Market Data

July 18, 2023

Service Center Shipments and Inventories Report for June

Written by Estelle Tran

Editor’s note: Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, contact Lindsey Fox at lindsey@steelmarketupdate.com.

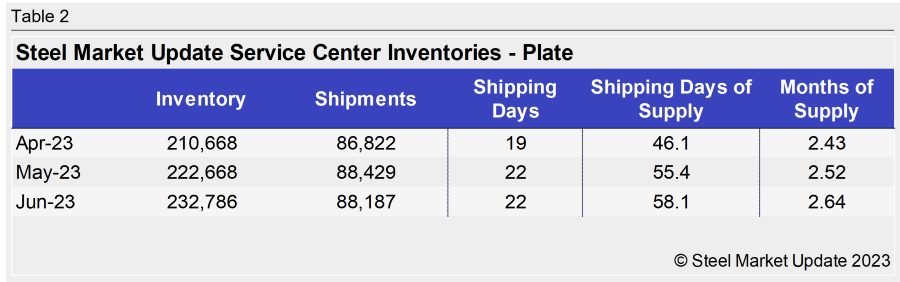

Flat Rolled = 52.3 Shipping Days of Supply

Plate = 58.1 Shipping Days of Supply

Flat Rolled

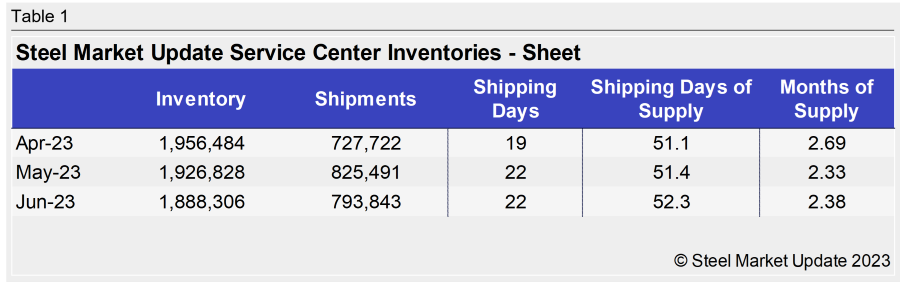

US service center flat-rolled steel supply edged up slightly in June as daily shipments dropped to the lowest rate this year. At the end of June, service centers carried 52.3 shipping days of supply, according to adjusted SMU data. This is up from 51.4 shipping days in May. Flat-rolled steel inventories represented 2.38 months of supply in June, nearly flat compared with 2.33 months of supply in May. There were 22 shipping days in both May and June, respectively.

The total volume of flat-rolled steel held by service centers declined month on month (m/m). This factor paired with the lower daily shipping levels in June, kept supply nearly even m/m. Based on recent shipment levels, we view inventories to be nearly balanced or in a slight surplus. Current inventories, combined with the amount of material on order seem to be adequate for demand levels, as lead times have extended just slightly. The latest SMU survey reported mill HRC lead times at 4.71 weeks, up from 4.56 weeks two weeks prior.

Market contacts have reported mixed messages, as mills seek to raise prices, while some mills remain eager to make sizeable deals to fill holes. Service center contacts have reported that they feel their inventories are balanced. The latest SMU survey showed that 50% of service centers saw their manufacturing customers reducing orders, which is an increase from 41% two weeks prior. Meanwhile, 43% of service centers said manufacturing customers were maintaining orders and 7% were increasing orders.

The amount of flat-rolled steel on order in June was up from May. While the total volume of flat-rolled steel on order decreased m/m, with the lower daily shipping rate in June, the material on order represented slightly more supply. There have been some opportunistic deals to help mills extend lead times, though lead times remain fairly short. The amount of material on order in June was up slightly from May.

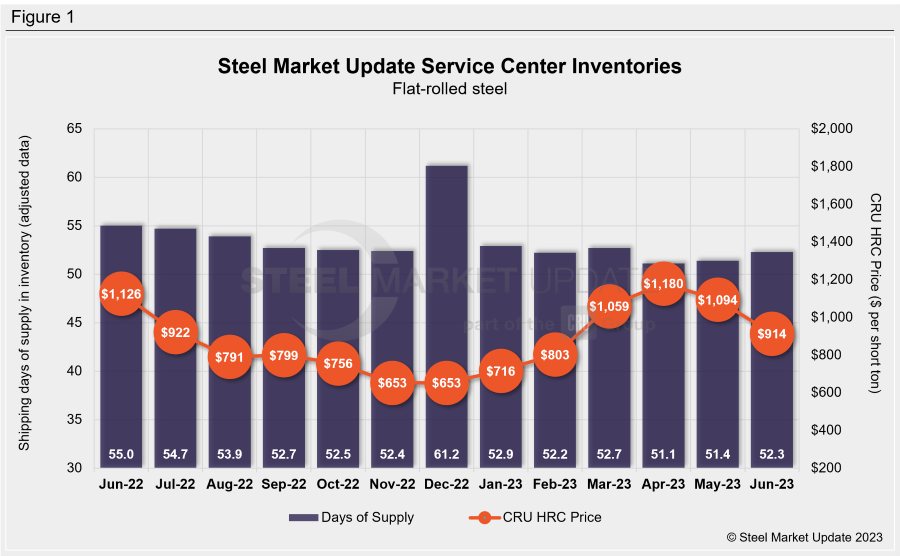

Plate

US service center plate inventories grew again in June with slowing shipments. Similar to sheet, the daily shipping rate for plate fell to the lowest level seen this year. At the end of June, service centers carried 58.1 shipping days of plate supply, up from 55.4 shipping days in May. Plate inventories represented 2.64 months of supply in June, up from 2.52 months in May.

With the slowdown in demand, plate inventories look to be in a slight surplus. Buyers have been reporting that mills are more willing to negotiate on prices, and additional supply entering the market should put further pressure on prices. Plate mill lead times have been steady at 6 weeks in the last two surveys.

The amount of material on order in June fell drastically. The amount of plate on order in June was also down vs. May. Service centers remain cautious about building too much inventory, with bearish outlooks on pricing and weakening demand.