Market Segment

March 22, 2023

North American Auto Assemblies Up Again in February

Written by David Schollaert

North American auto assemblies rose 1.3%% in February, expanding for a second straight month after declining repeatedly to close out 2022. Last month’s assemblies are 8.4% higher year-on-year (YoY), according to LMC Automotive data.

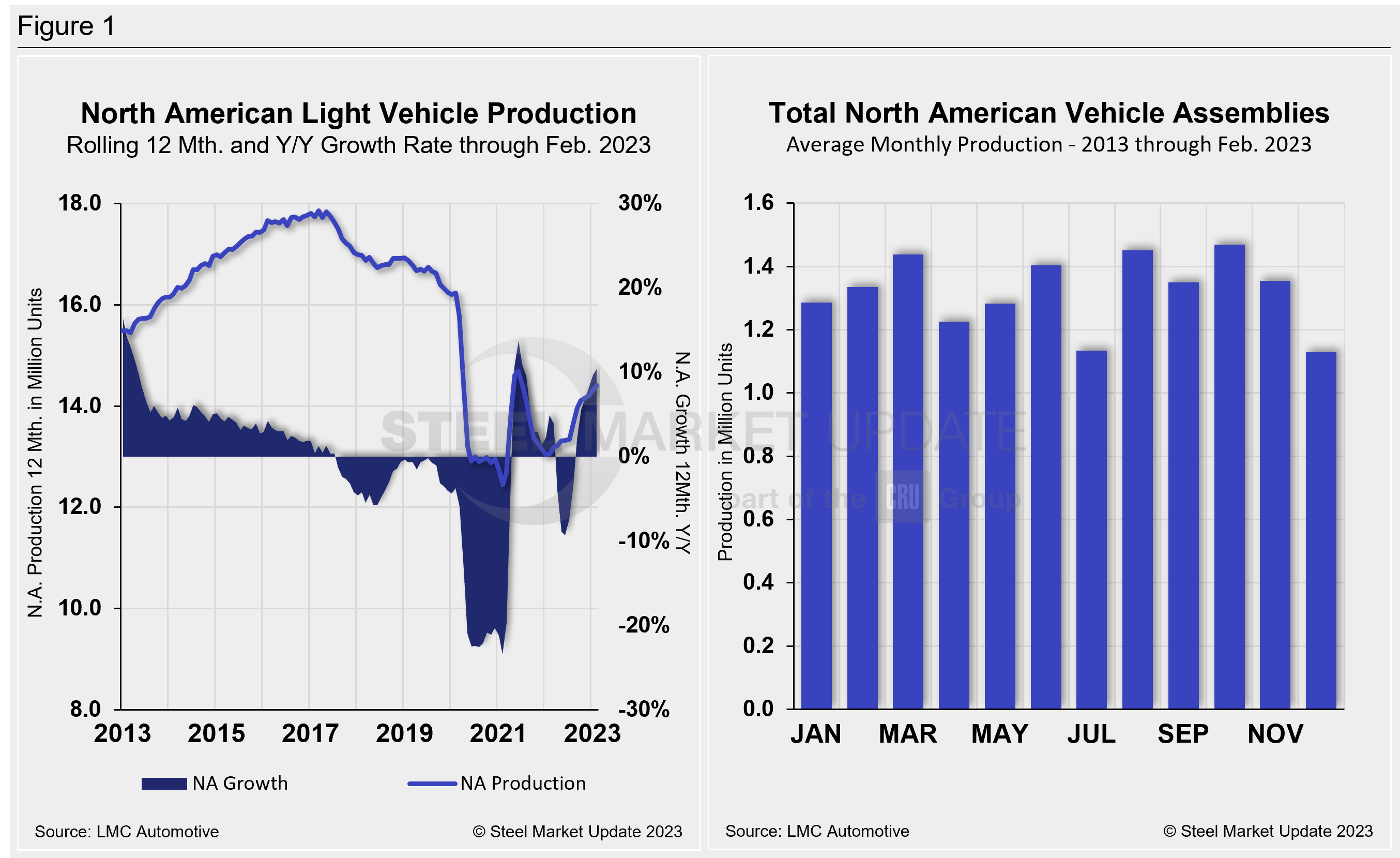

Despite the repeated increases through February, production hasn’t topped the 1.2-million-unit mark since November. And while inventories have improved, the market remains supply-constrained, working itself out of the deficit levied by parts and supply shortages.

