Market Data

June 9, 2023

Current Steel Buyers Sentiment Index Rises Above Future

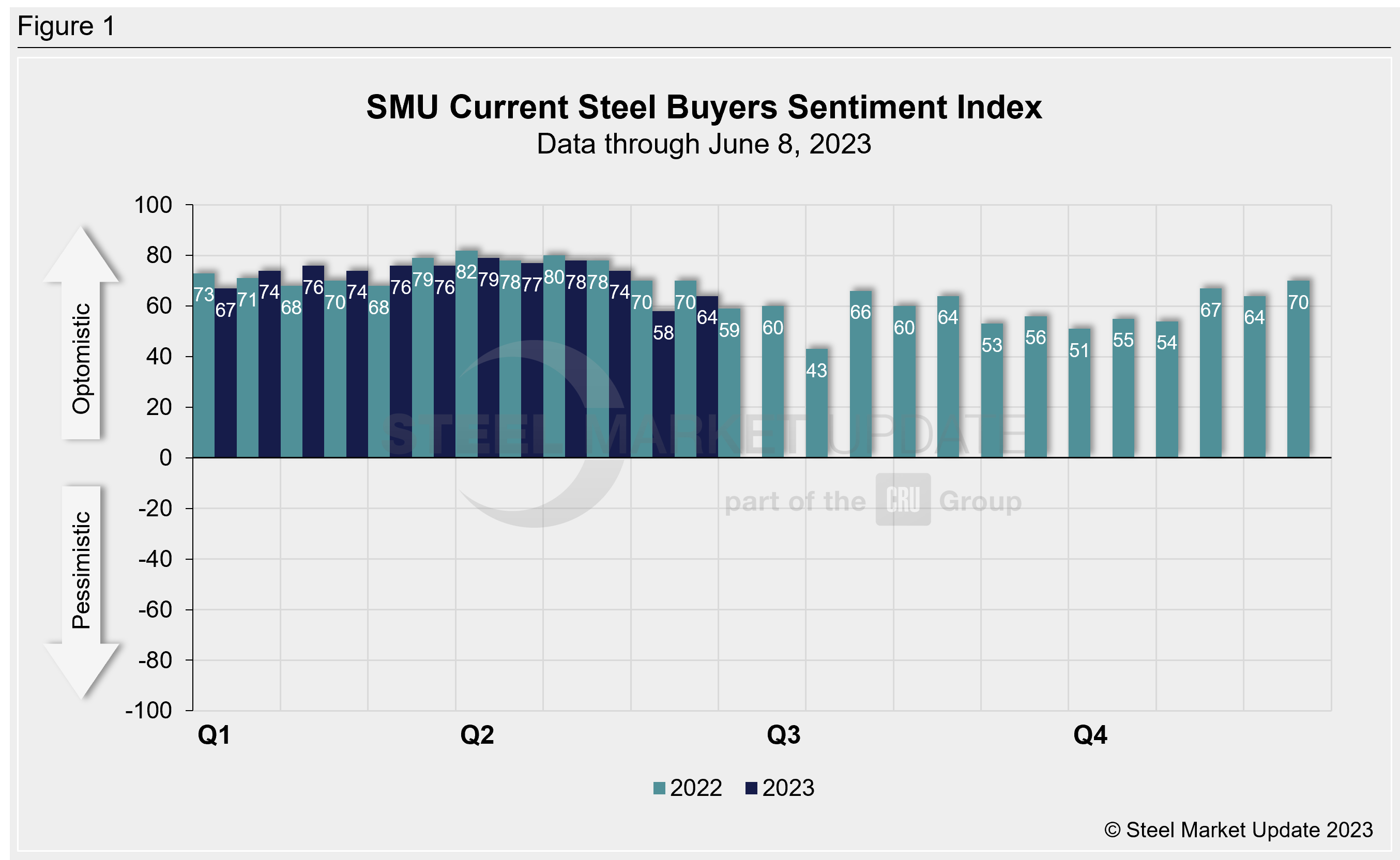

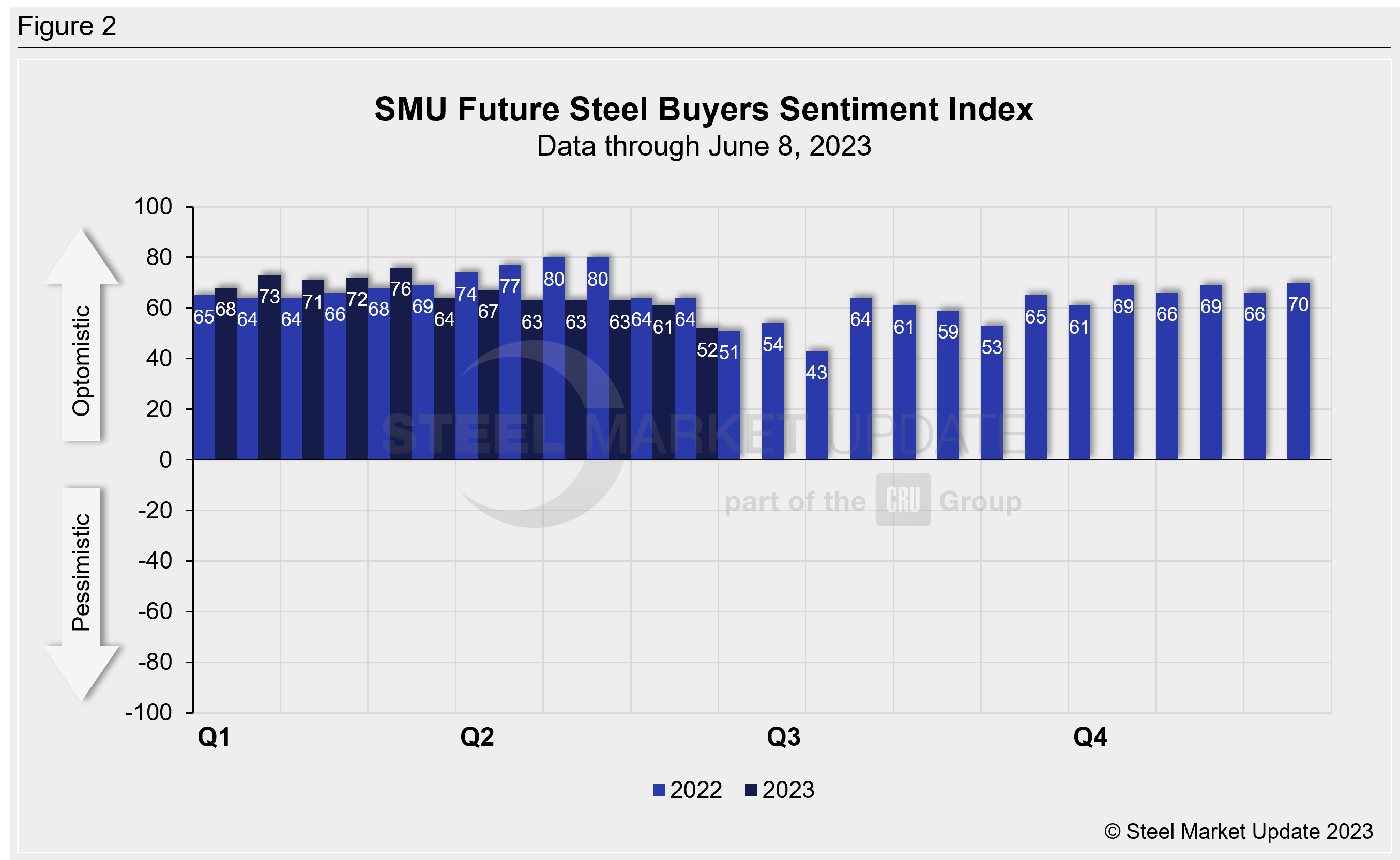

SMU’s Current Steel Buyers Sentiment Index rose above the Future Buyers Sentiment Index during the week ending June 9 as future sentiment slumped, according to our most recent survey data.

Every other week we poll steel buyers about sentiment. The Steel Buyers Sentiment Indices measure how steel buyers feel about their company’s chances of success in the current market, as well as three-to-six months down the road. We have historical data dating to 2008.

SMU’s Current Buyers Sentiment Index stood at +64 this week, up six points from +58 two weeks prior (Figure 1). This rebound follows a 16-point tumble of the index in the previous market check. Still, with the exception of the +58 reading two weeks earlier, +64 is the lowest reading since the beginning of December 2022.

SMU’s Future Buyers Sentiment Index measures buyers’ feelings about business conditions three-to-six months in the future. For the week ending June 9, the index slumped nine points to +52. After rising above current sentiment in our previous market check, future sentiment has again dipped below current sentiment, where it has remained for the vast majority of this year.

