Market Data

May 25, 2023

Mills Willing to Negotiate Lower Sheet Prices Across the Board

Steel buyers across all products surveyed by SMU this week are finding mills more willing to negotiate lower spot pricing vs. two weeks ago.

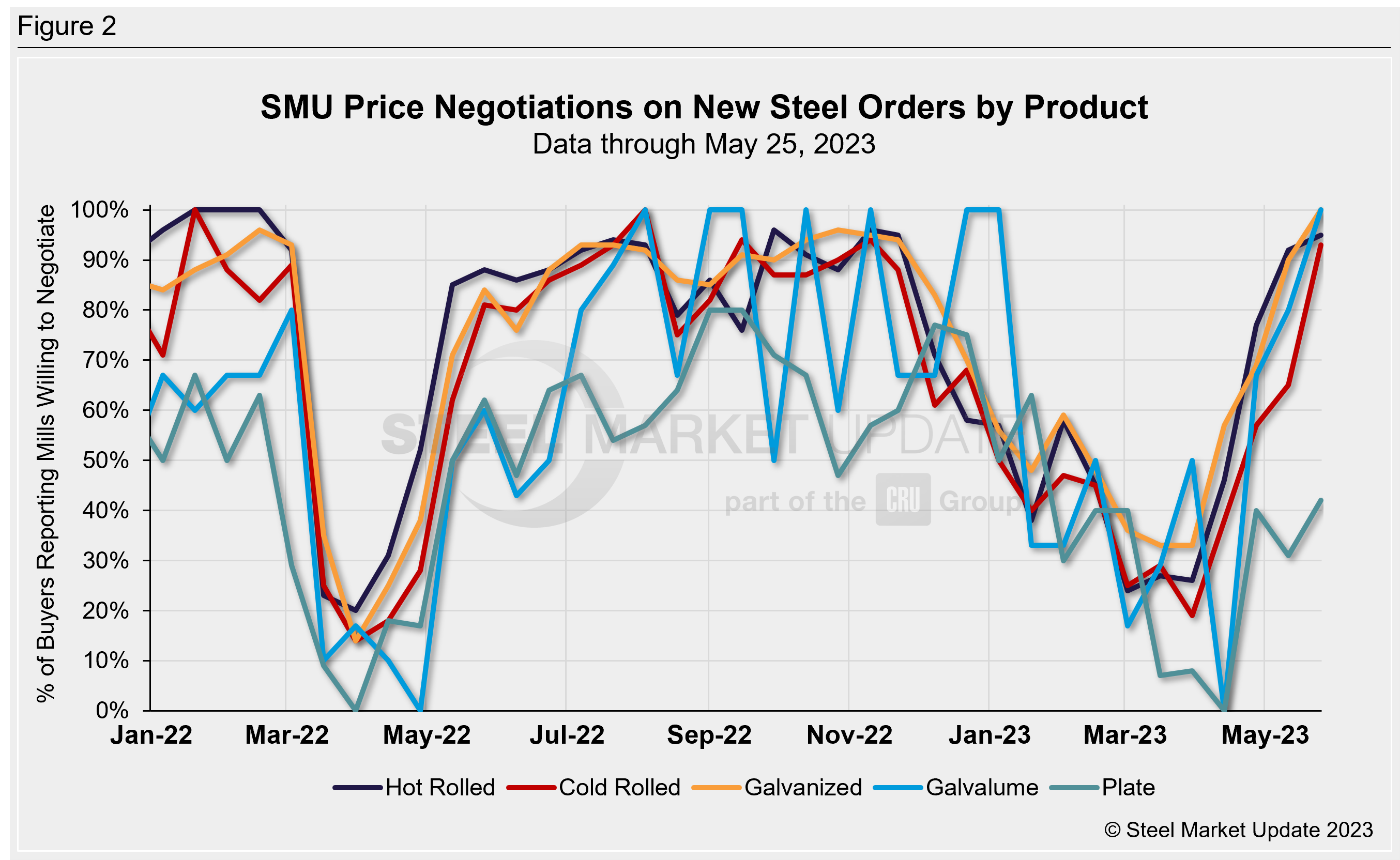

Galvanized saw the percentage of buyers saying mills were willing to talk price climb to 100% this week, up from 90% at the previous market check, while cold rolled rose 28 percentage points to 93% in the same comparison.

