Market Segment

May 4, 2023

ArcelorMittal’s Q1 Earnings Lifted by Strength in North America

Written by Laura Miller

The most recent cycle of destocking has ended, ArcelorMittal said, with first-quarter sales and shipments rising notably from the prior quarter, boosted by strength in the North American region. Those figures remain lower, however, compared to highs seen in the year-ago quarter.

The Luxembourg-based global steelmaking giant posted Q1 net income of $1.096 billion, a substantial increase from Q4’22 net income of $261 million, but down from $4.125 billion in Q1’22. Sales of $18.5 billion were up 9.5% sequentially but down 15% year over year (YoY).

![]()

Global steel shipments of 14.5 million metric tons were 9.8% higher sequentially but down 5% on-year. The YoY decrease in shipments is due to lower shipments in the ACIS region (-27.5% due to ongoing effects from the war in Ukraine), Europe (-7.0%), and Brazil (-3.3%). This was partially offset by a 15.8% rise in North American shipments.

“Market conditions improved as anticipated in the first quarter, with the end of customer destocking supporting apparent steel consumption growth and a rebound in steel spreads. This, alongside better general economic sentiment, resulted in good growth in first quarter profits as well as higher Ebitda per ton,” said ArcelorMittal CEO Aditya Mittal in the company’s Q1 earnings report.

“The improvements we have seen in market conditions are not yet fully reflected in our results due to pricing lags, and we expect a further increase in profitability in the second quarter,” he noted.

“Geopolitical and economic uncertainty remains, but ArcelorMittal continues to demonstrate its ability to perform in all market conditions which bodes well for the remainder of this year,” he said.

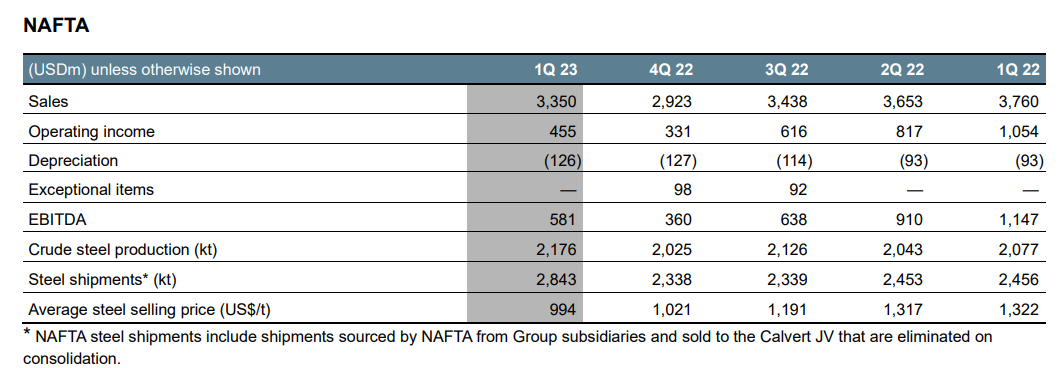

North America Results

Q1 steel shipments of 2.843 million metric tons in the North America region were higher by 22% sequentially and 16% YoY, while average selling prices decreased 3% sequentially and 25% YoY. This resulted in overall NAFTA sales of $3.35 billion being up 15% from Q4’22 but down 11% from Q1’22.

ArcelorMittal’s North American assets include the sheetmaking operations of ArcelorMittal Dofasco in Canada, ArcelorMittal Mexico, and AM/NS Calvert in Alabama. It also has long product, mining, tubular, and tailored blank operations.

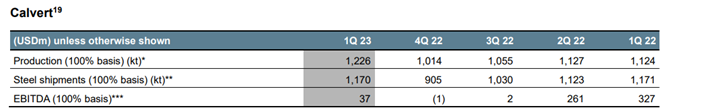

AM/NS Calvert Sheet Mill

Improving demand helped the AM/NS Calvert operation increase production both sequentially and YoY, with shipments of 1.17 million metric tons 29% higher than the prior quarter but comparable to Q1’22. The mill’s Q1 Ebitda of $37 million was an improvement over the Q4’22 loss of $1 million on higher shipments and lower slab inventory cost, the company said.

Production on the Calvert hot strip mill (HSM) reached 1.226 million metric tons in Q1. Annualized, shipments would be 4.9 million metric tons, which would be a 14% rise over 2022 production of 4.3 million metric tons.

Construction of Calvert’s 1.5-million-metric-ton-per-year (tpy) EAF and caster continues to progress, as does reliability and productivity on the new hot-strip mill. The company has increased the project’s capex budget to $1 billion “due to enlarged scope and inflation,” with the “option to add further capacity at lower capex intensity” remaining.

The company is considering a second, 1.5-million-tpy EAF.

On the Q1 earnings call with analysts on Thursday, May 4, ArcelorMittal executives explained the enlarged capex scope, saying: “This is a project that is being designed for 3 million [metric] tons. And as we go ahead and execute the first phase, it makes sense for us to prepare parts of the second phase.”

Mexico Hot Strip Mill

ArcelorMittal Mexico’s new 2.5-million-tpy HSM in Mexico ran at about 60% of utilization in Q1. Some maintenance is expected in the current quarter before the mill ramps up again in the second half of the year, with execs on the earnings call saying they hope to get that figure above 70%.

Texas HBI

The Q1 utilization rate of the company’s Texas HBI plant was above 90% of its nameplate capacity of 2 million tpy. Quarterly production was 500,000 metric tons, with Q1 profitability within company expectations and Q2 profitability expected to be higher. Last year, ArcelorMittal acquired an 80% share of the HBI plant built by voestalpine.

Europe Update

Executives on the earnings call gave June as the date for the restart of the two blast furnaces in Spain and France that have been down since March.

“We are working relentlessly to mitigate the impacts of the two incidents,” an executive said on the call, noting that they have been bringing slabs in from Brazil and India to keep production up.

By Laura Miller, laura@steelmarketupdate.com