Market Data

May 26, 2023

Global Steel Production Falls Back After Hitting 10-Month High

Written by Laura Miller

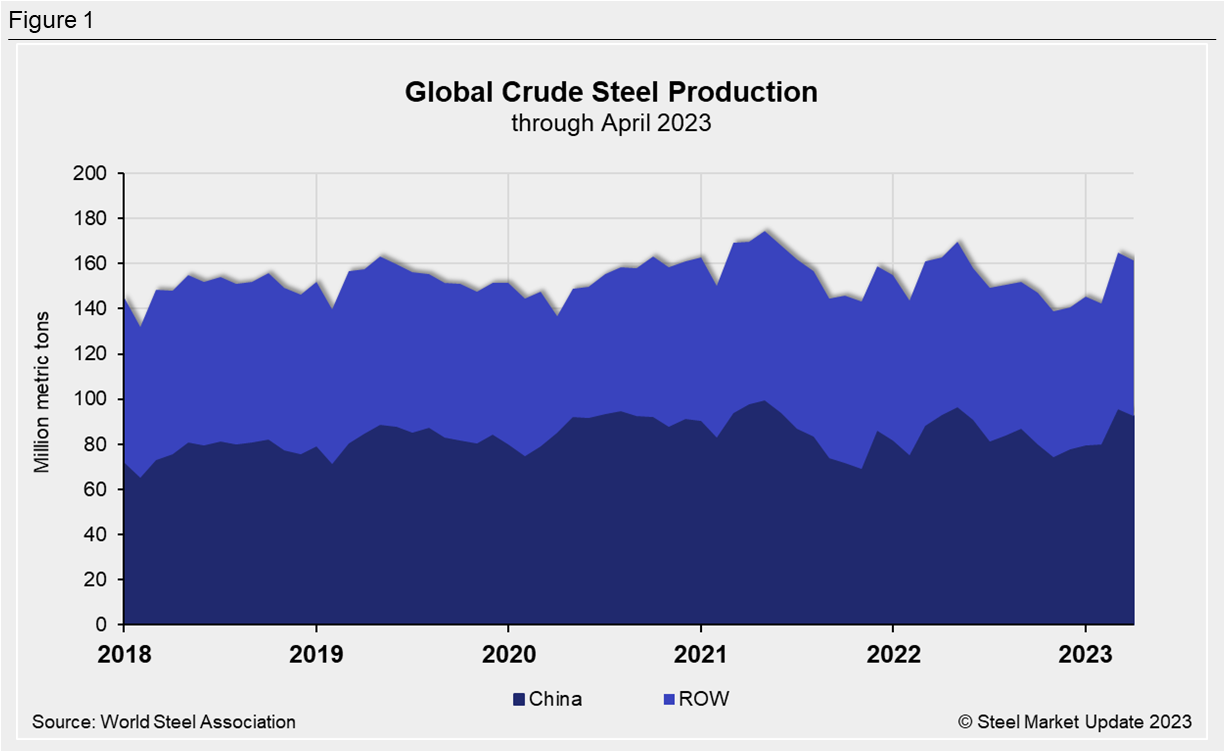

After hitting a 10-month high in March, global crude steel production fell back in April as output declined in both China and the rest of the world (RoW). Production was down 2.4% from the same month last year, according to the latest data from the World Steel Association (worldsteel) analyzed by SMU.

Global steel output was an estimated 161.4 million metric tons (177.9 million net tons), worldsteel said, down 2.2% from March’s 165.1 million metric tons.

Chinese steel production, at 92.6 million metric tons, accounted for 57.4% of the global total. Output in the RoW was 68.8 million metric tons, down 0.9% from the month prior.

April’s global total was down by 7.5%, or 13 million metric tons, than May 2021’s all-time high of 174.4 million metric tons.

Shown below in Figure 2 is the annualized monthly global steel production on a three-month moving average (3MMA) basis, as well as capacity utilization since January 2018. Also shown is the year-on-year (YoY) growth rate of global production on the same 3MMA basis. Both are based on worldsteel data.

Mill capacity utilization in April on a 3MMA basis was 76.2%, a rise of 2.6 percentage points from March.