On the supply side, the inventory picture continues to improve, and new supply is expected to continue growing this year. The gradual shift comes as easing supply constraints alleviate production bottlenecks.

The impact of the global semiconductor crisis on the North American automotive market was extensive, at times crippling. The onset of the pandemic certainly slowed auto assemblies, but the chip shortage levied debilitating blows.

Though at times slow, the recovery has been notable, especially since the second half of 2022. However, the production slowdown throughout the fourth quarter of 2022 emphasizes there is still ground to be made up. When compared to the last “normal” year in 2019, production is still 13.9% behind.

North American vehicle production, including personal and commercial vehicles, totaled 1.19 million units in February, up from 1.16 million units in January, and similarly ahead of the 1.10 million produced one year ago.

Below in Figure 1 is North American light-vehicle production since 2013 on a rolling 12-month basis with a YoY growth rate. Also included is the average monthly production, which includes seasonality since 2013.

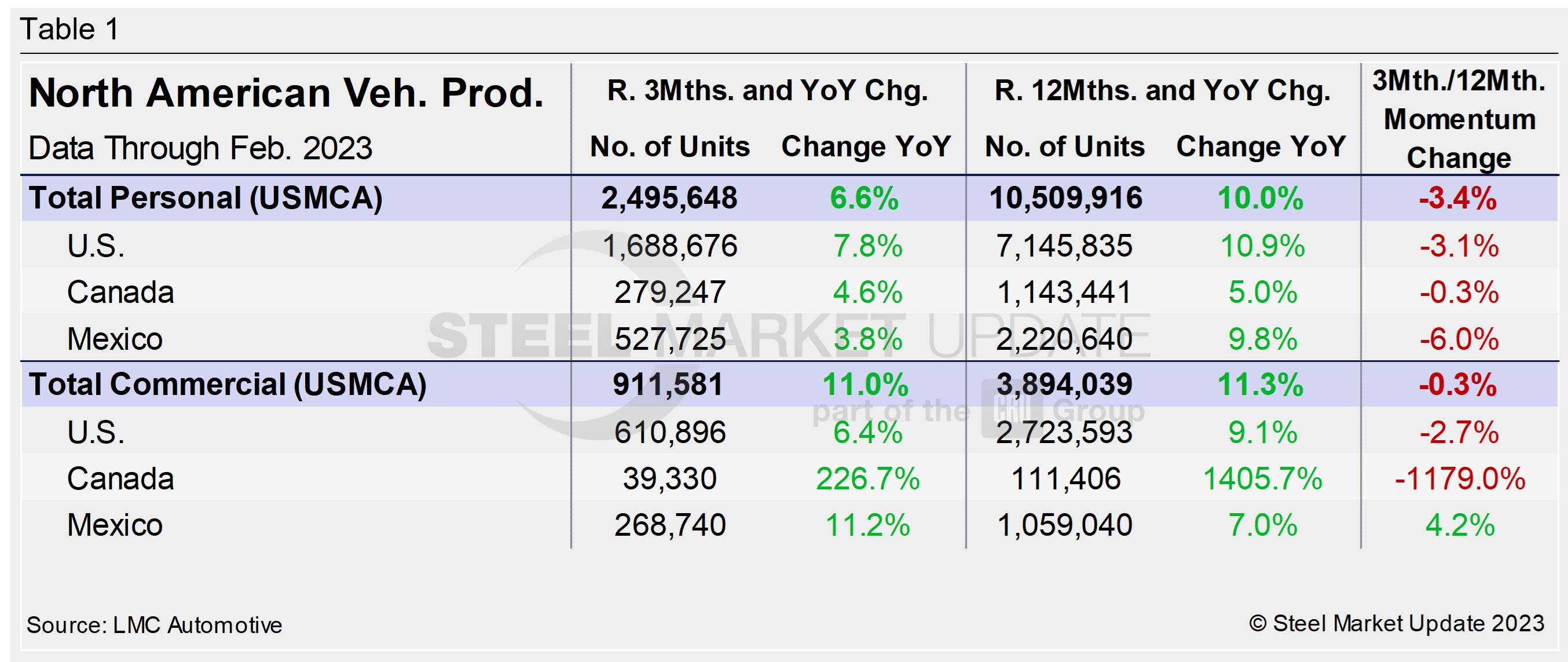

A short-term snapshot of assembly by nation and vehicle type is shown in the table below. It breaks down total North American personal and commercial vehicle production into US, Canadian, and Mexican components. It also includes the three- and 12-month growth rates for each and their momentum change.

The initial recovery from Covid’s early spread was significant, but the effect of the chip and parts shortage has been more extensive and prolonged. Through last September, growth rates for personal and commercial light vehicles were -25.8% and -8.4%, respectively. They have since recovered nicely, with both posting steady gains.

For the three months through February, the growth rate for total personal and commercial vehicle assemblies in the USMCA region is up, but behind the 12-month basis totals. Noticeable is the momentum change posting a negative for the fourth straight month.

