Analysis

June 13, 2023

US Light-Vehicle Sales Fall in May, Still Higher YoY

Written by David Schollaert

Editor’s note: Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, contact Lindsey Fox at lindsey@steelmarketupdate.com.

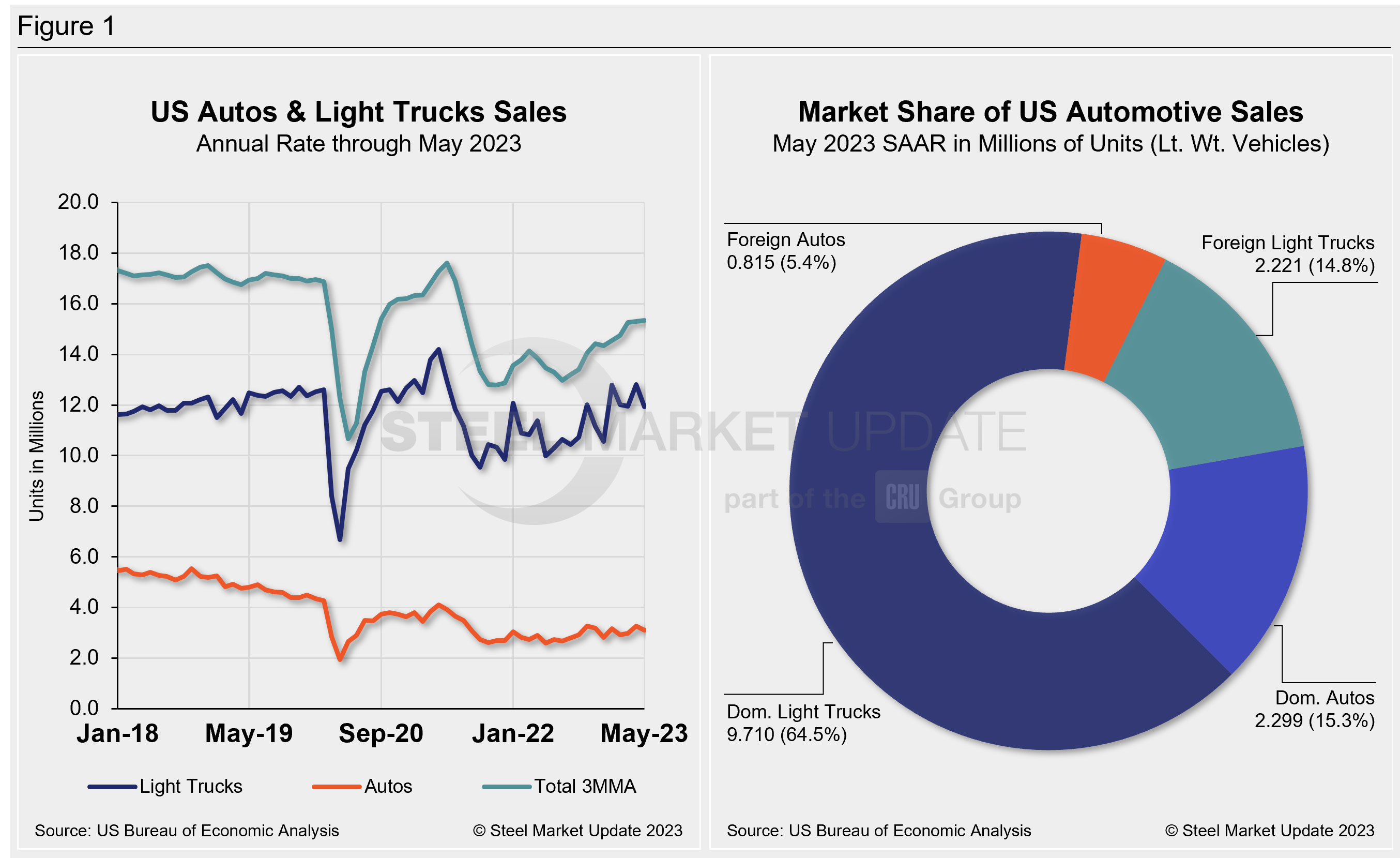

US light-vehicle (LV) sales rose to an unadjusted 1.36 million units in May, up 22.9% vs. year-ago levels, the US Bureau of Economic Analysis (BEA) reported. Despite the year-on-year (YoY) boost, domestic LV sales fell 6.5% month-on-month (MoM).

On an annualized basis, LV sales were 15.1 million units in May, down from 15.9 million units the month prior, and below the consensus forecast which called for a more modest decline to 15.3 million units.