On a tons-per-day basis, April’s 3MMA was 5.264 million metric tons, a rise of 4.6% from the month prior. That figure is off by 549,000 metric tons from May 2021’s record rate of 5.813 million metric tons per day. YoY growth in production on a 3MMA basis in April was up 0.3% from March’s rate. This was the first positive increase since November.

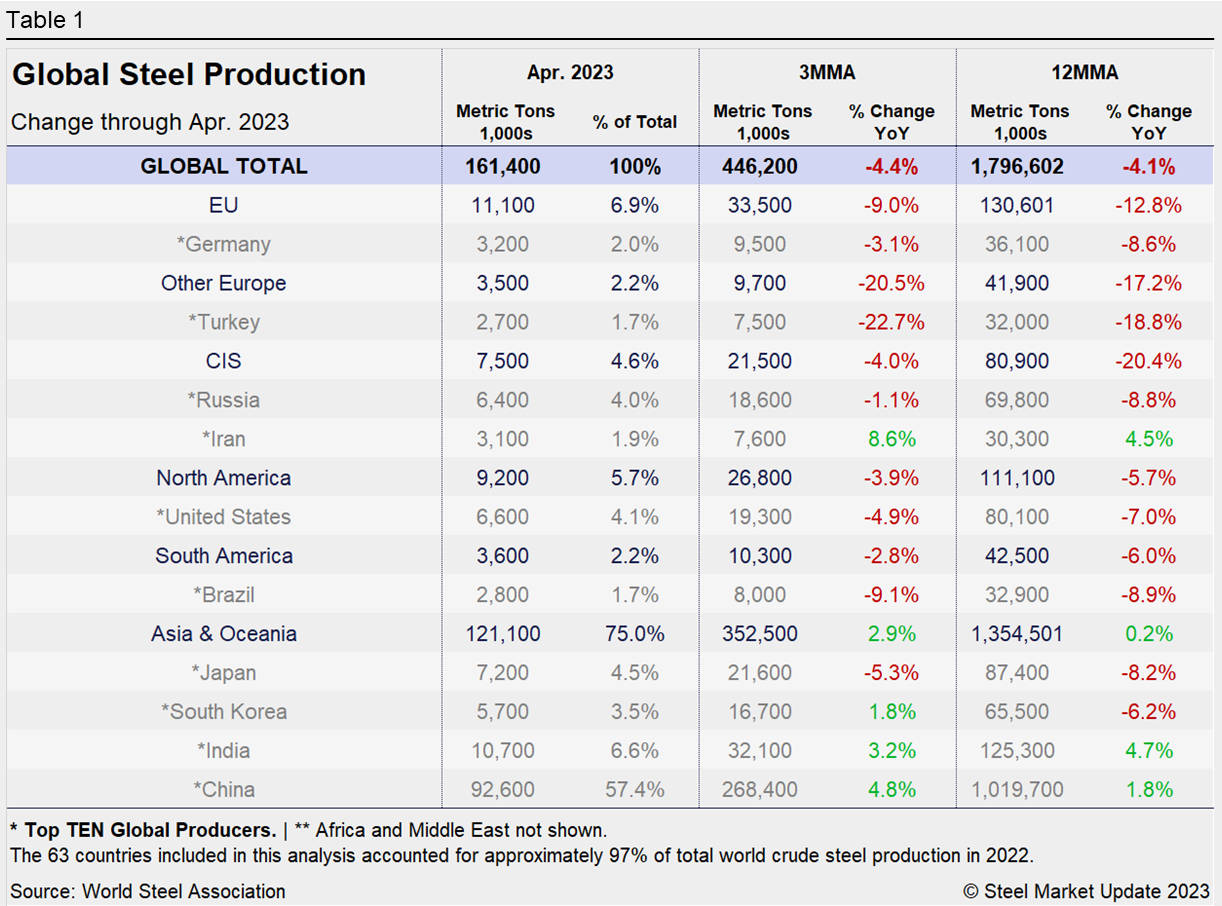

Table 1 below shows global production by region and highlights the top 10 steel-producing nations. YoY growth rates are mixed, with just China, India, and Iran showing YoY growth on both a 3MMA and a 12MMA basis.

North American production is down on a YoY basis, even more so in the 12 months through April.

