Mexico

June 13, 2023

US Steel Exports Fall Back in April From March's Recent High

Written by Laura Miller

After hitting an almost five-year high in March, US steel exports fell back during the month of April.

Exports totaled 768,235 net tons in April, according to the latest figures available from the US Department of Commerce. This was a 13% month-on-month (MoM) and a 7% year-on-year (YoY) decline. Note that March exports of 886,458 tons were at their highest monthly level since June 2018 (Figure 1).

Shipments to Canada and Mexico typically account for over 90% of monthly exports. April shipments to the USMCA trading partners were at a three-month low.

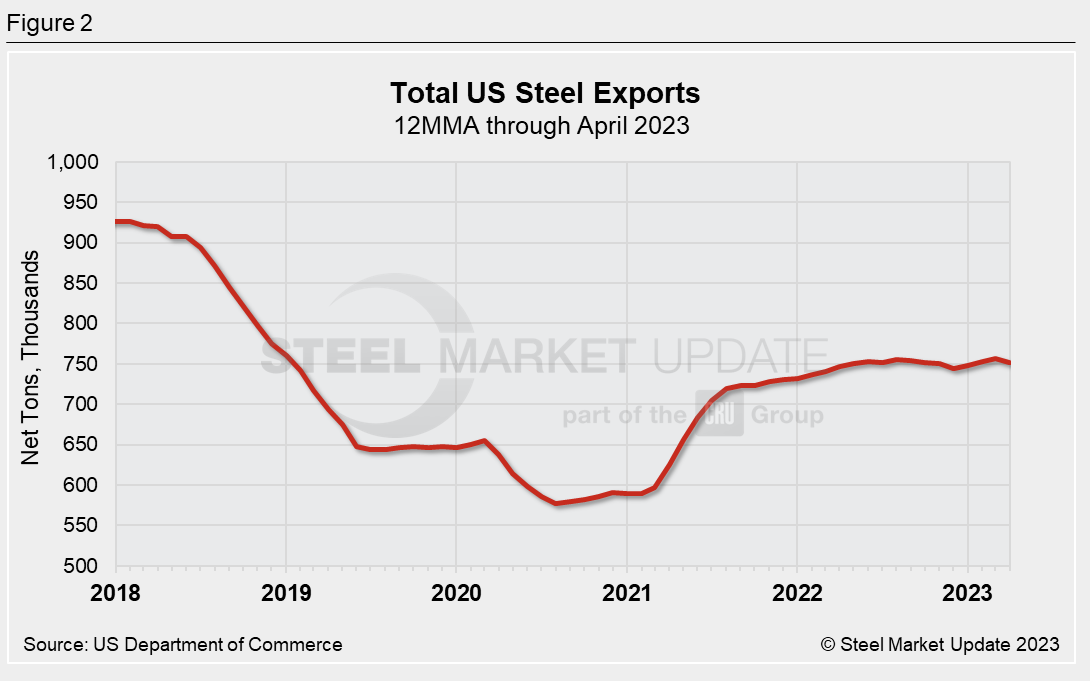

Looking at exports on a 12-month moving average (12MMA) basis reveals that exports have been fairly steady since mid-2021, inching up from 704,196 tons in July 2021 to 751,311 tons in April (Figure 2)

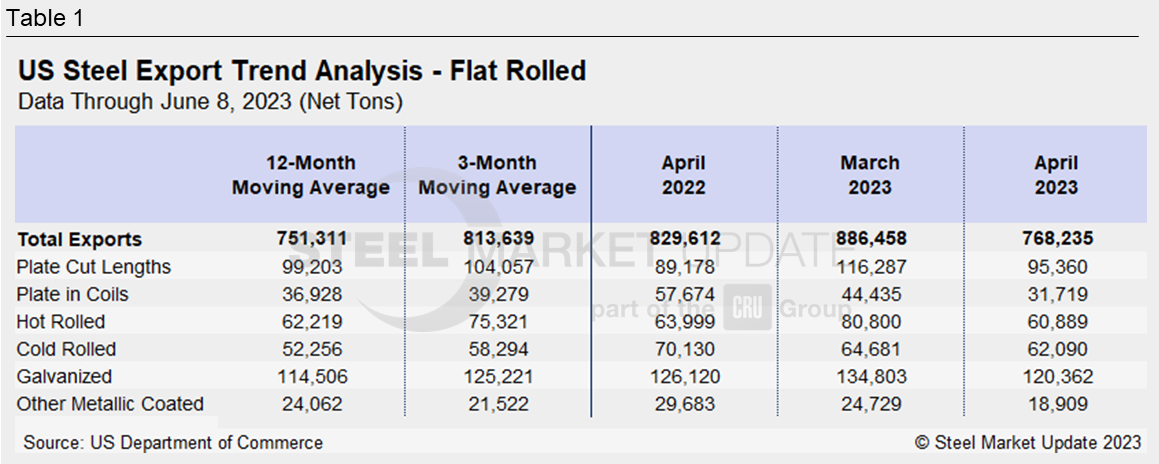

Exports of major flat-rolled steel products (Table 1) all showed MoM and YoY declines, save for cut-to-length plate, which was down MoM but showed YoY growth of 7%.

