Market Segment

April 27, 2023

Majority of Steel Buyers Find Mills More Willing to Negotiate Prices

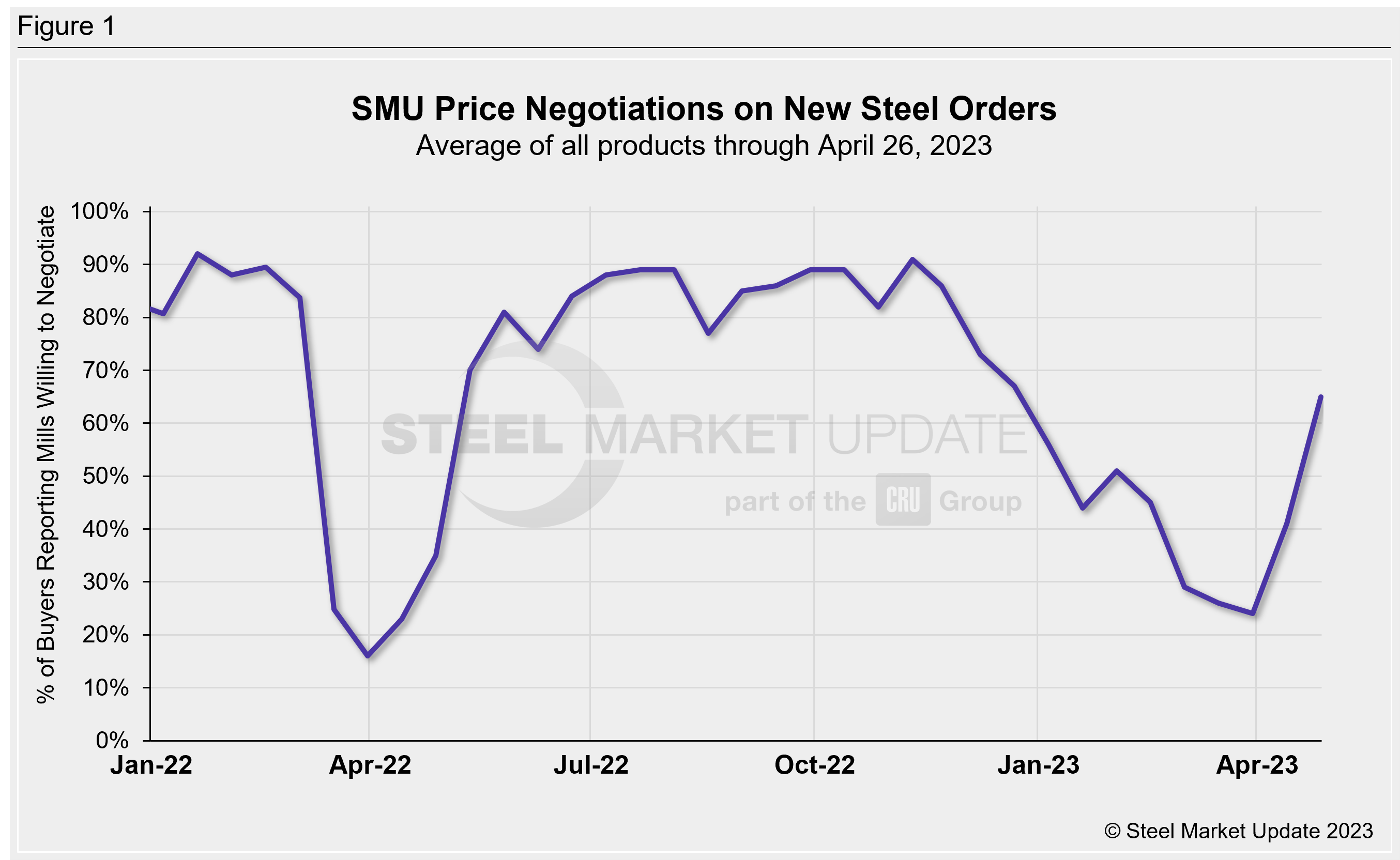

The percentage of steel buyers saying mills are willing to negotiate spot pricing jumped above 60% for the first time since late December, according to SMU data.