Personal Vehicle Production

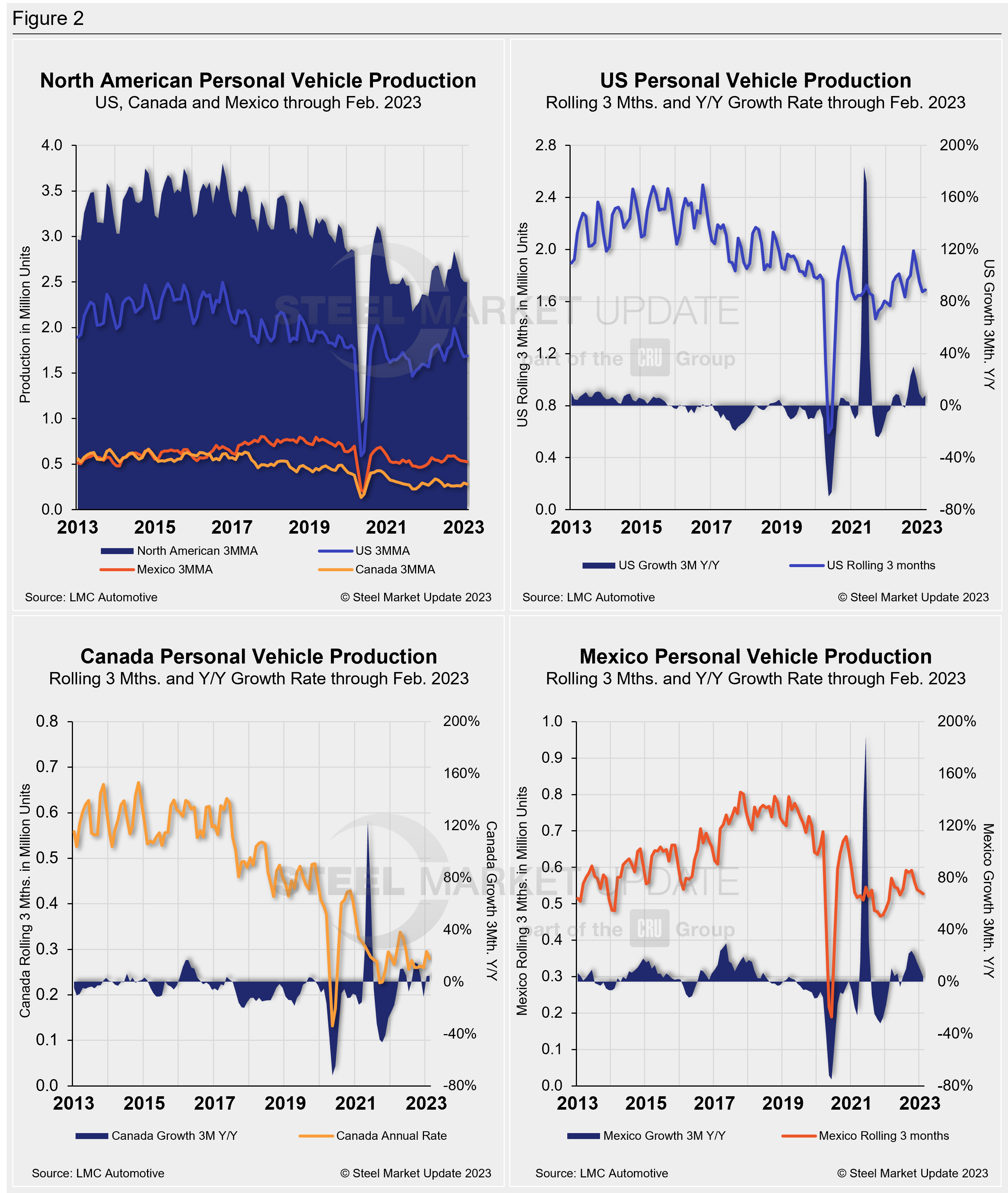

The longer-term picture of personal vehicle production across North America is shown below. The charts in Figure 2 show the total personal vehicle production for North America and the total for the US, Canada, and Mexico. Personal vehicle production in these three countries and their YoY growth rates are also displayed.

In terms of personal vehicle production, the region saw a month-over-month (MoM) increase in February, albeit a marginal one at 0.7%.

The US saw the largest increase in units produced in February vs. January, up just 10,974 units (+1.9%). It was followed by Mexico, up 7,891 units (+4.4%), while Canada produced 12,910 fewer units (-12.4%) MoM.

The positive gains last month for the region were impacted by the decline in Canada and marginal gains in the US and Mexico. The gain still pushed the annual growth rate to 6.6%, up 0.4 percentage points MoM.

Production share across the region was largely unchanged. The US saw its personal vehicle production share of the North American market edge up by 0.7 percentage points to 67.7%. Mexico was down 0.2 percentage points to a regional market share of 21.1%, and Canada was down 0.6 percentage points to 11.2%.

