Mexico

July 10, 2023

Steel Exports Hit Almost Five-Year High in May

Written by Laura Miller

US steel exports spiked in May to the highest monthly level in nearly five years.

Exports reached 914,018 net tons in May (Fig. 1), according to the latest figures from the US Department of Commerce. That’s 19% higher month-on-month and 15% higher year-on-year. Recall that exports in March neared a five-year high; May’s total was 3% higher than March’s exports of 886,458 tons.

Shipments to Mexico were at a recent high of 446,610 tons in May on noticeably higher amounts of cut-to-length plate, hot-dipped galvanized sheet and strip, and cold-rolled sheet.

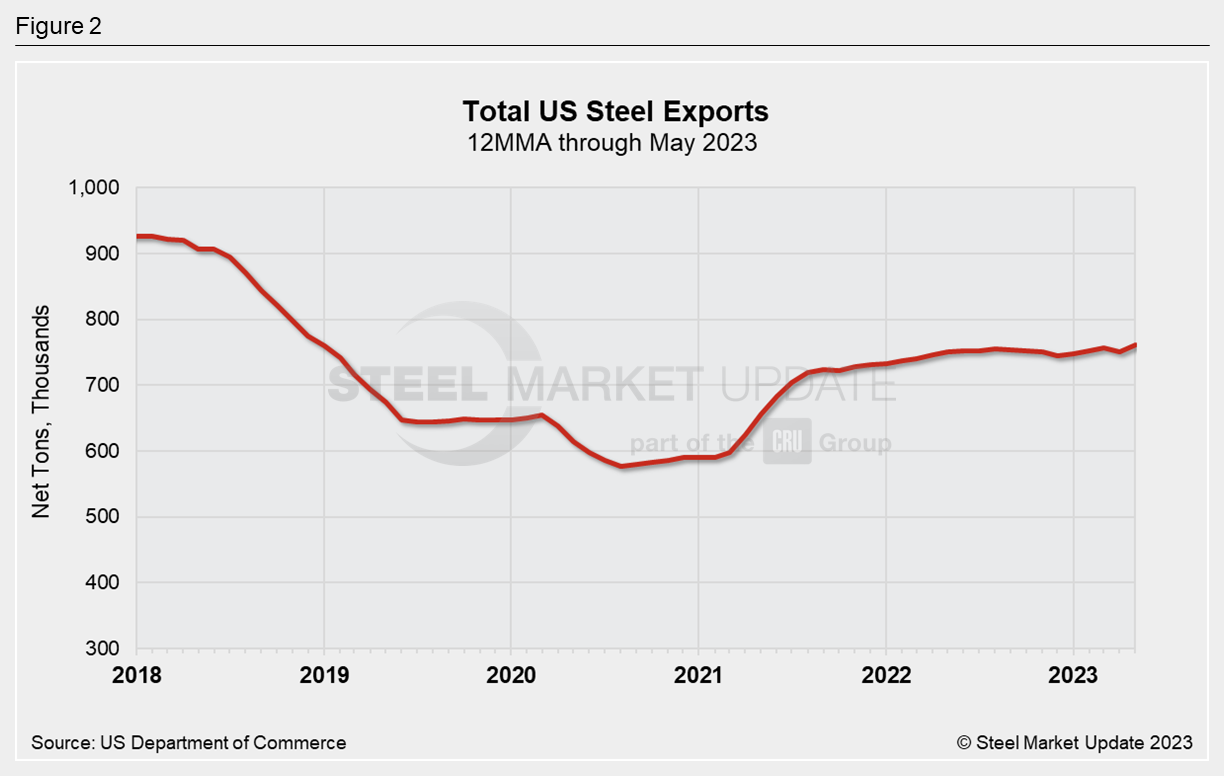

After rising sharply mid-2021, the 12-month moving average (12MMA) of exports has been slowly inching higher. In May, it reached 761,404 tons (Fig. 2). We have to go back to December 2018 to see a higher 12MMA.