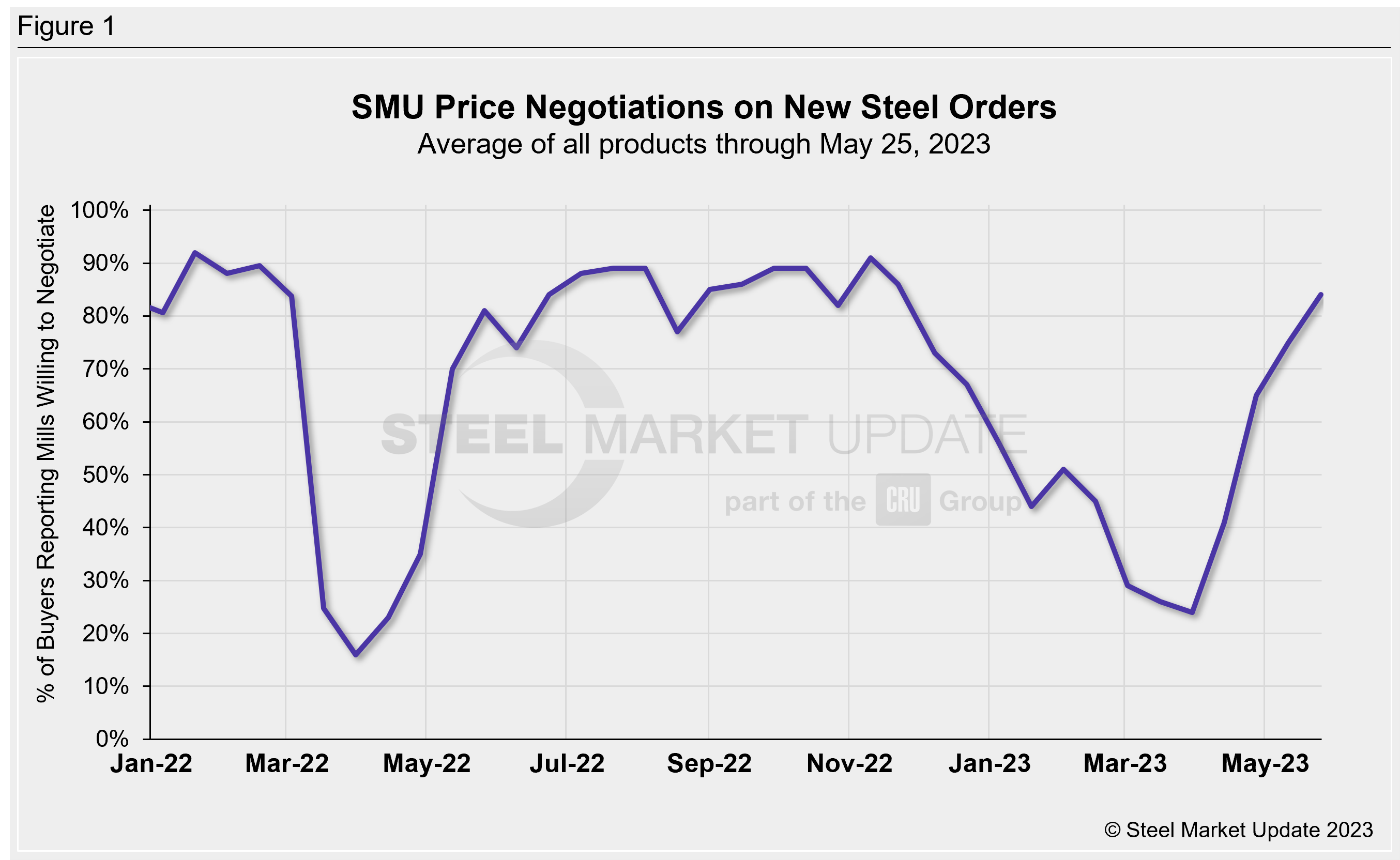

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. This week, 84% of steel buyers (Figure 1) across both sheet and plate markets reported mills were willing to negotiate cheaper tags on new orders, rising nine percentage points from 75% two weeks ago. The percentage has been rising consecutively since it stood at 24% at the end of March, which is the lowest reported figure so far this year.

Figure 2 below shows negotiation rates by product. Hot rolled increased three percentage points to 95% of buyers reporting mills more willing to negotiate lower prices vs. two weeks earlier; plate at 42% (+11); and Galvalume at 100% (+20). Recall that Galvalume can be more volatile because we have fewer survey participants there.

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Ethan Bernard, ethan@steelmarketupdate.com