Analysis

May 30, 2023

North American Auto Assemblies Edge Down in April

Written by David Schollaert

North American auto assemblies declined by 15.5% in April, edging down for the first time year-to-date, and for the first time since last November. Last month’s assemblies, however, were still 7.8% higher year-on-year (YoY), according to LMC Automotive data.

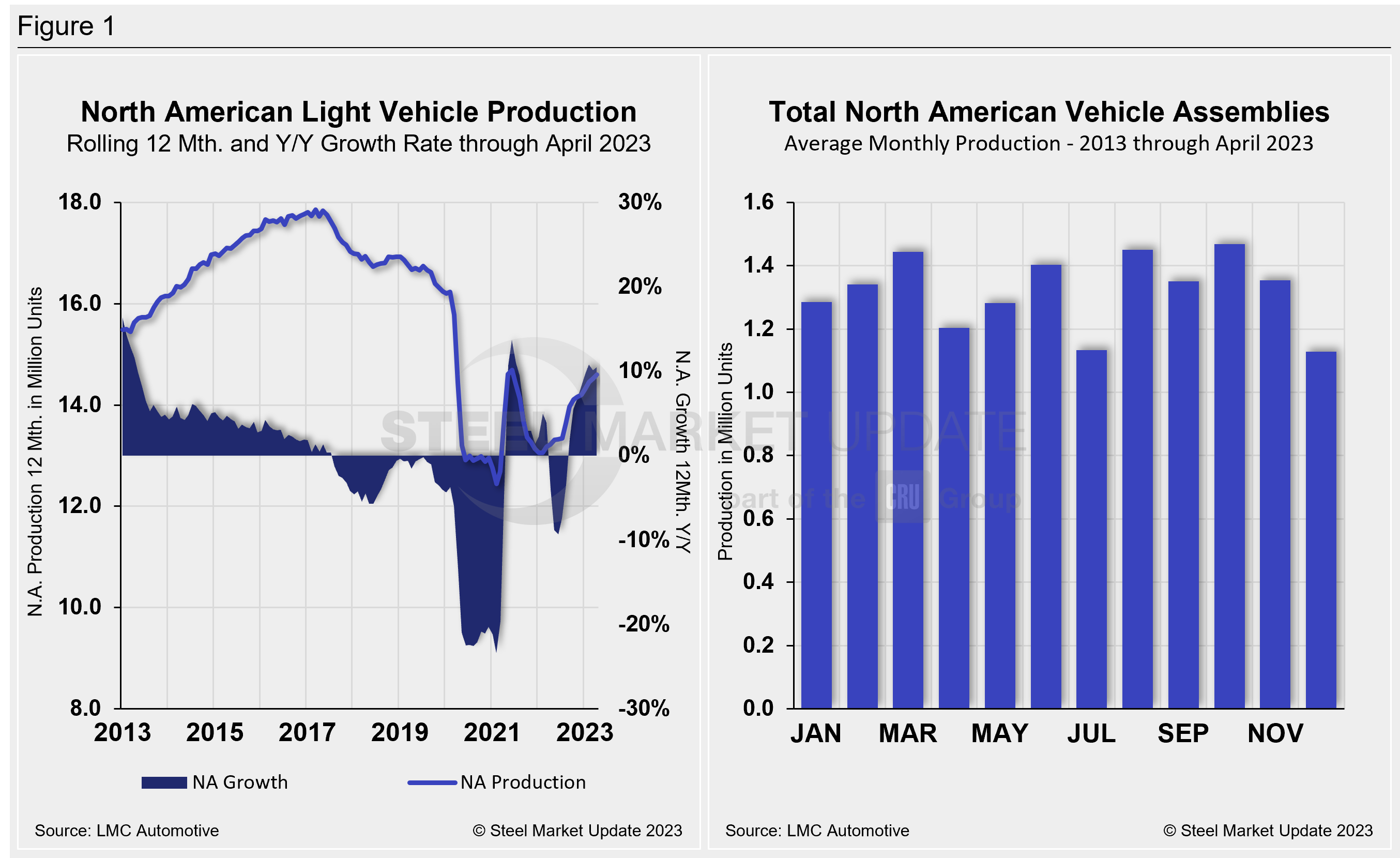

While supply levels began to rebound in the second half of last year, inventories fell modestly in April for the first time in nine months, in part due to seasonal factors. The dynamic is expected to be a short stall as auto production props up over the coming months on improved supply chain pressures.

Increased vehicle availability is expected to improve and support sales moving forward. Demand though could be in question and slow as economic headwinds build.

Both Covid and the global semiconductor crisis were extremely consequential to the North American automotive market, though the chip scarcity levied a larger blow primarily due to its prolonged nature. And automakers are still recovering from the parts and microchip shortage, as shown by the fact that April’s assembly total was still behind by more than 12% when compared to 2019’s pre-pandemic totals.

