Analysis

March 24, 2023

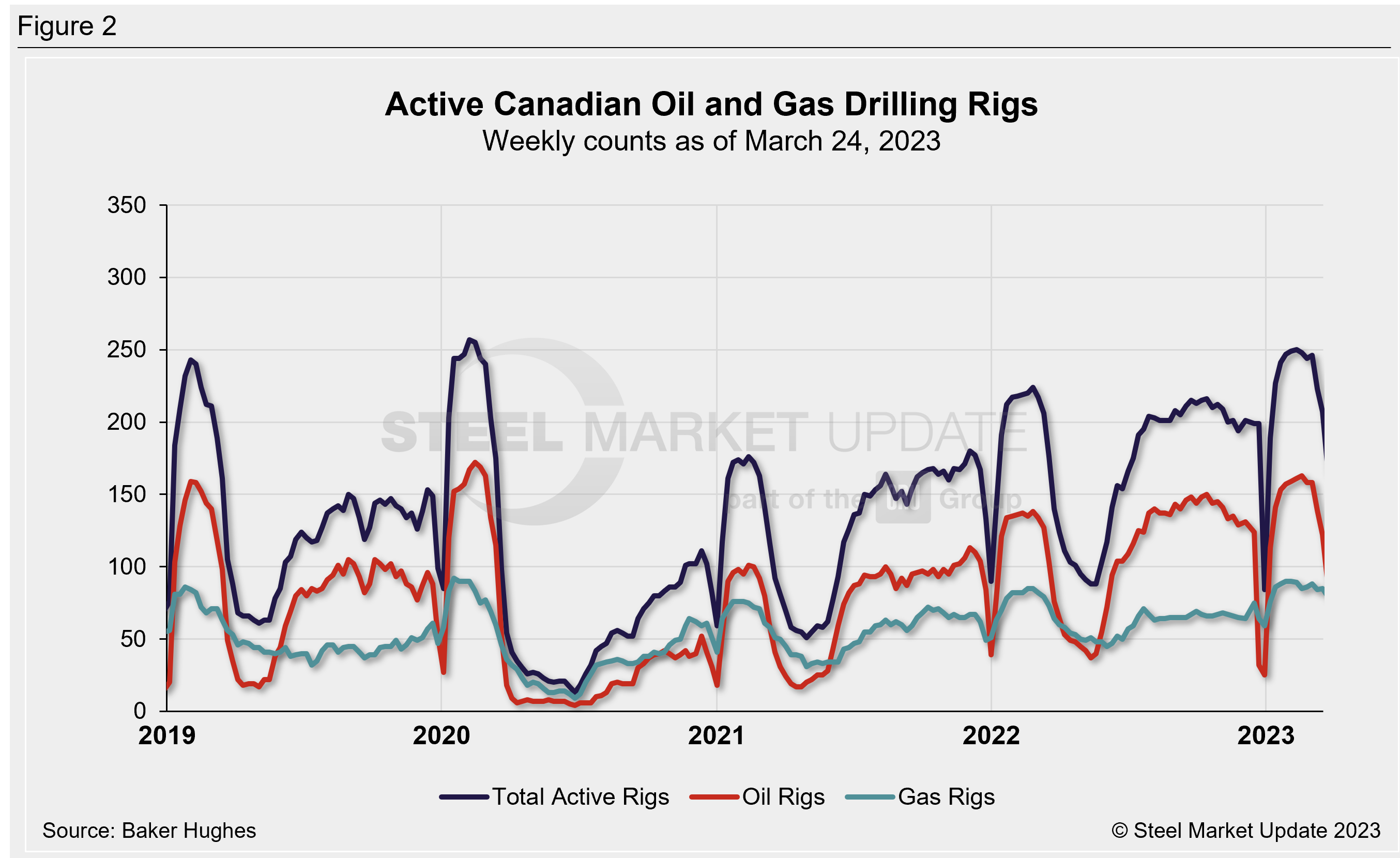

Canadian Rig Count Falls, US Increases

Written by Becca Moczygemba

Rig counts dropped in Canada but increased again in the US this week, according to data from oilfield services company Baker Hughes.

The total US rig count was 758 for the week ended March 24, up four rigs from the week prior. The number of active oil rigs in the US increased to 593 from the prior week’s 589. The number of gas rigs stayed the same at 162. Compared to this time last year, the US count is up 88 rigs, with oil rigs up 62, gas rigs up 25, and miscellaneous rigs up one, respectively.

The number of active Canadian rigs fell by 42 to 165 this week from the prior week. Oil rigs in Canada dropped to 86 from 122, while gas rigs dropped by six to 79 in the same comparison. The Canadian count is up 25 rigs compared to last year, with oil rigs accounting for most of those gains.

The international rig count increased by 14 to 915 rigs for the month of February vs. the prior month and is up 28 rigs from the same month last year.

The number of oil and gas rigs in operation is important to the steel industry because it is a leading indicator of demand for oil country tubular goods (OCTG), a key end-market for steel sheet.

Steel Market Update also publishes an in-depth “Energy Update” report covering oil and natural gas prices, detailed rig count data, and oil stock levels. That is available here for Premium members.

For a history of both the US and Canadian rig count, visit the Rig Count page on the Steel Market Update website here.

A rotary rig is one that rotates the drill pipe from the surface to either drill a new well or to sidetrack an existing one. Wells are drilled to explore for, develop, and produce oil or natural gas. The Baker Hughes Rotary Rig count includes only those rigs that are significant consumers of oilfield services and supplies.

By Becca Moczygemba, becca@steelmarketupdate.com