The US remained the number four top-producing steel nation in April. With 6.6 million metric tons of output, production was down 5.3% from the same month in 2022. Year-to-date production of 26.1 million metric tons was off 4.1% from last year.

China’s Crude Steel Production

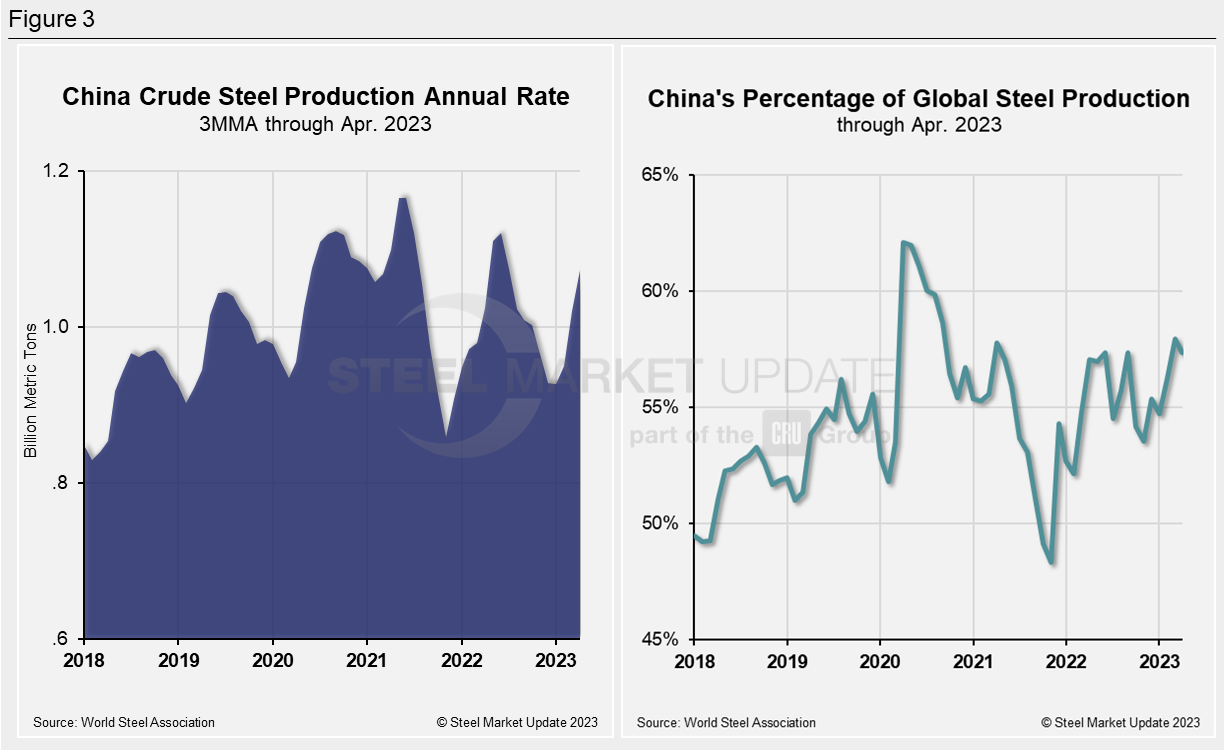

China’s monthly steel production was estimated at 92.6 million metric tons in April. This was 3.2% lower than March but still the second-highest month so far this year. Last month’s total was just 6.9 million metric tons below China’s all-time monthly high crude steel output of 99.5 million metric tons in May 2021.

China’s annualized production, on a 3MMA, was at a nine-month high at 1.074 billion metric tons in April (see Figure 3). That figure is 4.8% higher year-on-year.

Chinese production accounted for 57.4% of the global total in April, down from March’s recent high of 58.0% (see Figure 3). China’s production in March was the highest percentage of the global total since late 2020.

The fluctuations in China’s steel production since January 2018 vs. the growth of global steel excluding China, both on a 3MMA basis, are shown side-by-side in Figure 4.

China’s 3MMA annual growth rate was 4.8% in April – a five-month high.

YoY growth in the RoW’s production peaked at 38.0% in April 2021 and then trended downward, falling into the negative in March 2022 and has since remained negative. April’s YoY growth rate, at -1.6%, was the highest since March 2022.

By Laura Miller, laura@steelmarketupdate.com