Prices

June 13, 2023

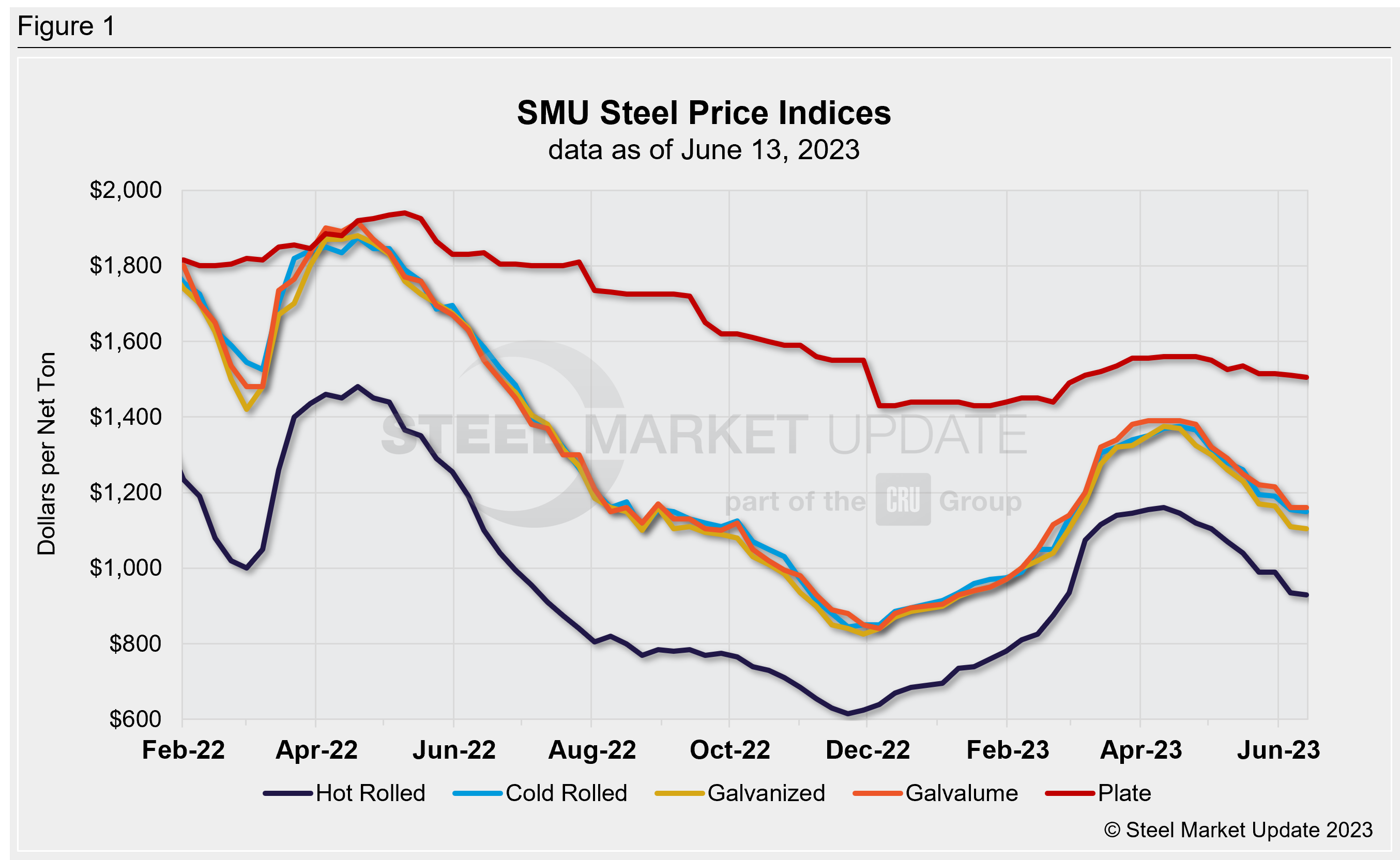

SMU Price Ranges: Sheet Decline Moderates, More Erosion Likely

Written by David Schollaert

Sheet prices fell at a more modest pace this week after a sharp decline last week, as business seemed somewhat curbed.

