Analysis

April 4, 2023

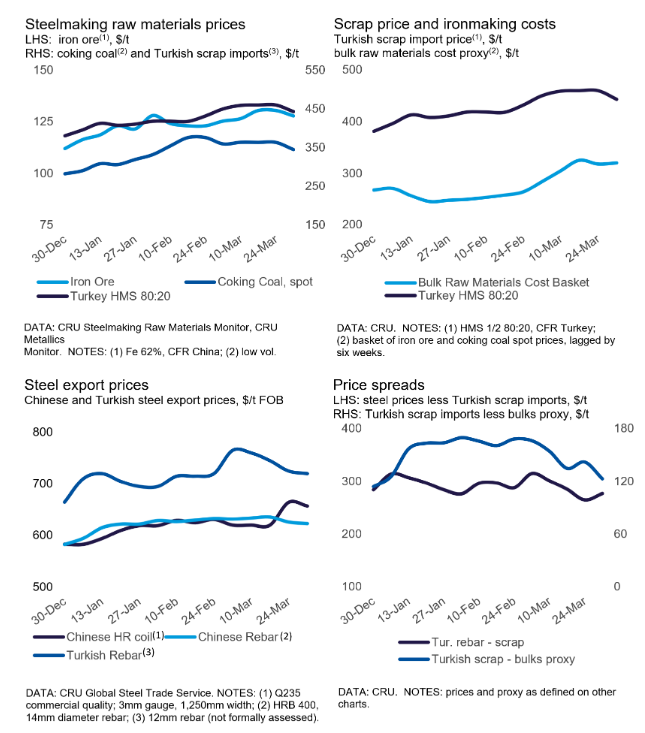

CRU: Turkish Scrap Import Prices Drop at the End of March

Written by Rosy Finlayson

Turkish scrap import prices fell in the last week of March as buying activity remained low and domestic supply improved, according to analysis from the CRU Group.

CRU’s assessed Turkish scrap price for HMS1/2 80:20 is $443 per metric ton CFR, down by $17 week-on-week (WoW) and $7 month-on-month (MoM).

Turkish buyers are taking a cautious approach as construction activity is slower than expected and market uncertainty has persisted due to the upcoming general election. At the same time, the domestic scrap supply has increased because of collection of material following the demolition of earthquake-affected infrastructure in southeast Turkey. Moreover, improvement in scrap supply is usual for this time of year as warmer weather conditions are more conducive for scrap collection.

In the Turkish finished steel market, the rebar export price has decreased to $720 per metric ton FOB (down by $45 MoM and $5 WoW), while the HR coil export price remains unchanged at $830 per metric ton FOB (up by $30 MoM). This is largely in response to sluggish demand amid reducing production costs, following the government announcement of 15% and 20% cuts to electricity and natural gas prices, respectively, starting April 1.

In the Asian scrap market, demand has remained lackluster with no fresh deals concluded last week. Japanese bulk scrap offers are ~$440-445 per metric ton CFR (unchanged WoW) and offers from Hong Kong for HMS1/2 50:50 are priced at ~$420 per metric ton CFR.

By Rosy Finlayson, CRU Research Analyst

This article was originally published on April 3 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com