Prices

February 15, 2023

Service Center Shipments and Inventories Report for January

Written by Estelle Tran

Editor’s note: Steel Market Update is pleased to share this Premium content with Executive members. For information on how to upgrade to a Premium-level subscription, contact Lindsey Fox at lindsey@steelmarketupdate.com

Flat Rolled = 52.9 Shipping Days of Supply

Plate = 45.8 Shipping Days of Supply

Flat Rolled

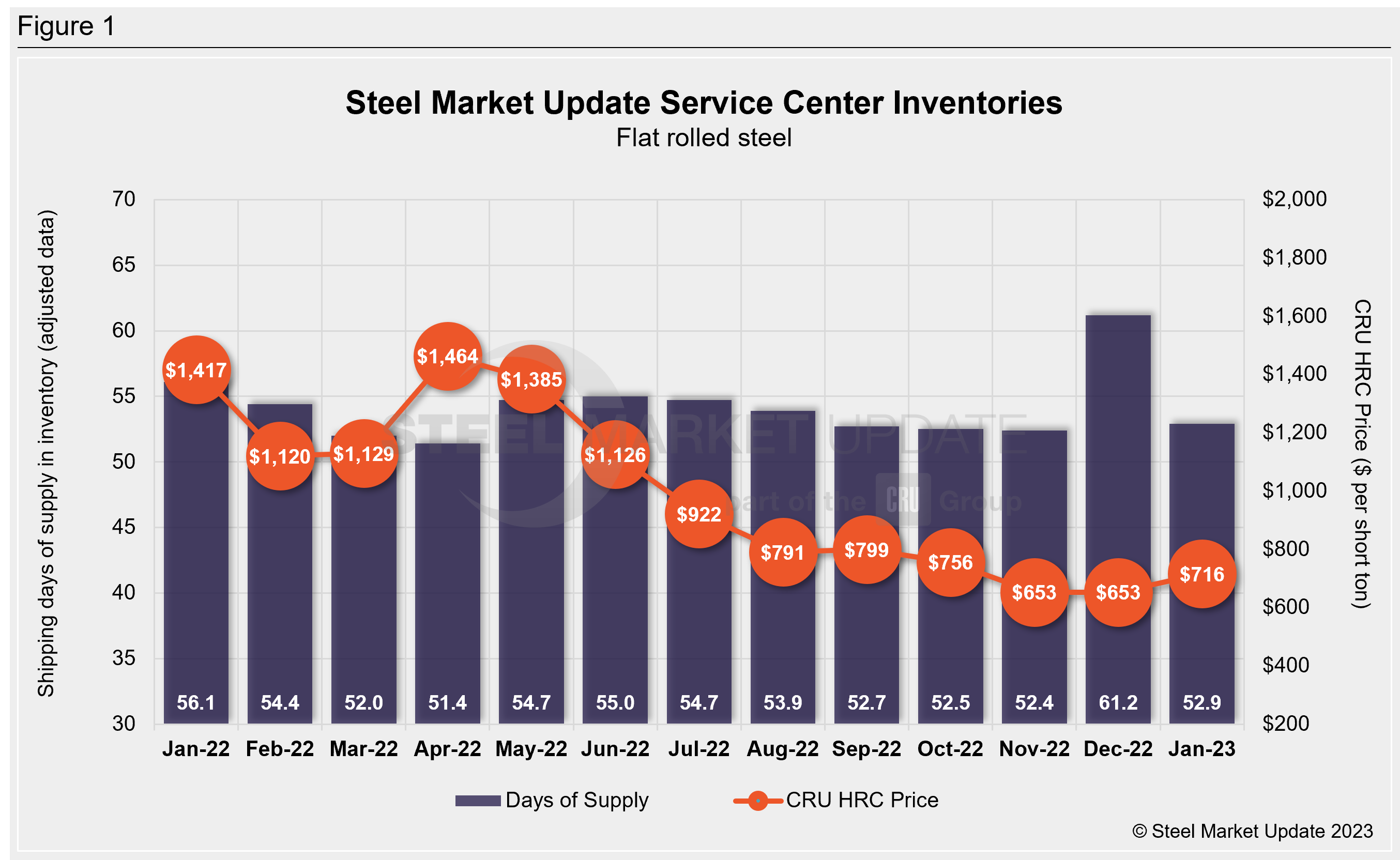

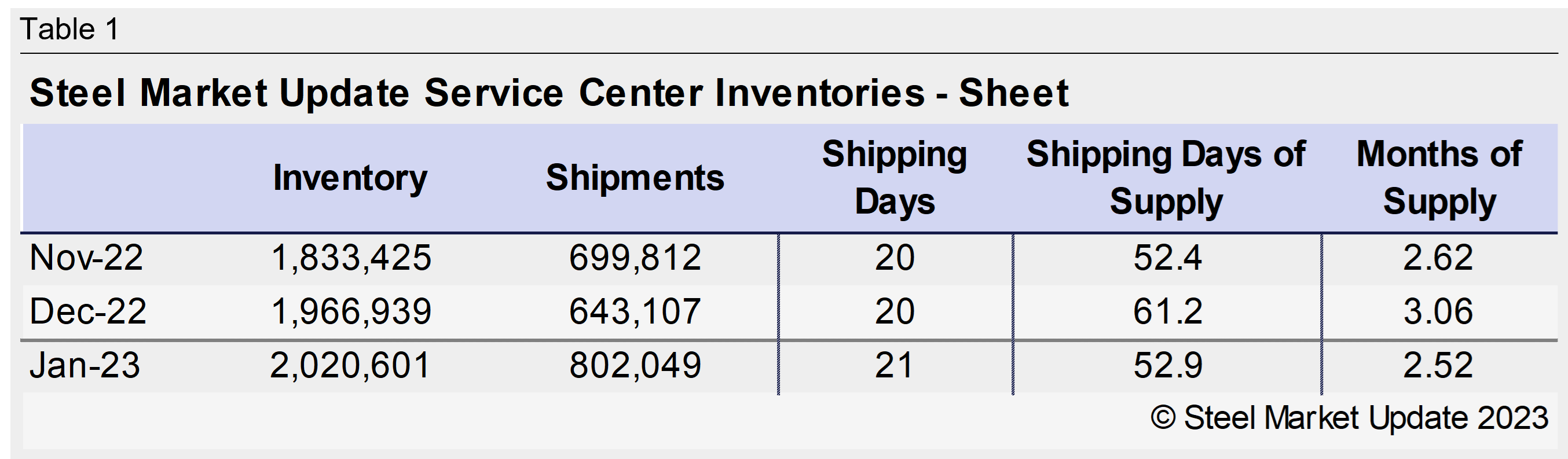

US service center flat-rolled steel supply in January reflected typical seasonal patterns. After a massive swell in inventories in December, flat-rolled steel supply fell in January with a boost in shipments. At the end of January, service centers carried 52.9 shipping days of supply on an adjusted basis, down from 61.2 shipping days in December, according to SMU data. In terms of months on hand, January inventories represented 2.52 months of supply, down from 3.06 months in December.

January had 21 shipping days, while we calculated 20 shipping days in December. January’s flat-rolled steel inventory level was lower compared to the 56.1 shipping days of supply at the end of January 2022, when prices were falling dramatically. In contrast, this year, prices have been going up steadily, and shipments have also spiked. The daily shipping rate reached levels last seen in May 2021.

Some service centers reported much higher shipments in January, with increased shipments to the auto and solar sectors. Demand has been robust, though many are still skeptical about how much of the demand is related to manufacturers that have pulled forward orders to try to beat price increases. The spike in shipments in January is a seasonal phenomenon. However, it was more pronounced this year, with a slower-than-usual December and multiple price increase announcements early this year driving a stronger January.