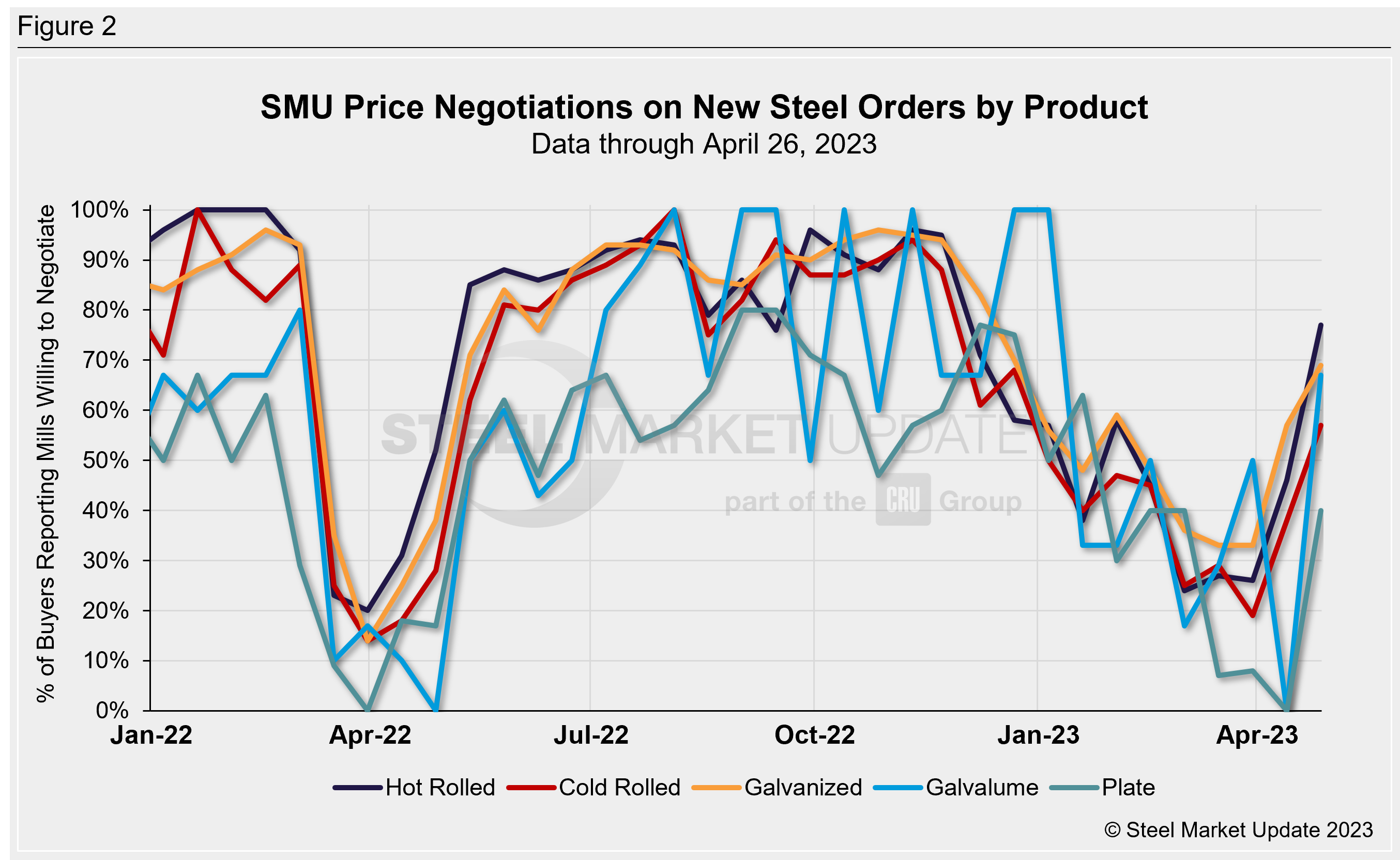

All the products SMU surveys showed substantial gains this week, with plate climbing to 40% of buyers saying mills were willing to talk price vs. 0% two weeks ago.

Every two weeks, SMU asks steel buyers whether domestic mills are willing to negotiate lower spot pricing on new orders. This week, 65% of steel buyers (Figure 1) across both sheet and plate markets reported that mills were willing to negotiate lower prices on new orders, up 24 percentage points from 41% two weeks ago. We need to go back to the beginning of February for the last time a majority of steel buyers found mills willing to negotiate tags, and back to the Christmas holiday for that percentage to top 60%.

Figure 2 below shows negotiation rates by product. All the products were up over 10 percentage points, with hot-rolled products up 31 percentage points from two weeks ago to 77% of buyers saying mills were willing to negotiate prices; cold rolled at 57% (+19); galvanized at 69% (+12); and Galvalume at 67% (+67). Recall that the Galvalume market is more volatile as there are fewer participants.

Note: SMU surveys active steel buyers every other week to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Ethan Bernard, ethan@steelmarketupdate.com