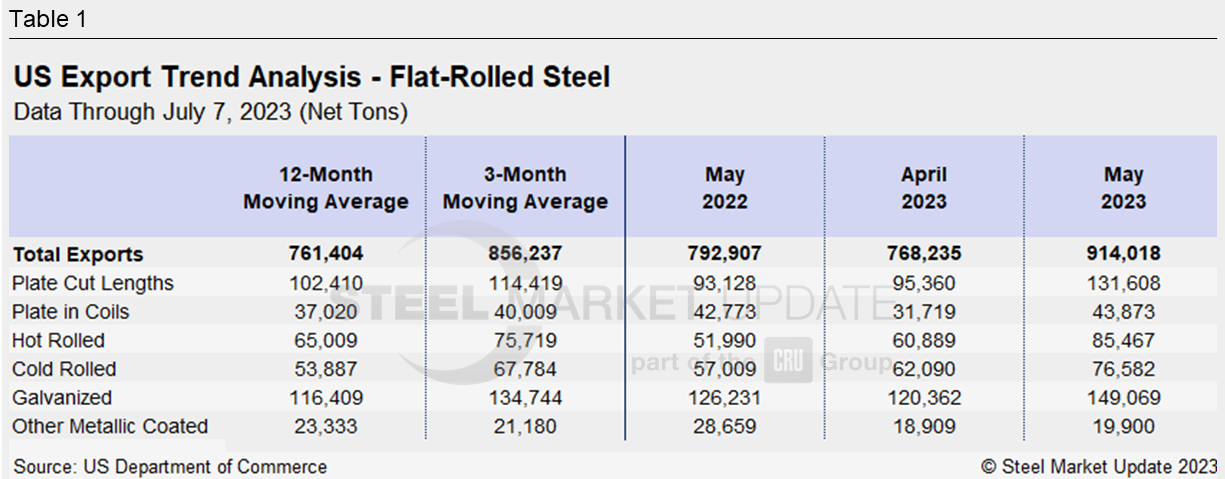

May’s exports of most flat-rolled products were markedly higher than their 3-month and 12-month moving averages (Table 1), except for the other-metallic coated.