The amount of material on order declined in January vs. December. This is partly a reflection of the much higher daily shipping rate in January.

While demand appears to be strong for the near term, we are not seeing the large opportunistic spot purchases that usually help to support price increases. Lead times have also remained flat, with the most recent SMU survey reporting HRC lead times at 4.94 weeks.

Plate

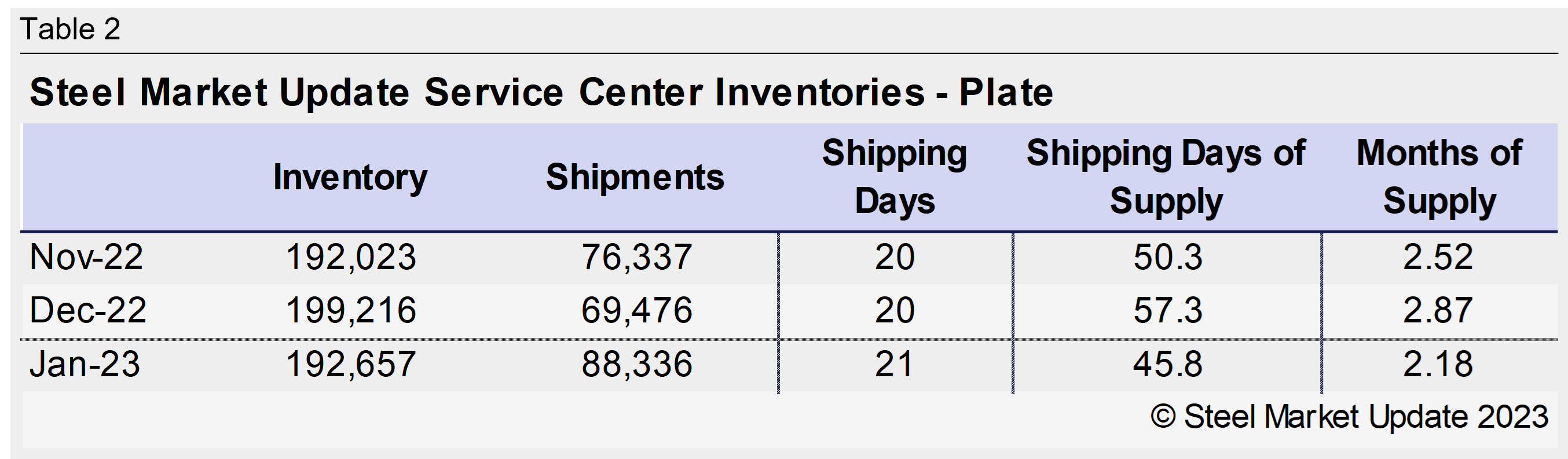

US service center plate inventories fell further in January amid pricing uncertainty. At the end of January, service centers carried 45.8 shipping days of plate supply, down from 57.3 shipping days of supply in November. Plate stocks represented 2.18 months of supply in January, down from 2.87 months of supply in December.

The lower January inventories confirm what we have heard about tighter supply. Mills have made efforts to keep prices from falling, and prices have been within a narrow band for the month of January. The low inventories should be supportive of pricing in the near term.

The drop in plate inventories coincided with increased material on order in January. While the amount of material on order has picked up in total volume, January shipping rates were lower when compared to December.

The amount of plate on order represented 90.9% of the slightly lower inventories, up from 82.6% in December.

By Estelle Tran, estelle.tran@crugroup.com