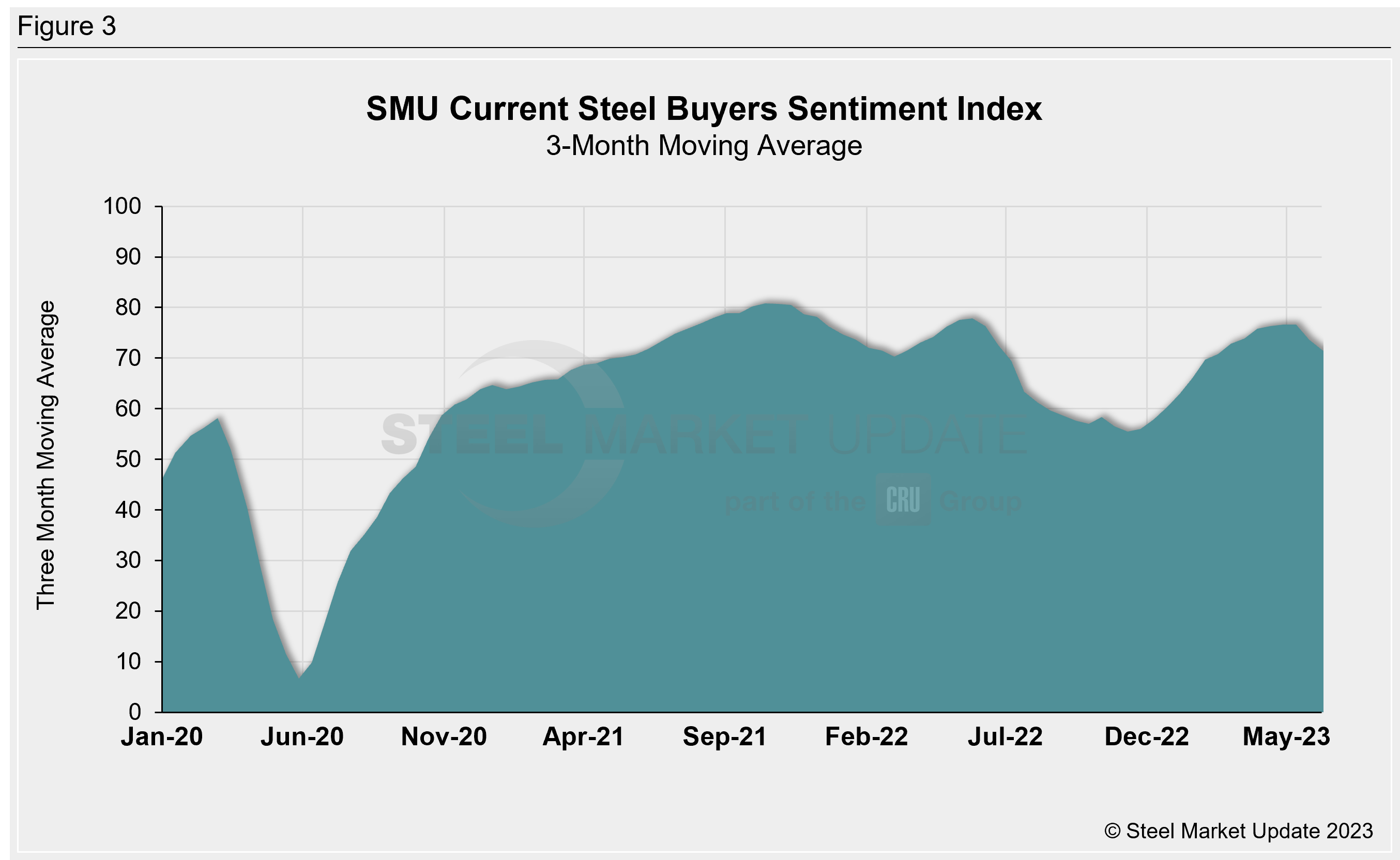

Measured as a three-month moving average, the Current Sentiment 3MMA dropped two points to +71.67 vs. two weeks earlier (Figure 3).