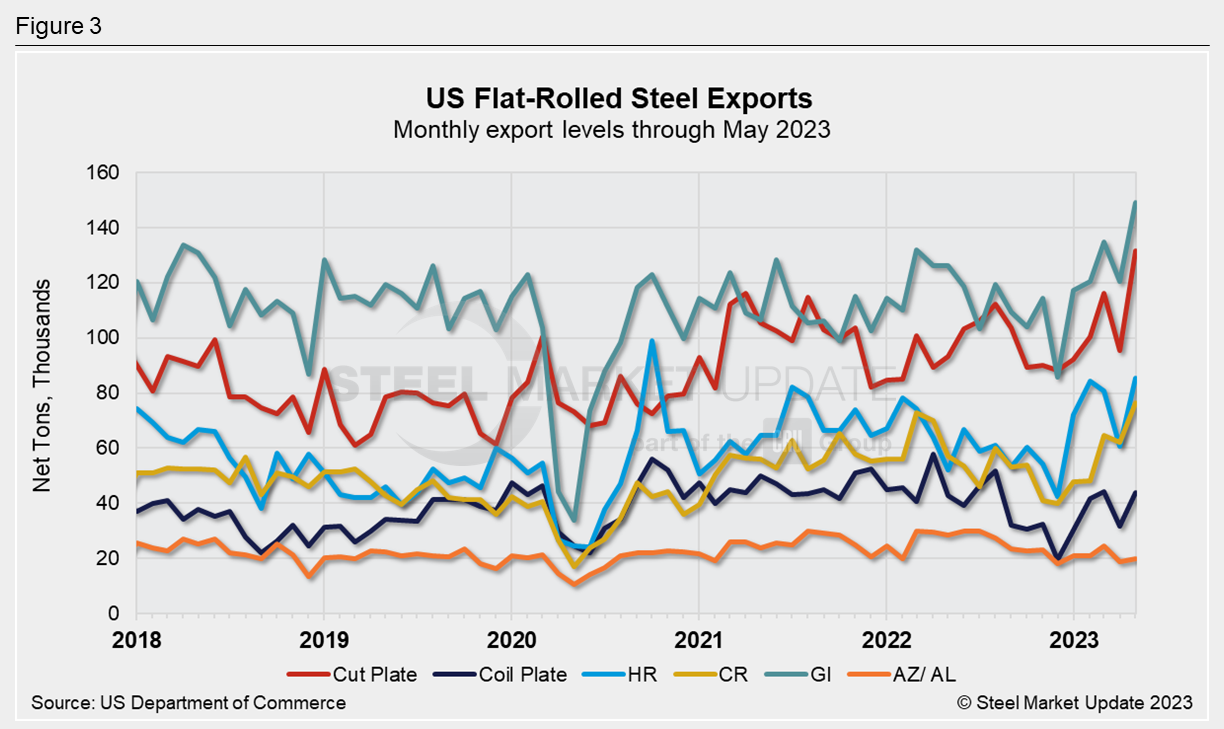

May exports of galvanized sheet, cut-to-length plate, hot-rolled sheet, and cold-rolled sheet were at their highest monthly levels recorded in some time (Fig. 3).

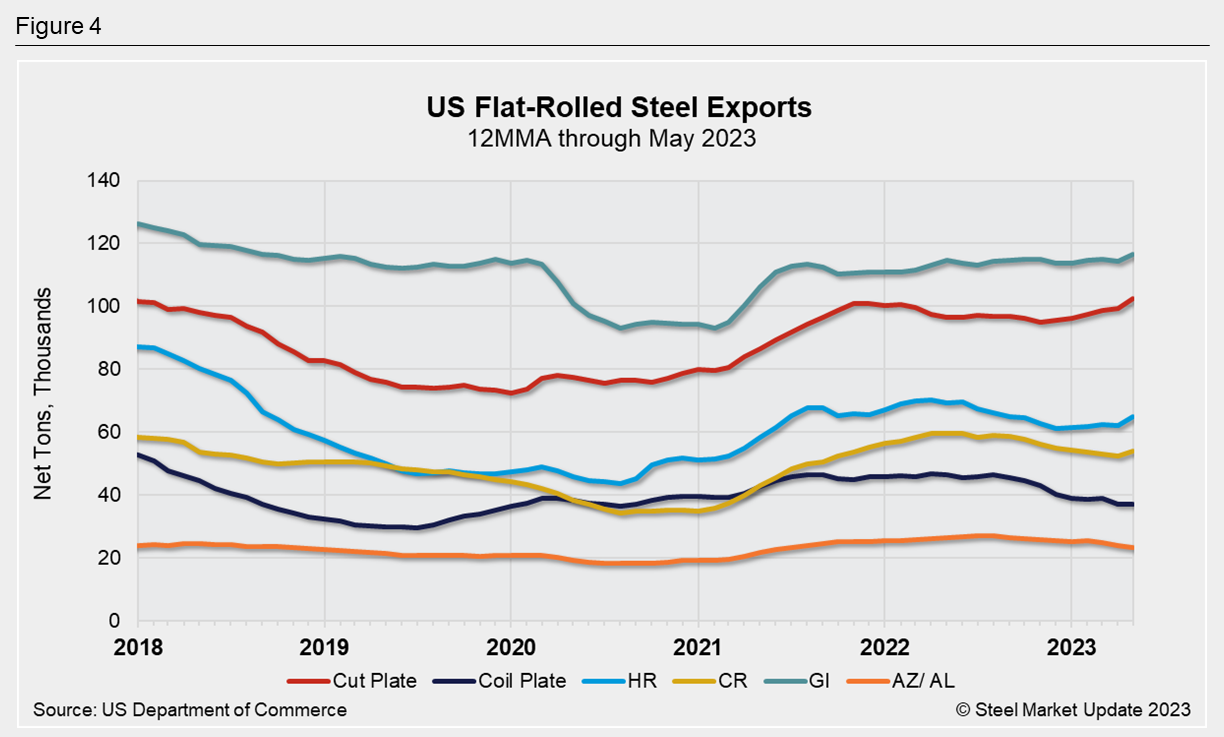

Looking at the 12MMA of individual flat-rolled products shows galvanized, cut plate, and cold rolled exports recovering to near pre-pandemic levels (Fig 4.).

We have an interactive graphing tool available on our website where readers can further investigate historical export data in total and by product.

By Laura Miller, laura@steelmarketupdate.com