Analysis

May 23, 2023

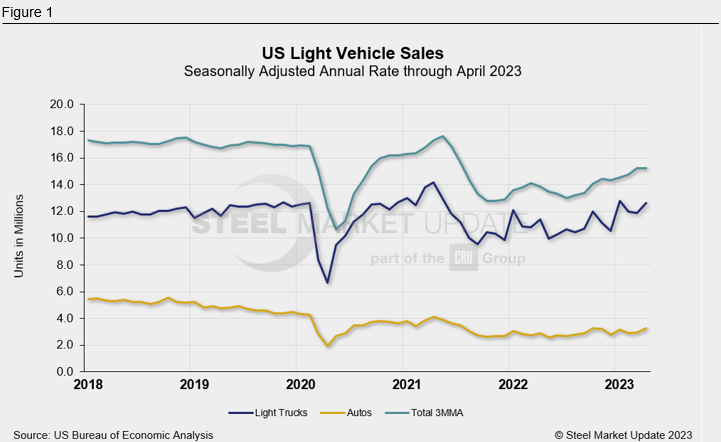

Light-Vehicle Sales Show Strength in April

Written by Laura Miller

April was a strong month for sales of light vehicles in the US, with monthly sales pushing the seasonally adjusted annual rate to 15.9 million, according to figures from the Bureau of Economy Analysis (BEA).

Light-vehicle sales totaled 1.347 million units in April, according to the BEA. This was a 1.5% decline from the month prior but a 9.0% rise from April 2022.

The year-on-year gain was “all the more impressive by the fact that April 2023 had one fewer selling day than April 2022,” LMC Automotive said in a news release commenting on preliminary April estimates.

The April SAAR for auto sales was 3.28 million – the highest rate seen since July 2021. The light-trucks SAAR of 12.634 million was just slightly behind January’s rate of 12.796 million.

LMC noted that “the market appears to be finally moving beyond supply chain woes.” With customers waiting longer to purchase vehicles, OEMs are learning the benefits of tighter inventories, the forecasting agency said.

“In some ways the market is returning to something approaching normal,” LMC added.

By Laura Miller, laura@steelmarketupdate.com