Prices

June 21, 2023

ABI Shows Modest Improvement in May

Written by Laura Miller

In a good sign for the construction markets, architectural firms saw a rebound in business conditions in May after experiencing a softer April.

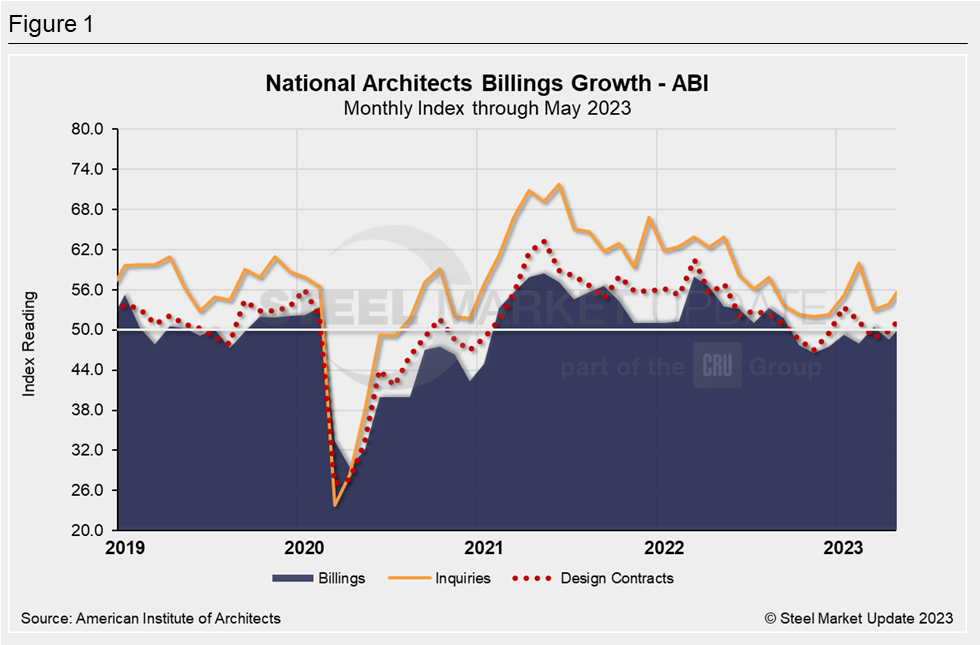

The American Institute of Architects (AIA) and Deltek reported a May reading of 51.0 in the Architecture Billings Index (ABI). This was a rise from the previous month’s reading of 48.5 and the highest reading since September.

The ABI is a leading economic indicator for nonresidential construction activity with a lead time of 9-12 months. Note than any score above 50 indicates an increase in billings.

Architecture firms also reported a rise in inquiries for new projects, with that portion of the index accelerating from 53.9 in April to 57.2 in May. The value of new design contracts also increased, from 49.8 to 52.3.

“The modest improvement in overall demand for architectural services that we saw last month is encouraging news,” commented Kermit Baker, AIA chief economist.

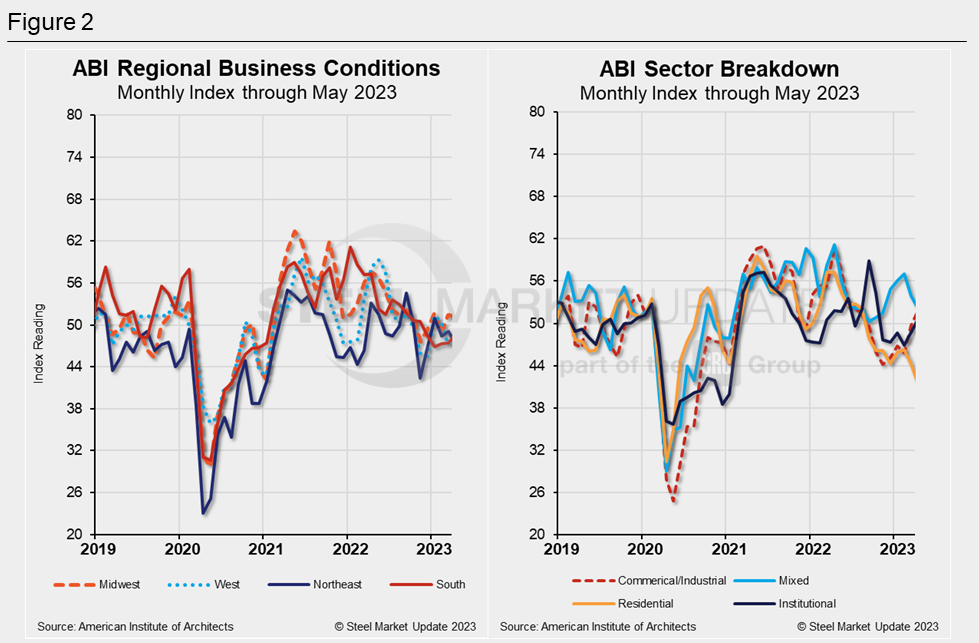

He noted, however, that “there continues to be variation in the performance of firms by regional location and building specialization. This suggests that overall business conditions for the profession likely will continue to be variable.”

Billings increased in the South while declining in the West and Northeast. Billings were essentially flat at Midwest firms, AIA said.

Billings for institutional specialization projects were strong, while billings for multifamily residential projects fell to their lowest levels in two years. Commercial/industrial billings, meanwhile, fell for a ninth consecutive month.

“I am hearing of softness in certain sectors, like inpatient healthcare, residential, and life sciences. Ability to get or afford financing, and high construction prices, appear to be factors,” noted one Northeast firm.

An interactive history of the AIA Architecture Billings Index is available on the SMU website.

By Laura Miller, laura@steelmarketupdate.com