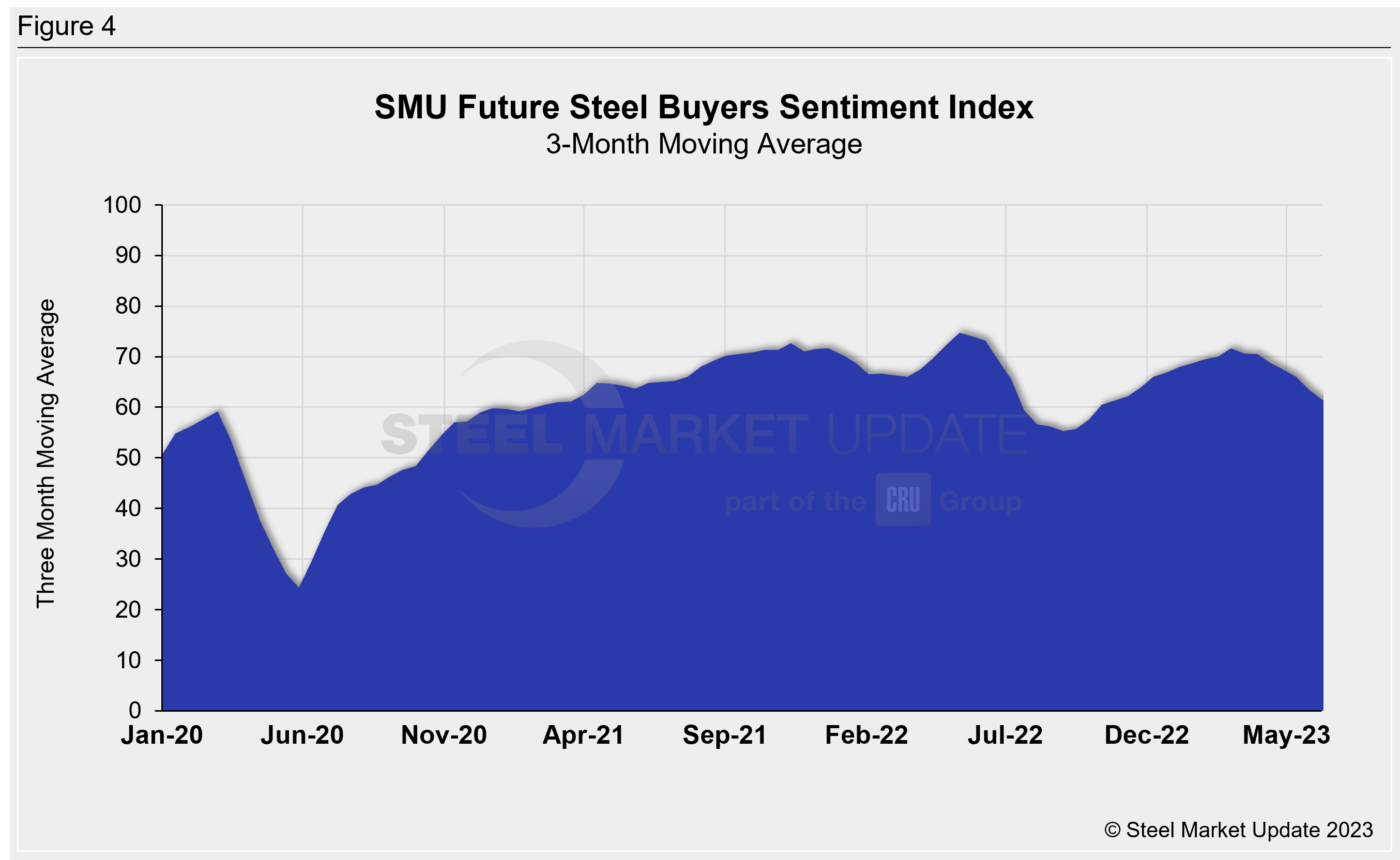

This week’s Future Sentiment 3MMA was +61.5, also down two points from the previous market check (Figure 4).

What SMU Survey Respondents Had to Say:

“Our company will be OK, but nothing like the last couple of years.”

“We have maintained fairly good inventory levels to take advantage of this falling market. We know… what goes up, always comes back down.”

“Absolutely, (we will be successful in today’s market)! As a steel-intensive OEM, lowering tags isn’t the worst thing in the world for us.”

“I suspect business will slow down before picking back up.”

“Everyone is playing the waiting game: Only buy what you need, tomorrow it’ll be cheaper.”

“Contract demand is stable, but spot has picked up.”

About the SMU Steel Buyers Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via SMU surveys twice per month.

Click here to view an interactive graphic of the SMU Current Steel Buyers Sentiment Index and of the SMU Future Steel Buyers Sentiment Index.

By Ethan Bernard, ethan@steelmarketupdate.com