CRU

March 28, 2023

CRU: Turkish Scrap Import Prices Unchanged

Written by Rosy Finlayson

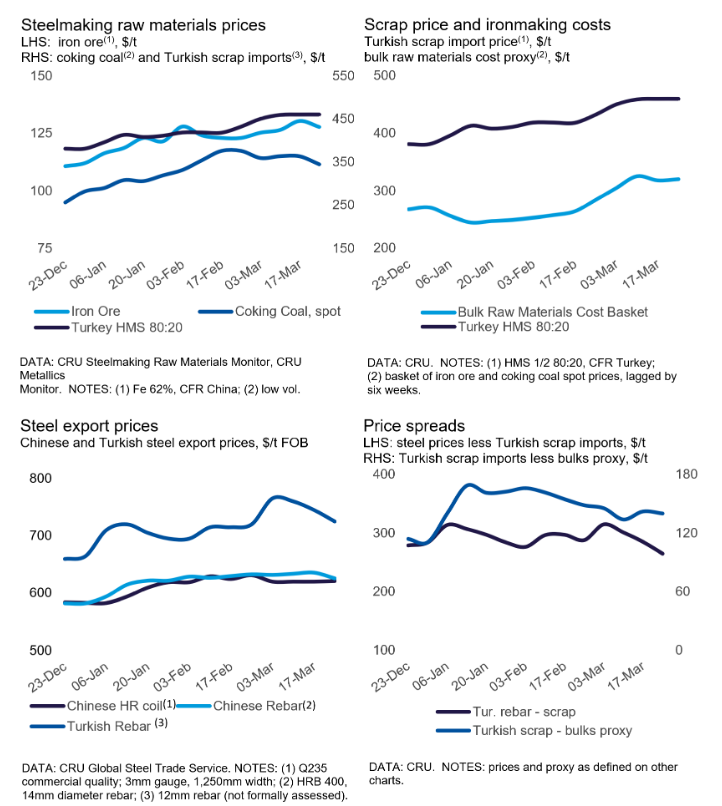

CRU has rolled-over its Turkish scrap price due to low market activity. Trading has slowed over the past two weeks as buyers are unwilling to accept current price levels in anticipation of a downward correction.

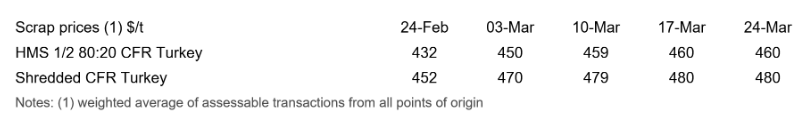

Thus, the CRU-assessed Turkish scrap price for HMS1/2 80:20 remains unchanged week-on-week (WoW) at $460 per metric ton CFR.

Similar to developments in the scrap market, buyer reluctance in the Turkish finished steel market has led to price falls. The Turkish rebar export price is now at $725 per metric ton FOB (down $20 WoW) and the Turkish HR coil export price is now at $830 per metric ton FOB (down $30 WoW). Scrap prices are bound to fall off current levels if a downtrend continues for finished steel prices in the coming weeks.

Meanwhile, in the Asian scrap market, no fresh deals were heard last week. This is despite Japanese bulk offers to Vietnam dropping by $15-20 WoW to $445 per metric ton CFR.

By Rosy Finlayson, CRU Research Analyst

This article was originally published on March 27 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com