CRU

June 16, 2023

CRU: Weak Demand Pushes Global Scrap Prices Down

Written by Puneet Paliwal

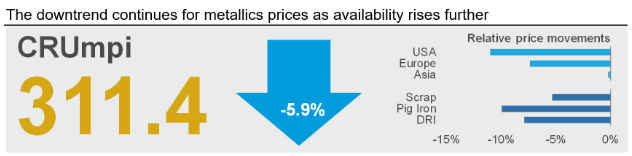

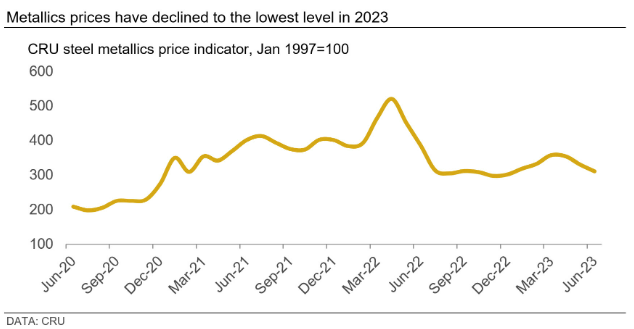

Metallics prices have fallen in most global markets over the last month, driven by weak steel demand and improved metallics supply. Lower finished steel prices and EAF margins have weighed heavily on metallics prices across major markets. Scrap bids from key buyers have reduced further amid ample availability, while recent pig iron price cuts have triggered production curtailments. Accordingly, the CRU metallics price indicator (CRUmpi) for June fell by 5.9% month-on-month (MoM) to its lowest value in 2023.

![]() Asian prices have been more resilient than those in Europe and the US due to relatively constrained supply. Meanwhile, global prices of ore-based metallics have seen sharper MoM drop than that of scrap, following improvement in trade flows. Weak construction steel demand, low steel prices and lower margins have caused EAF operating rates to fall across key economies, while scrap generation continues to grow due to seasonal factors. The resultant rise in availability has caused scrap bids to turn lower, eventually exacerbating downward pressure on ore-based metallics prices.

Asian prices have been more resilient than those in Europe and the US due to relatively constrained supply. Meanwhile, global prices of ore-based metallics have seen sharper MoM drop than that of scrap, following improvement in trade flows. Weak construction steel demand, low steel prices and lower margins have caused EAF operating rates to fall across key economies, while scrap generation continues to grow due to seasonal factors. The resultant rise in availability has caused scrap bids to turn lower, eventually exacerbating downward pressure on ore-based metallics prices.

Prices of metallics have fallen further in major markets globally following a parallel downslide in steel prices. Steel demand in major markets has stayed subdued, particularly owing to prevalent caution due to weakening macro-economic environment. Some of the European economies have already “officially” entered recession and policy interventions are currently underway to minimize its impact. Amongst steel end users, the construction sector is most affected by the economic downturn. The resultant project delays/deferments have reduced sales for EAF-based steelmakers, and this has lowered demand for metallics, particularly scrap.

Some European EAF-based steelmakers have already cut production and have plans to extend maintenance outage periods. Even with these production curtailments, market participants believe that steel prices are likely to reduce further for the remainder of June and into July. Scrap prices in the region have found some support from improved Turkish buying after the conclusion of national elections.

In the US market, prices of prime grades of scrap have seen their sharpest MoM decline since October 2022 as ample supply and lackluster demand put additional pressure on the market. Despite declines over the last two months, flows to scrap yards are still steady in many regions, although the Northeast had started to see volumes drop off. As domestic prices fell, export prices trended higher in recent weeks, prompting dealers to offer more volumes to exports rather than domestic buyers. Another key development in this market is that pig iron prices have reduced by a larger extent than that of scrap, narrowing the price gap between the two. US pig iron inventories are at sufficient levels entering the summer slowdown period, while traders have adopted a “wait-and-see” approach to observe the impact of Brazilian production cuts in the near term.

A notable exception to the metallics price downtrend being observed in major markets is the Chinese market, wherein scrap supply has tightened causing prices to rise MoM. Scrap prices in this market were following a declining trend until end of May, whereafter rumors around possible government stimulus for the real estate sector triggered higher scrap buying. The decline in Chinese scrap supply has outpaced the reduction in scrap demand over the past month, while several scrap dealers held on to inventory in want of higher prices. A combination of these factors has caused scrap supply to tighten and prices to rise in the Chinese domestic market. In other Asian markets, scrap prices are rangebound MoM and the pace of decline is much lower than that in western markets due to renewed bullishness in the Chinese steel market.

By Puneet Paliwal, CRU senior analyst, puneet.paliwal@crugroup.com