Commercial Vehicle Production

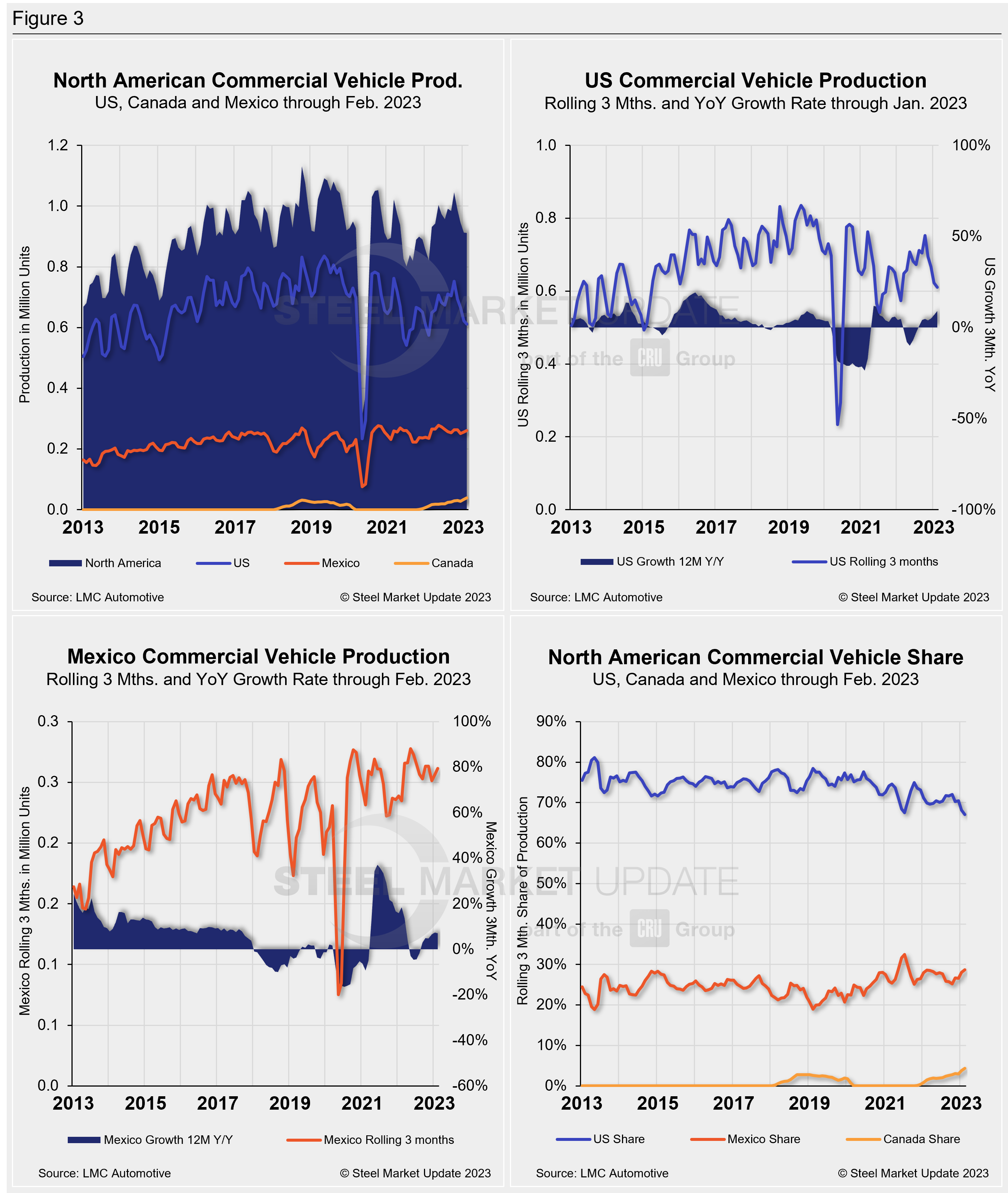

Total commercial vehicle production for North America and the total for each nation within the region are shown in the first chart in Figure 3 on a rolling three-month basis. Commercial vehicle production in the US and Mexico and their YoY growth rates, as well as the production share for each nation in North America, are also shown.

Of note for the Canadian automotive sector: February marked the 16th month since Canada resumed commercial vehicle production after a 20-month production halt. Canada produced 15,695 light commercial vehicles in February, a 2.3% increase from January, and the highest total since August 2018.

North American commercial vehicle production was up 2.8% in February with a total of 318,092 units produced during the month, an increase of 8,810 units MoM. The gain was impacted by a lack of growth in Mexico last month. The US saw a 4.2% increase in commercial vehicle production in February, to complement Canada’s increase. US assemblies were up 8,463 units to a total of 208,152 units for the month.

The overall increase put the commercial production growth rate at 9.1% for the region last month, up from 6.8% in January.

The market share across the region shifted slightly. The US held more than two-thirds of the market, with a total share of 67%, down 1.2 percentage points, followed by Mexico with a 28.7% share, and Canada with at 4.3% share in February.

Presently, Mexico exports just under 80% of its light-vehicle production, with the US and Canada the highest-volume destinations.

Editor’s Note: This report is based on data from LMC Automotive for automotive assemblies in the US, Canada, and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 metric tons gross vehicle weight rating; heavy trucks and buses are not included).

By David Schollaert, david@steelmarketupdate.com