North American vehicle production, including personal and commercial vehicles, totaled 1.22 million units in April, down from 1.44 million units in March, but nearly 8% ahead of the 1.13 million produced one year ago.

Below in Figure 1 is North American light-vehicle production since 2013 on a rolling 12-month basis with a YoY growth rate. Also included is the average monthly production, which includes seasonality since 2013.

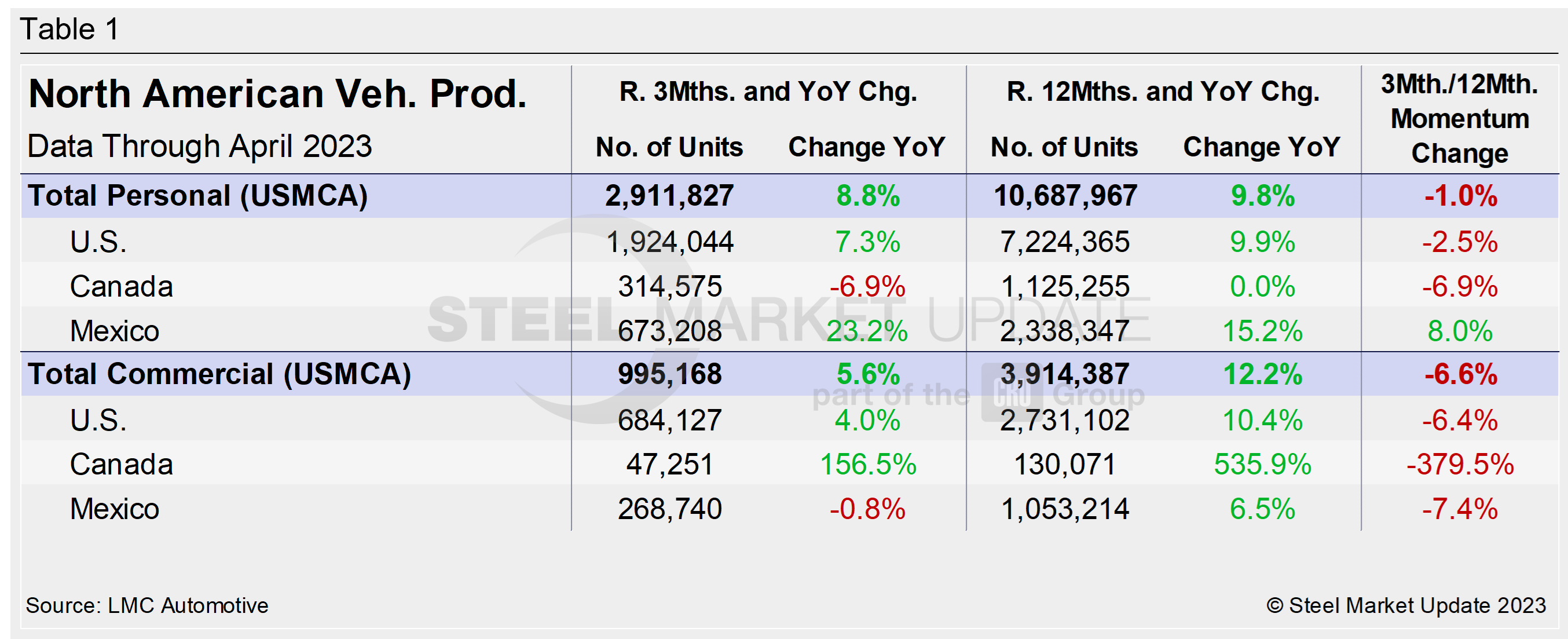

A short-term snapshot of assembly by nation and vehicle type is shown in the table below. It breaks down total North American personal and commercial vehicle production into US, Canadian, and Mexican components. It also includes the three- and 12-month growth rates for each and their momentum change.

Through last September, growth rates for personal and commercial light vehicles were -25.8% and -8.4%, respectively. They have since recovered nicely, with both posting steady gains.

For the three months through April, the growth rate for total personal and commercial vehicle assemblies in the USMCA region is up, but behind the 12-month basis totals. Noticeable is the negative momentum for the sixth consecutive month.