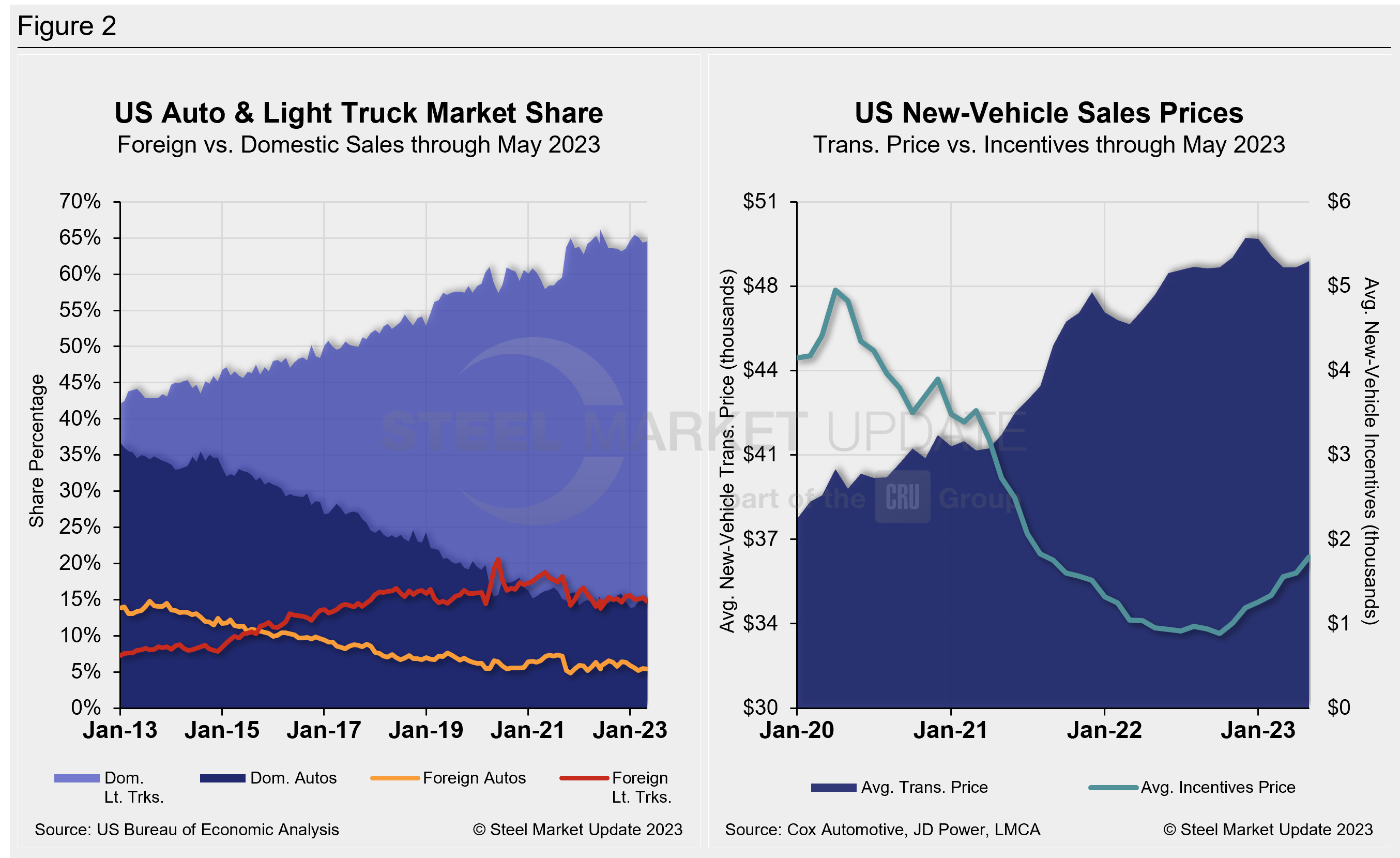

Auto sales continue to be impacted by high-priced inventory. Although the supply of affordable vehicles is growing gradually, the market is still heavily skewed toward higher-end models. This continues to pose a major headwind for most consumers, especially given the current swelled interest rate environment. And retail incentives, though being pressured higher, up 64% YoY in May, are still just about half of what they were in May 2019 – before the global pandemic and semiconductor shortage cut auto assemblies.

Despite that, the average daily selling rate was 54,481 – calculated over 25 days – up from May 2022’s 46,169 daily rate. And passenger vehicle sales increased YoY while sales of light-trucks ticked up by 23.1% over the same period. Light-trucks accounted for 79% of last month’s sales, roughly one percentage point below its share of sales in May 2022.

Below in Figure 1 is the long-term picture of sales of autos and lightweight trucks in the US from 2013 through May 2023. Additionally, it includes the market share sales breakdown of last month’s 15.1 million vehicles at a seasonally adjusted annual rate.

The new-vehicle average transaction price (ATP) was $48,528 in May, up 0.5% from April and up for the first time in five months. Last month’s ATP was also 2.9% (+$1,380) above the year-ago period, according to Cox Automotive data.

Incentives increased again for the seventh straight month. Last month’s incentives were $1,788, up from $1,599 in April, and the highest total since August 2021. With the MoM increase, incentives remained above the $1,000 mark for the seventh time in 10 months and roughly 4% of the average transaction price. Incentives are up 88.2%, or $838 YoY.

In May, the annualized selling rate of light trucks was 11.931 million units, down 6.9% vs. the prior month but still nearly 20% better YoY. Auto annualized selling rates saw similar dynamics, down 5% but up 19.9%, respectively, in the same comparisons.

Figure 2 details the US auto and light-truck market share since 2013 and the divergence between average transaction prices and incentives in the US market since 2020.

Editor’s Note: This report is based on data from the US Bureau of Economic Analysis (BEA), LMC Automotive, JD Power, and Cox Automotive for automotive sales in the US, Canada, and Mexico. Specifically, the report describes light vehicle sales in the US.

By David Schollaert, david@steelmarketupdate.com