishing a prolonged trend reversal.

What a difference a couple of days makes. In white, we see the current futures curve, after prices in the front retreated on Tuesday, Wednesday, and Thursday of this week as discussions of a less-than-robust physical demand response to recent price increase announcements circulated through the market. That said, the July/August contango remains, with August still trading at the highest point of the curve, settling at $920, down from last week’s high of $941. Further out, backwardation beyond August is steepening, with Q1’23 only slightly bouncing off the recent lows from four weeks ago. As we’ve repeatedly noted, backwardation signals a short market rather than a price prediction.

Looking more closely at the recent fundamentals driving the futures market, physical lead times are elevated compared to historical norms, and our analysis of current mill profitability suggests they are far from being squeezed. This dynamic is juxtaposed against consumer inventories at record lows, ex. COVID. The combination of these factors leads us to conclude that the next few weeks in the paper markets look increasingly volatile and will likely create a choppy trading environment before a clearer direction materializes.

The chart below shows the HRC spot price – the 2nd-month future.

The forward curve is not a predictor of price; however, we acknowledge that the 2nd-month future is anchored to the spot price because of the proximity in time. So, buyers should be concerned when we see the stark difference between the shaded and non-shaded regions. This is the clearest indication of violent volatility that we have. In the four years before January 2021, this spread was above $50 or below -$50 only 2.9% of the time. In the 2+ years since, that spread is above or below those levels 59.2% of the time.

We have frequently said that the post-pandemic steel market is fundamentally different than what came before, and this chart is one of the best illustrations. What is driving this volatility? The exponential increase in reshoring manufacturing (a process that slowly started following Section 232 tariffs), domestic producers have consolidated, and we’ve seen interest rates rocket higher after 15+ years of them being a nonfactor in decision-making. All these factors leave steel buyers exposed to a whipsaw of prices. As soon as it starts to feel normal again, get ready for another shoe to drop.

By Daniel Doderer and Brad Clark

Daniel Doderer has been at Flack Global Metals since October 2018. He is an economist and the Head of Research as part of the Metal Bank team, where he conducts extensive historical analysis and reports on the steel industry and the broader US economy.

Brad Clark is Managing Director of Flack Metal Bank. Brad has traded both physical and financial commodities for over 20 years in both Europe and the US. He most recently was head of risk management at Big River Steel and is a former contributor to SMU.

About Flack Global Metals

In 2010, Flack Global Metals (FGM) was founded with the mission to reinvent how metal is bought and sold. Over 13 years later, the company has evolved into a hybrid organization combining an innovative domestic flat-rolled metals distributor and supply chain manager, a hedging and risk management group supported by the most sophisticated ferrous trading desk in the industry known as Flack Metal Bank (FMB), and an investment platform focused on steel-consuming OEMs called Flack Manufacturing Investments (FMI). Together, these entities deliver certainty and provide optionality to control commodity price risk in the volatile steel industry.