Personal Vehicle Production

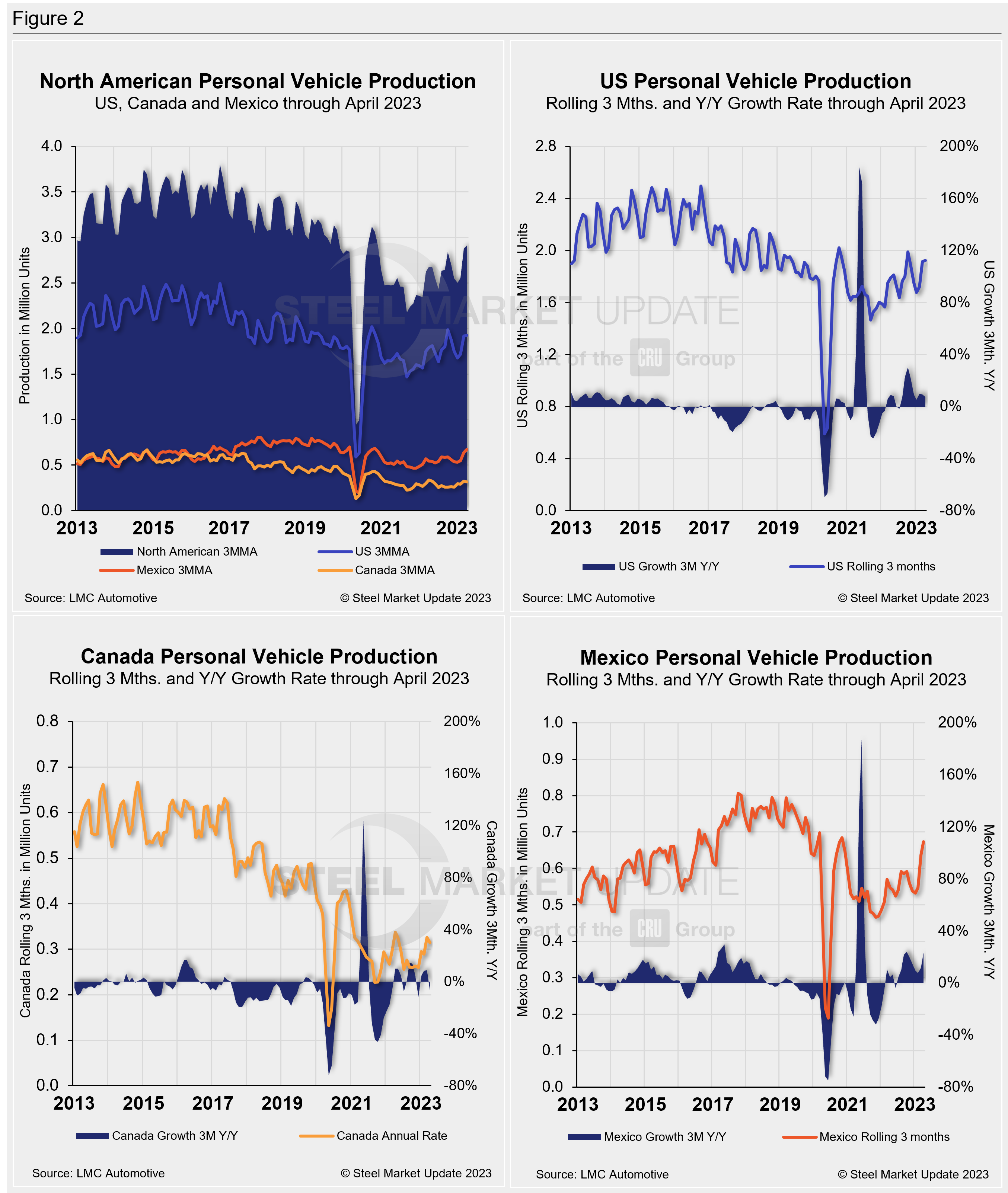

The longer-term picture of personal vehicle production across North America is shown below. The charts in Figure 2 show the total personal vehicle production for North America and the total for the US, Canada, and Mexico. Personal vehicle production in these three countries and their YoY growth rates are also displayed.

In terms of personal vehicle production, the region saw a month-over-month (MoM) decrease in April, down 17%, unable to replicate the acceleration seen in March.

The US saw the largest decline in units produced in April vs. March, down 118,240 units (-16.7%). It was followed by Mexico, down 38,377 units (-15.2%), while Canada produced 27,077 fewer units (-22.6%) MoM.

Production share across the region was largely unchanged. The US and Canada saw personal vehicle production share of the North American market edge down by 0.5 percentage points to 66.1% and 10.8%, respectively. Mexico saw its share edge up 1% to a share of 23.1%.

