Market Data

June 19, 2023

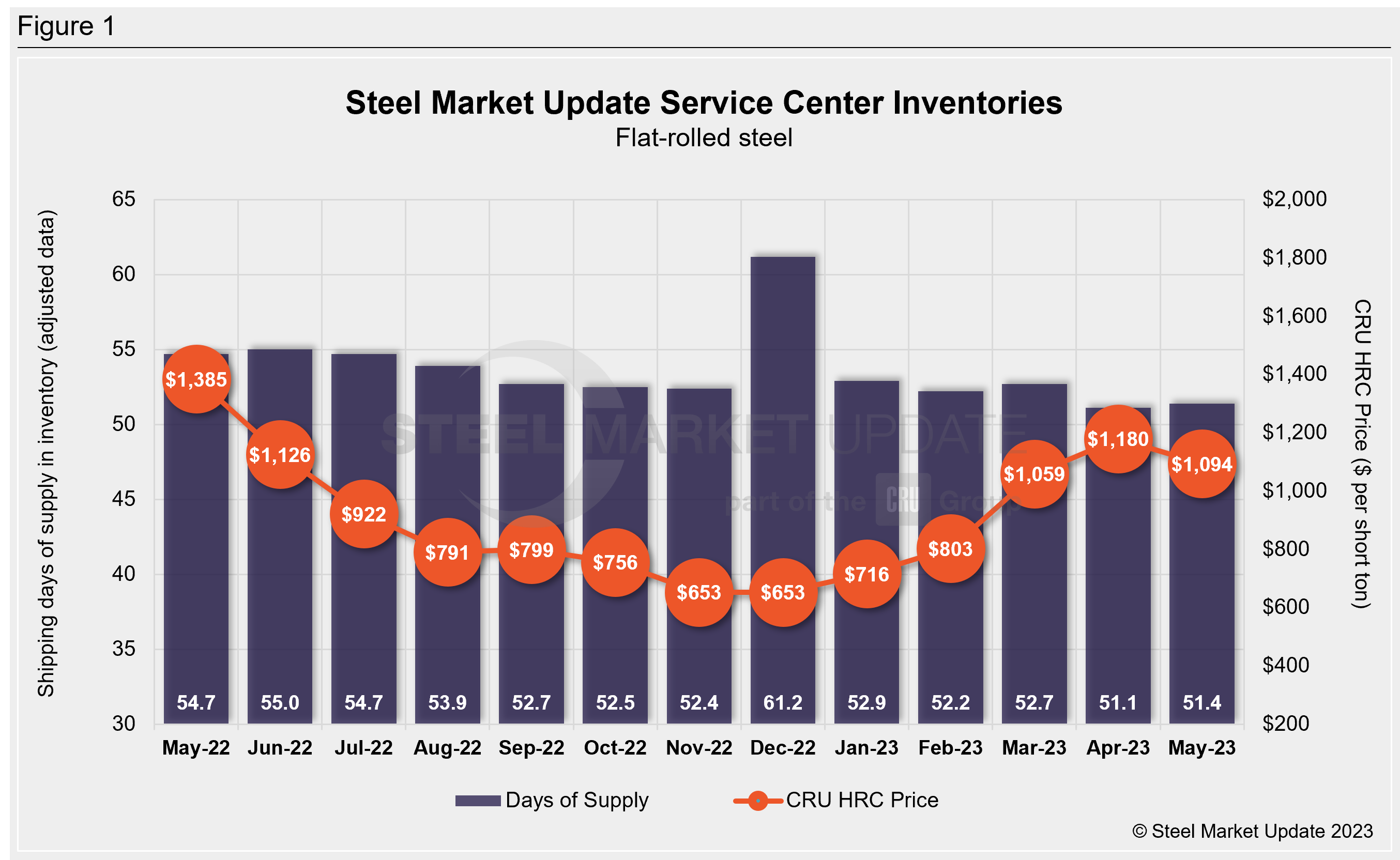

Service Center Shipments and Inventories Report for May

Written by Estelle Tran

Flat Rolled = 51.4 Shipping Days of Supply

Plate = 55.4 Shipping Days of Supply

Flat Rolled

US service center flat-rolled steel inventories were nearly flat month on month in May with shipments still strong. Service centers carried 51.4 shipping days of supply at the end of May, according to adjusted SMU data. This was up slightly from 51.1 shipping days of supply in April. Flat-rolled steel inventories representing months of supply went down to 2.33 months in May from 2.69 in April. This is distorted though because May had 22 shipping days, compared to April’s 19.

The small increase in sheet supply in May could be related to material arriving ahead of schedule, which supported higher intake at service centers. Mill lead times for sheet hit a peak in March and have been shrinking ever since. In the latest SMU survey published June 9th, HRC lead times moved in to 4.91 weeks, compared to 5.82 weeks a month ago.

The 22 shipping days in May as well as a steady daily shipping rate kept inventories from rising significantly. Inventories seem to be in balance or in a slight surplus. Q2 is typically the strongest period of the year, though market participants were unsure how May would look given the weaker-than-usual Q4 followed by the stronger-than-expected Q1 this year and falling sheet prices.

The amount of material on order at the end of May decreased month on month but will be enough to keep service centers well stocked in June and July, as demand to the auto industry slows. Service centers shipping days of sheet supply on order at the end of May was down from April. The amount of material on order in May was also down vs. April.

Services centers have been pulling back on orders because of steadily falling prices. The latest SMU survey found 40% of service centers were reducing inventory while 52% were maintaining inventory. The month prior, 31% of service centers reduced inventory and 65% maintained inventory.

Plate

US service center plate inventories popped up in May, as shipments slowed drastically. At the end of May, service centers carried 55.4 shipping days of supply. This was up from 46.1 shipping days of supply in April. In terms of months on hand, service centers had 2.52 months of plate supply on hand in May, up from 2.43 in April.

Anecdotally, service centers said they were nervous about holding too much inventory because of pricing outlooks. The massive spread between plate and HRC has been putting pressure on plate prices. New capacity ramping up is also expected to add to the downward pressure on prices.

Some market contacts reported that demand was steady, while others said shipments fell off in April and slowed further in May. Bearish outlooks as well as demand pulled forward into Q1 caused shipments to fall off in May. Even with three more shipping days in May compared to April, some service centers reported lower monthly shipments in May.

Inventories seem to be in balance for plate with service centers focused on filling gaps and keeping their inventories lean as prices decline. Plate mills have also been rolling material ahead of schedule, which possibly contributed to the swell in inventories in May.

The latest SMU survey reported plate mill lead times at 6.64 weeks, down from 6.92 weeks the month prior.

Service centers’ supply on order at the end of May was up from April. With heavier inventories, the amount of material on order in May was down vs. April.

By Estelle Tran, estelle.tran@crugroup.com