Market Data

March 24, 2023

CMC Earnings Hit By Weather Woes, Planned Outage

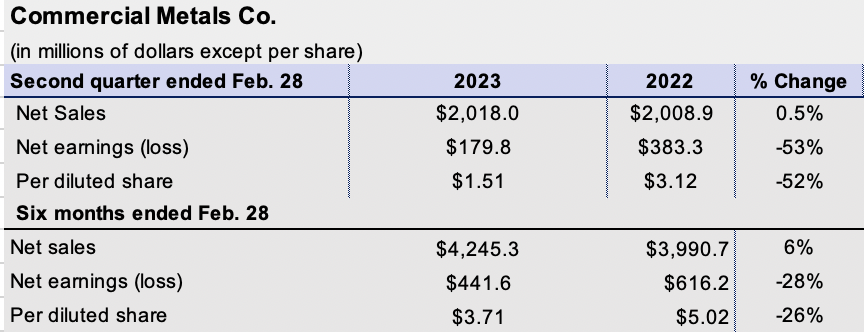

Commercial Metals Co.’s (CMC’s) net earnings slipped 53% in its fiscal 2023 second quarter compared with the same period a year earlier on weather issues and a planned outage.

“CMC achieved strong financial results during the second quarter while managing a number of challenges, including weather-related shipment disruptions in our core geographies, costs associated with a major planned outage and steel product metal margin pressures,” Barbara R. Smith, CMC chairman, president, and CEO, said in a statement.

“CMC achieved strong financial results during the second quarter while managing a number of challenges, including weather-related shipment disruptions in our core geographies, costs associated with a major planned outage and steel product metal margin pressures,” Barbara R. Smith, CMC chairman, president, and CEO, said in a statement.

The Irving, Texas-based long products steelmaker and recycler posted net earnings of $179.8 million in its Q2 vs. $383.3 million a year earlier on net sales that ticked up 0.5% to $2 billion.

The company said the average selling price for steel products dropped by $56 per ton in its North America segment vs. Q2 2022, while the cost of scrap used fell $90 per ton. This resulted in a year-over-year increase of $34 per ton in steel product margins over scrap.

The North America segment shipped 661,000 tons of steel products in Q2, slightly higher than 652,000 tons a year earlier.

Smith said CMC is entering spring with “record backlog value” for this time of year, and continues “to experience healthy project bid volumes, giving us confidence in the strength of our book of business.”

She added that the company stands to benefit from strong demand from reshoring-oriented industrial projects and public infrastructure work, “the more rebar-intensive nature of which represents a long-term tailwind for our business.”

Smith was particularly bullish on Infrastructure Investment and Jobs Act signed into law in late 2021. The program will “substantially” increase the amount of federal funding available to states and local governments to support highway construction.

“At the average run rate over the five-year program, we estimate that federal funding will increase by 65% compared to the FAST Act and create 1.5 million tons of incremental rebar demand,” she said in a Q2 earnings conference call.

She continued that that there are signs this work is “moving through the pipeline,” and should show up in bid markets during calendar 2023.

Looking into the near term, Smith emphasized the opening of the Arizona 2 micro-mill later in the spring.

She said CMC will begin cold commissioning both the melt shop and rolling mill shortly before moving into the hot commissioning phase.

“We expect to begin producing rebar for sale during our fourth fiscal quarter,” she added.

As for steel prices, Smith said CMC anticipates that “recent North America long steel price increase announcements will stabilize metal margins at historically high levels.”

However, Smith noted the company’s Q3 will be affected by a scheduled upgrade project similar in magnitude to the planned outage in Q2.

By Ethan Bernard, ethan@steelmarketupdate.com