Commercial Vehicle Production

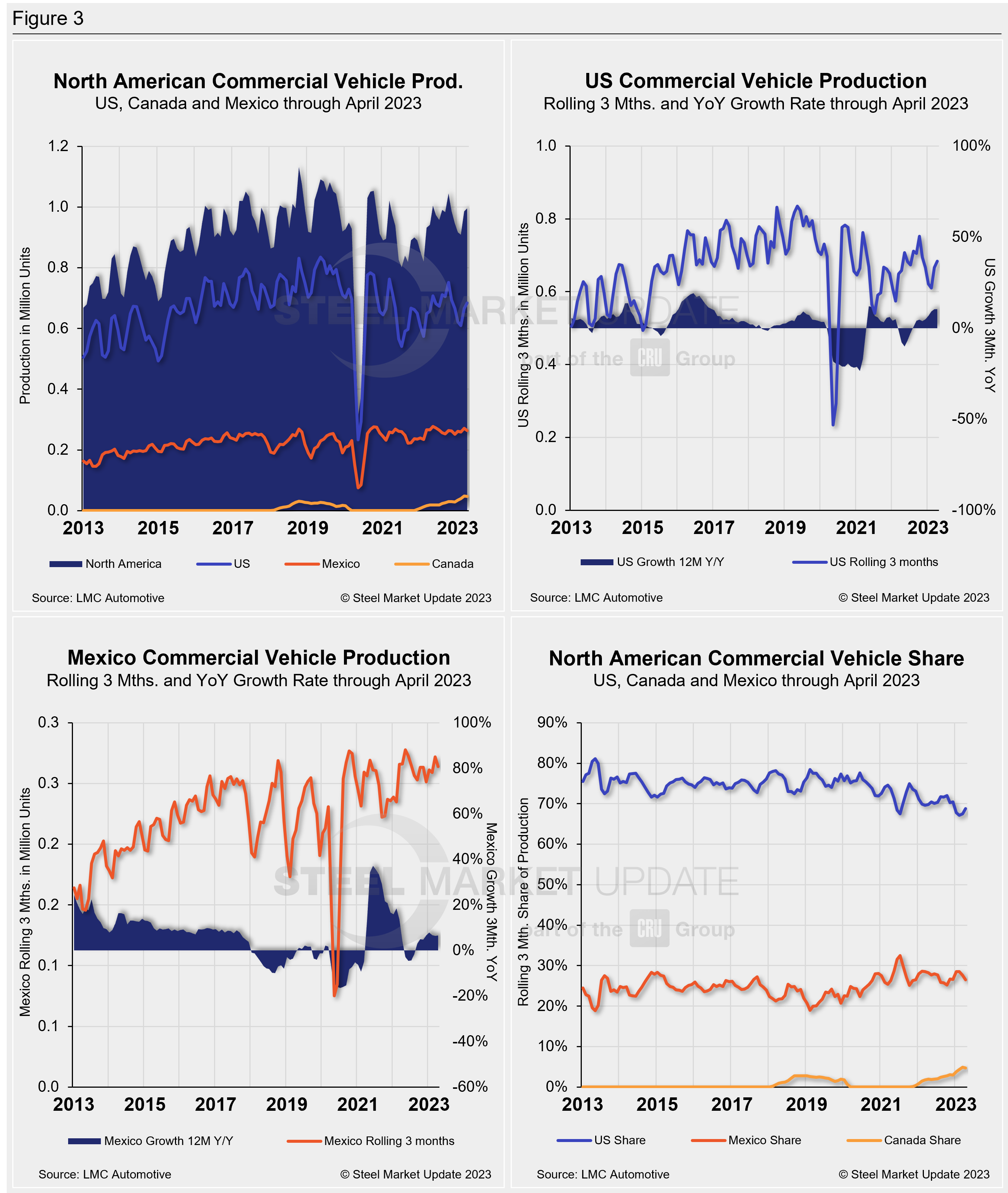

Total commercial vehicle production for North America and the total for each nation within the region are shown in the first chart in Figure 3 on a rolling three-month basis. Commercial vehicle production in the US and Mexico and their YoY growth rates, as well as the production share for each nation in North America, are also shown.

Canada produced 14,016 light commercial vehicles in April, a 20% decrease from March’s total.

North American commercial vehicle production was down 11.2% in April with a total of 321,621 units produced during the month, a decrease of 40,368 units MoM. The loss was driven by the US, which saw a 16.3% decline in commercial vehicle production in April, producing 42,317 fewer vehicles MoM. Canada also saw a 20% decrease in commercial auto assemblies, while Mexico saw a 6.4% boost, or 5,474 more vehicles over the same period.

The overall decline put the commercial production growth rate at 5.6% for the region last month, down from 5.9% in March.

The market share across the region shifted slightly. The US held more than two-thirds of the market, with a total share of 68.7%, up 1.2 percentage points, followed by Mexico with a 26.5% share, and Canada with at 4.7% share in April.

Presently, Mexico exports just under 80% of its light-vehicle production, with the US and Canada the highest-volume destinations.

Editor’s Note: This report is based on data from LMC Automotive for automotive assemblies in the US, Canada, and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 metric tons gross vehicle weight rating; heavy trucks and buses are not included).

By David Schollaert, david@steelmarketupdate.com