Galvanized sheet and strip is the most-exported flat-rolled product. At 120,362 tons in April, exports were down 11% from the three-month moving average (3MMA) but up 5% from the 12MMA.

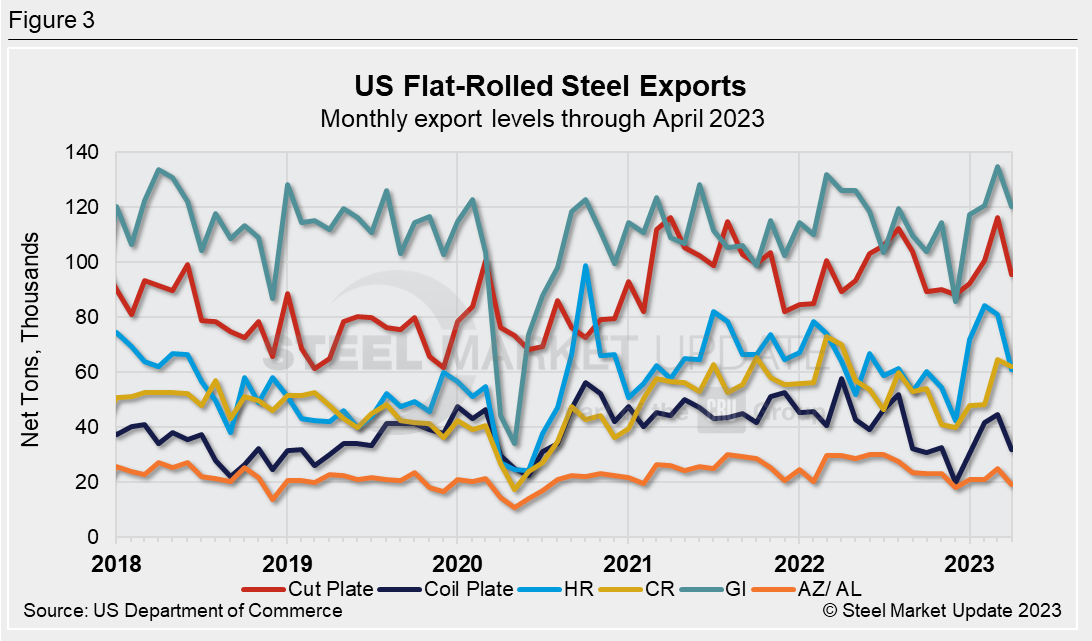

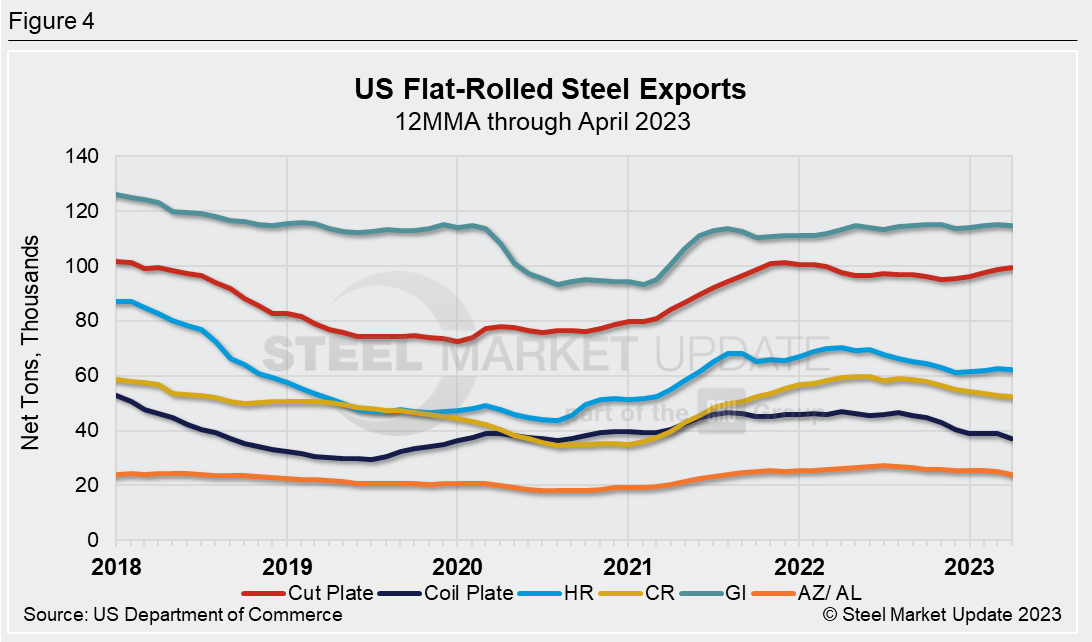

While flat-rolled exports can be erratic month-to-month (Figure 3), looking at their 12MMAs shows most sheet products creeping higher from their recent lows in mid-2020 (Figure 4).

The recent lows for the 12MMA of plate exports were in mid-2019. While cut plate exports have been recovering nicely, exports of coiled plate have been inching downward.

Readers can further investigate historical export data in total and by product using the interactive graphic tool available on our website.

By Laura Miller, laura@steelmarketupdate.com