After Memorial Day prices fell, leading to the sharpest price drop since June 21, 2022. Now, the slide seems to have temporarily cooled, though sources indicated it was almost exclusively due to a lack of activity.

SMU’s hot-rolled coil price now stands at $930 per ton ($46.50 per cwt), down $5 per ton from a week ago. While chatter existed of even lower prices, there was little in the way of confirmation, as unsolicited offers seemed to gain traction.

Value-added products also posted widespread declines, though again at much smaller rates than the double-digit cuts the week prior. Cold-rolled was down $5 per ton, as was galvanized and Galvalume. We’ve seen two mills lower coating extras as zinc prices erode, and sources anticipate other mills will follow.

Though sheet prices didn’t follow last week’s sharp fall, sources agree that further tag erosion is likely as domestic product remains at a premium to offshore sheet. Also, discounting should intensify as new capacity continues to ramp up.

Plate prices were only down marginally, at $1,505 per ton, but talk surrounding aggressive discounting from published prices continued.

Our sheet price momentum indicator remains at lower. Our plate price momentum indicator continues to point sideways.

Hot-Rolled Coil: The SMU price range is $890–970 per net ton ($44.50–48.50 per cwt), with an average of $930 per ton ($46.50 per cwt) FOB mill, east of the Rockies. The bottom end of our range was unchanged vs. one week ago, while the top end was down $10 per ton week on week (WoW). Our overall average down $5 per ton WoW. Our price momentum indicator for hot-rolled coil points downward, meaning we expect the market will be down over the next 30 days.

Hot-Rolled Lead Times: 3–7 weeks

Cold-Rolled Coil: The SMU price range is $1,100–1,200 per net ton ($55.00–60.00 per cwt), with an average of $1,150 per ton ($57.50per cwt) FOB mill, east of the Rockies. The lower end of our range was sideways WoW, while the top end was down $10 per ton compared to a week ago. Our overall average is down $5 per ton WoW. Our price momentum indicator on cold-rolled coil points downward, meaning we expect the market will be down over the next 30 days.

Cold-Rolled Lead Times: 5–9 weeks

Galvanized Coil: The SMU price range is $1,040–1,170 per net ton ($52.00–58.50 per cwt), with an average of $1,105 per ton ($55.25 per cwt) FOB mill, east of the Rockies. The lower end of our range was unchanged vs. last week, while the top end of our range was down $10 per ton vs. one week ago. Our overall average is down $5 per ton vs. the prior week. Our price momentum indicator on galvanized steel points downward, meaning we expect the market will be down over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,137–1,267 per ton with an average of $1,202 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3–10 weeks

Galvalume Coil: The SMU price range is $1,136–1,185 per net ton ($56.75-59.25 per cwt), with an average of $1,160 per ton ($58.00 per cwt) FOB mill, east of the Rockies. Both the lower end of the range and the top end of the range were unchanged vs. last week. Our overall average sideways as a result when compared to one week ago. Our price momentum indicator on Galvalume steel now points downward, meaning we expect the market will be down over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,429–1,479 per ton with an average of $1,454 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6–8 weeks

Plate: The SMU price range is $1,450–1,560 per net ton ($72.50–78.00 per cwt), with an average of $1,505 per ton ($75.25 per cwt) FOB mill. The lower end of our range was unchanged compared to the prior week, while the top end of our range was down $10 per ton WoW. Our overall average was down $5 per ton vs. the prior week. Our price momentum indicator on steel plate moved to neutral, meaning we are unsure of what direction prices will go over the next 30 days.

Plate Lead Times: 4–9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

By David Schollaert, david@steelmarketupdate.com